Analysis

November 10, 2022

Final Thoughts

Written by David Schollaert

Steel prices continue to slide, and apparently so does sentiment. Based on SMU’s latest check of the market, sheet prices once again fell across the board, grinding lower and nearing levels some never expected to see again.

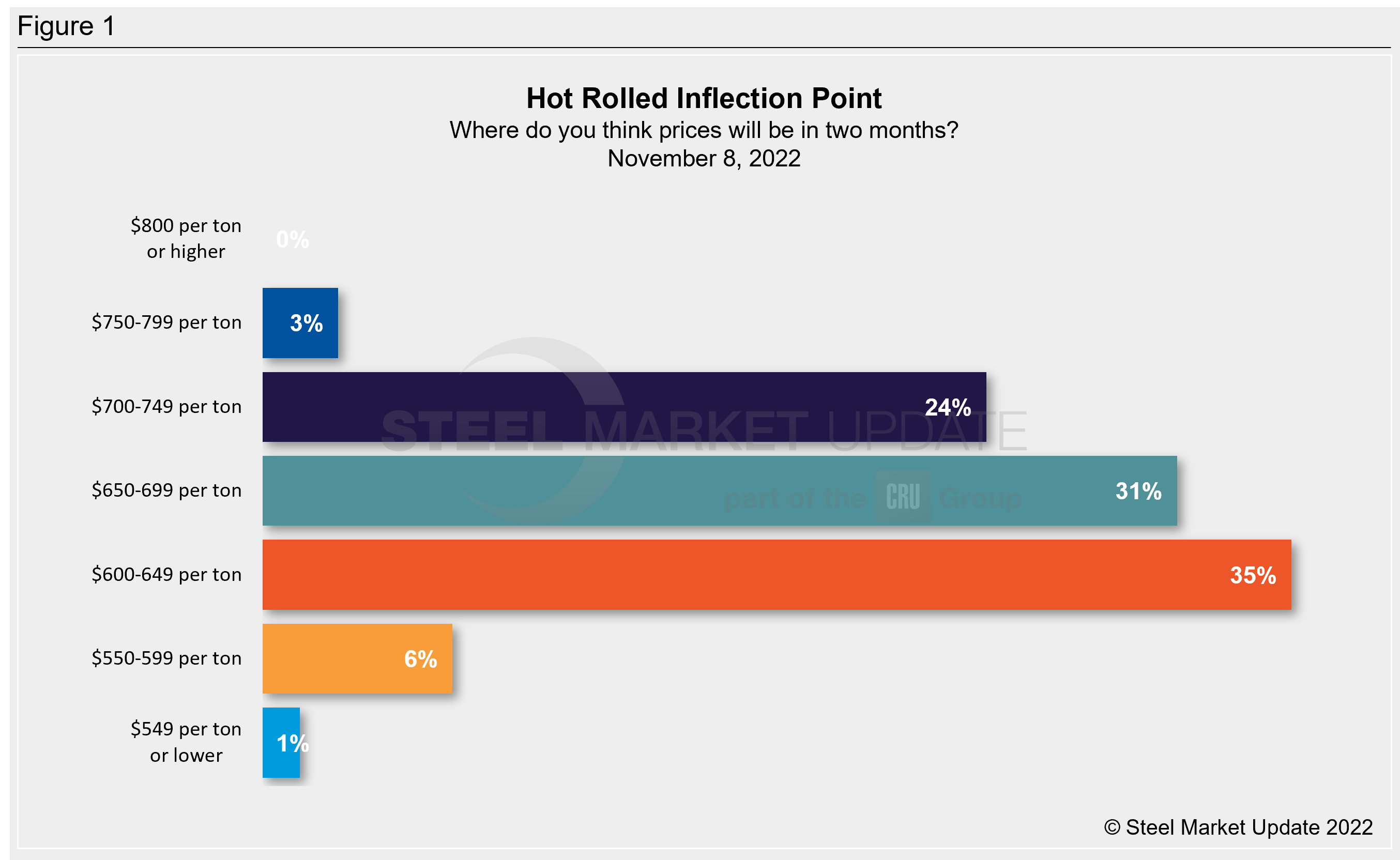

Speculation that hot-rolled coil (HRC) prices will be at or near the $600-per-ton mark takes center stage with some sources speculating that tags could be sub-$600 per ton in the near-term.

This week HRC prices were down $30 per ton ($1.50 per cwt) versus last week. Coated products saw an even more pronounced decline, with cold rolled down $55 per ton, galvanized down $35 per ton, and Galvalume off by $50 per ton. And while plate has been remarkably stable compared to sheet, prices slipped $30 per ton this week, with Nucor still holding the top end of the range.

HRC tags are now at their lowest level in more than two years, and CR and coated products are also nearing two-year lows.

This week’s survey asked respondents where they think prices will be two months from now. Take a look at the results in the chart below.

Funny enough though, the news of US Steel and the United Steelworks (USW) union striking a new tentative four-year labor agreement has brought about concerns of even lower steel prices as we wrap up 2022 and head into 2023.

I was speaking with several sources this week and there is a sense that HRC prices had a chance of staying afloat, or at least slowing their erosion, the longer the Pittsburgh-based steelmaker and its union workforce remained at odds over a new deal.

For those hoping for a labor-related stoppage or at least for negotiations to drag on in hopes of higher prices, well, we now know that’s not going to happen. What seems to be more likely is that prices come down and although most expect them to match pre-pandemic totals, some suggest they might rival early pandemic levels.

“If the economy tanks (I feel it will in 2023) then yes, we might get back to sub $600,” said a source. “Mills wanted $800 to be the new $600 and now we’re looking at sub $700 prices. One can only curb capacity utilization so much that it whacks their breakeven.”

