Canada

March 22, 2021

Canadian Pacific and Kansas City Southern Plan Rail Merger

Written by Sandy Williams

A railway network spanning Canada, the U.S. and Mexico is in the planning by Canadian Pacific and Kansas City Southern Railways. The two companies have entered into a merger agreement in which CP will acquire KCS for $29 billion and assume $3.8 billion of KCS debt. If approved by the Surface Transportation Board, it will be the first rail network connecting all three nations in North America.

“This transaction will be transformative for North America, providing significant positive impacts for our respective employees, customers, communities and shareholders,” said CP President and Chief Executive Officer Keith Creel. “This will create the first U.S.-Mexico-Canada railroad, bringing together two railroads that have been keenly focused on providing quality service to their customers to unlock the full potential of their networks. CP and KCS have been the two best performing Class 1 railroads for the past three years on a revenue growth basis.”

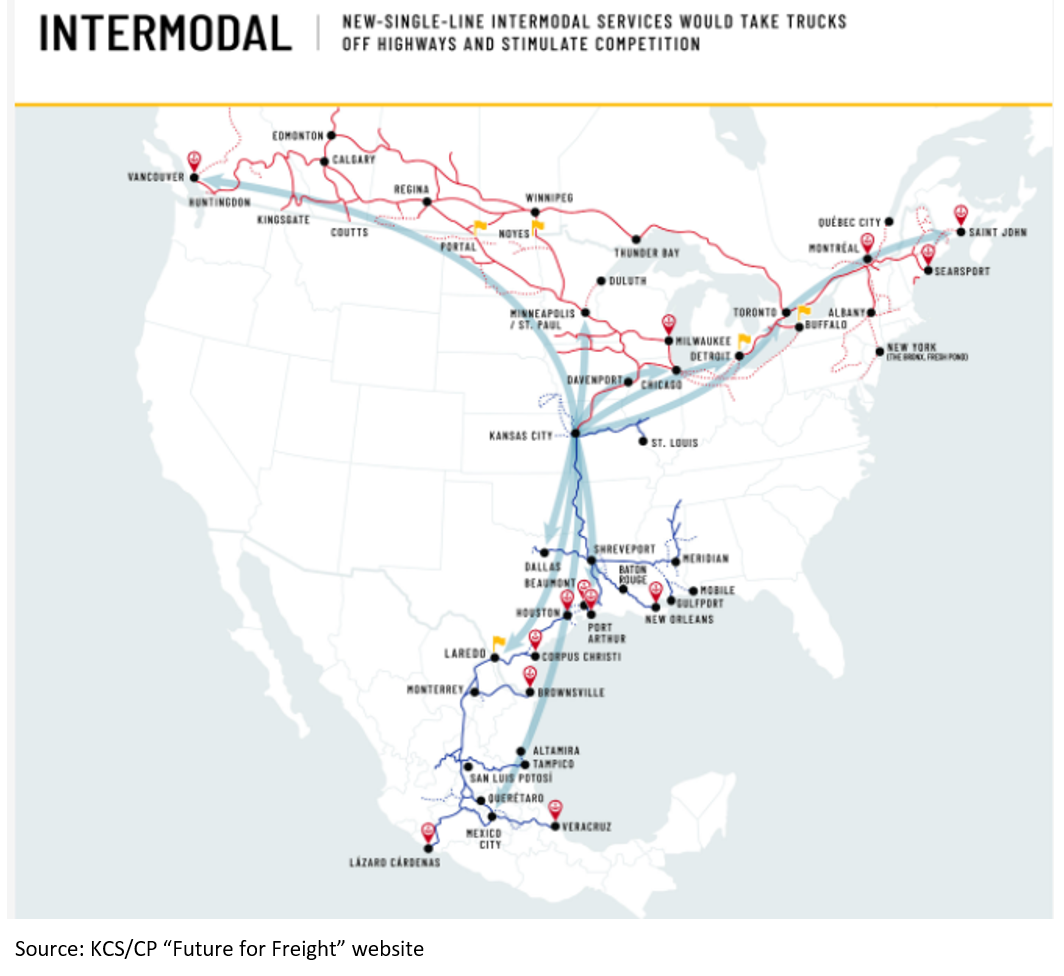

KCS and CP say the single integrated system will provide a competitive alternative to existing rail service providers and improve customer service. The single-line haul network will connect premier ports on the Gulf, Atlantic and Pacific Coasts that are key to the nation’s import/export markets. The network will also link auto production centers in Mexico, Ontario and Detroit with key vehicle distribution facilities.

An existing shared interchange and facility in Kansas City, Mo., the one point where KSC and CP connect, is expected to improve efficiency and reduce transit times and costs. New intermodal service would be established between Dallas, East Texas and Chicago. Some traffic between KCS-served points and the Upper Midwest/Western Canada will be able to bypass Chicago via the CP route through Iowa, potentially reducing rail traffic, fuel burn and emissions in Chicago.

Intermodal traffic will benefit from reduced highway travel with single-line rail service stretching from Vancouver, B.C., on the west coast and St. John, N.B., on the east coast funneling through Kansas City to Lázaro Cárdenas in Mexico.

“Rail is four times more fuel efficient than trucking, and one train can keep more than 300 trucks off public roads and produce 75 percent less greenhouse gas emissions,” said the companies in a press release. “CP is committed to sustainability and is currently developing North America’s first line-haul hydrogen-powered locomotive.”

Canada Pacific has tried at least three times to merge with a Class 1 railroad in the U.S. but each time was met with opposition from those who fear a wave of rail mergers might occur, disrupting service. The acquisition will require shareholder approval and placement of the KCS shares into a voting trust. The Surface Transportation Board and other applicable regulatory authorities must then grant approval for the transaction. The STB review is expected to be completed by mid-2022. If approved, Canada Pacific will gain control of KCS with Keith Creel serving as CEO. The merged company will be named Canadian Pacific Kansas City (CPKC).

“The new competition we will inject into the North American transportation market cannot happen soon enough, as the new USMCA Trade Agreement among these three countries makes the efficient integration of the continent’s supply chains more important than ever before,” said Creel. “Over the coming months, we look forward to speaking with customers of all sizes and communities across the combined network, to outline the compelling case for this combination and reinforce our steadfast commitment to service and safety as we bring these two iconic companies together.”

By Sandy Williams, Sandy@SteelMarketUpdate.com