“I expect HRC will get as low as $600 … I don’t see it going below that level unless a full-blown recession is in motion, and then if so, I don’t think there’s much that will be a concern to us on pricing of HRC so to speak,” said a second source.

If prices near or go below the $600 per ton mark — a level very few thought possible just this summer — sources speculate mills will certainly look to cut output and idle production to safeguard margins.

“I think $600 [per ton] is the bottom, as that is where pricing was pre-pandemic, otherwise mills will start shutting down furnaces to offset the supply-demand ratio,” said another source.

“It seemed for a while as if the floor was at $750 per ton but now it seems like $600 per ton is more likely and a real possibility,” said a source. “Sub $600 would be a real issue for the HRC mills but there’s lots of capacity out there.”

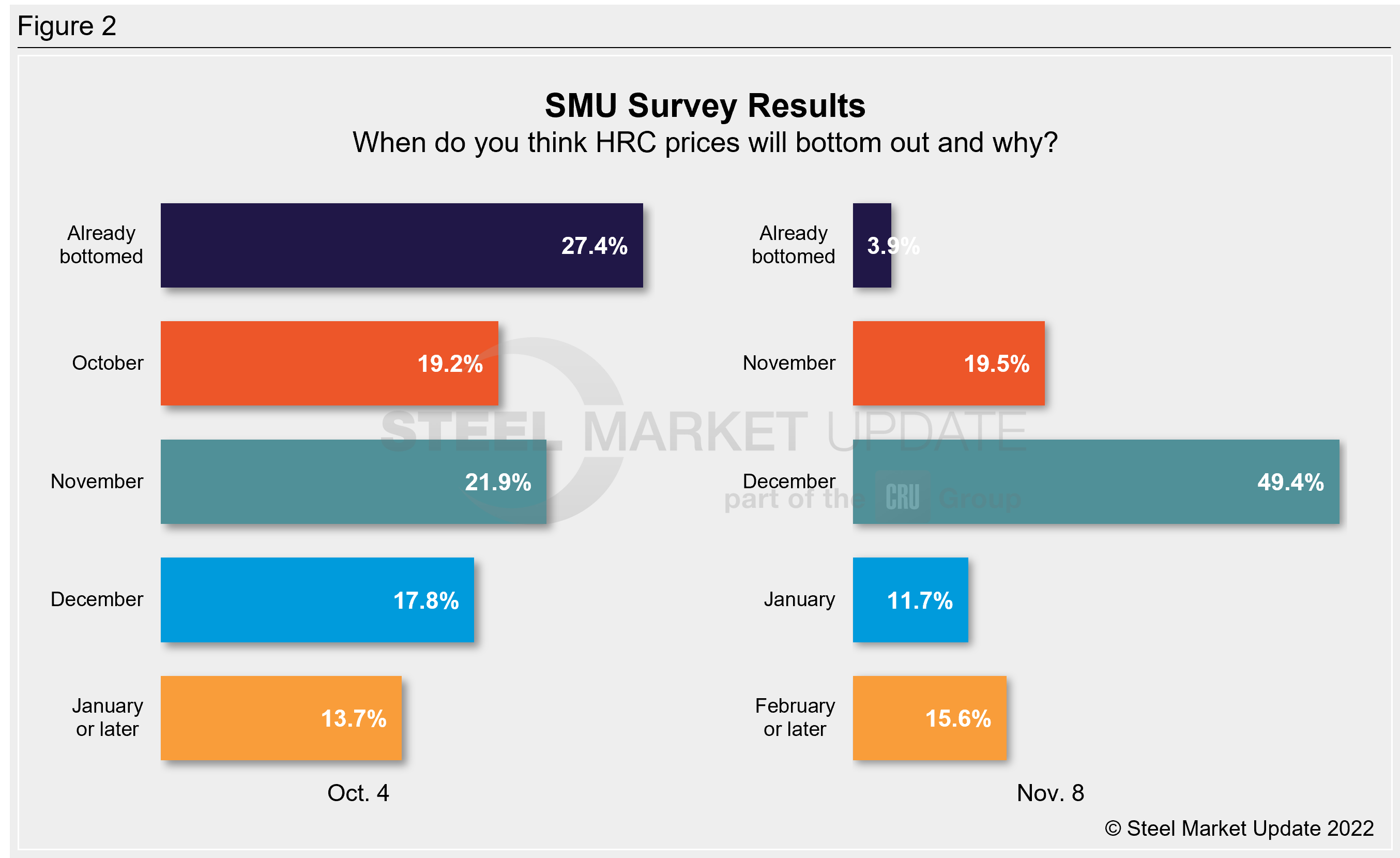

SMU Survey Results had already been submitted before US Steel and the USW officially announced their tentative labor pact, but even prior to their statements it’s clear more than 75% of survey respondents — primarily service center and manufacturing executives — believe prices will keep falling past November. In third place, a solid 15.6% believe a price bottom will not be reached until the second half of the first quarter of 2023.

Take a look at the results in the chart below. What a difference a month can make.

While demand is steady for most, and production and inventories continue to be adjusted down, most sources I’ve spoken to anticipate mills will dial back production even more as the fourth quarter continues to thwart further price erosion.

SMU Events

There’s still room available for our Introduction to Steel Hedging Training Course. The workshop will be running virtually on our customized platform from Nov. 30–Dec. 1. You can click here for more information.

Also, don’t forget to mark Feb. 5–7 on your calendar. That’s when SMU and the Port of Tampa Bay will be hosting the Tampa Steel Conference. It’s a growing event, and a great reason to get out of the cold and catch up with hundreds of your closest friends in steel. You can register here.

As always, a big thank you from all of us at SMU for your business.

By David Schollaert, David@SteelMarketUpdate.com