SMU price ranges: Sheet and plate prices tick higher again

Steel prices inched higher again this week across most of the sheet and plate products tracked by SMU.

Steel prices inched higher again this week across most of the sheet and plate products tracked by SMU.

Flat rolled = 57.1 shipping days of supply Plate = 55.7 shipping days of supply Flat rolled US service centers reined in flat roll supply in May, coinciding with declining shipments. At the end of May, service centers carried 57.1 shipping days of supply, according to adjusted SMU data. That’s down slightly from 57.6 shipping […]

All five of the averages for sheet and plate mill lead times tracked by SMU extended moderately this week, according to buyers responding to our latest market survey.

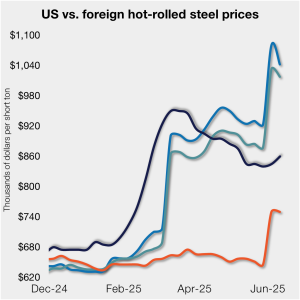

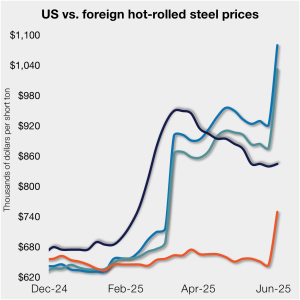

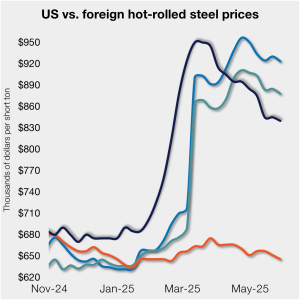

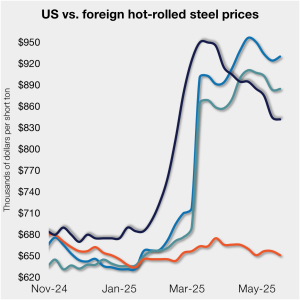

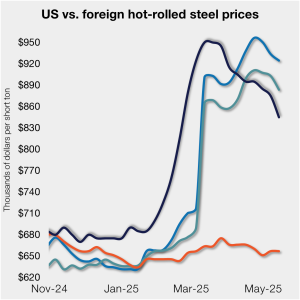

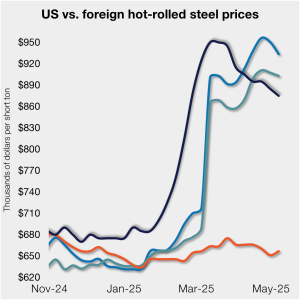

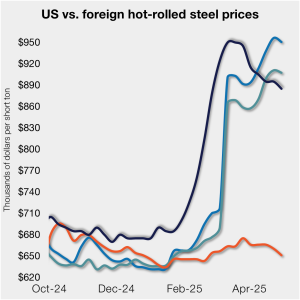

Domestic hot-rolled (HR) coil prices edged up marginally again this week, while offshore prices ticked down.

The price spread between HRC and prime scrap widened in June.

Even before the news about Mexico, I didn’t want to overstate the magnitude of the change in momentum. As far as we could tell, there hadn’t been a frenzy of new ordering following President Trump’s announcement of 50% Section 232 tariffs. But higher tariffs had unquestionably raised prices for imports, which typically provide the floor for domestic pricing. We’d heard, for example, that prices below $800 per short ton for hot-rolled (HR) coil were gone from the domestic market – even for larger buyers.

Steel prices climbed for a second straight week across all five sheet and plate products tracked by SMU.

Subdued demand is causing importers to cancel hot-rolled (HR) coil orders and renegotiate the terms of shipments currently enroute to the US, importers say. An executive for a large overseas mill said customers might find it difficult to justify making imports buys after US President Donald Trump doubled the 25% Section 232 tariff on imported steel […]

The $20/short ton increase applies to all of the steelmaker’s sheet mills, including West Coast joint-venture subsidiary CSI.

Domestic hot-rolled coil prices edged up marginally this week, while offshore prices ticked down.

April now represents the third-lowest monthly import rate witnessed in nearly two and a half years, with several steel products falling to multi-year lows

Following eight consecutive weeks of declines, sheet and plate prices saw some upward movement this week in the wake of last Friday’s Section 232 tariff increase announcement. Gains varied by product.

Nucor halted a four-week decline in its spot price for hot-rolled coil this week, maintaining its weekly consumer spot price (CSP) at $870/st.

The price premium of galvanized coil over hot-rolled (HR) coil has narrowed over the past two months, resuming the downward trend seen for most of the last year. As of May 27, the spread between these two products is at one of its lowest levels in nearly two years.

Mill lead times shrunk this week for all of the sheet products tracked by SMU and held steady on plate, according to buyers responding to our latest market survey.

Domestic hot-rolled coil prices moved lower again, maintaining the downward move seen in eight of the last 10 weeks.

Sheet and plate prices marginally declined again this week for the second consecutive week, pausing the strong downward trend seen from April through early May.

Nucor has lowered its consumer spot price (CSP) for hot-rolled coil by $10 per short ton (st), marking the fourth consecutive weekly decrease.

Domestic hot-rolled (HR) coil prices were flat this week after declining seven of the last nine weeks. Offshore prices have also eroded in recent weeks, though not nearly as significantly as in the US.

Most sheet and plate prices edged lower again this week, albeit at a slower pace compared to the movements seen over the last seven weeks. Buyers remain cautious and hesitant to hold onto much inventory, citing lingering demand concerns, ongoing tariff uncertainty, and a potentially weakening scrap market in June.

Nucor has lowered its consumer spot price by $20 per short ton, marking the third consecutive weekly decrease.

Domestic hot-rolled (HR) coil prices fell this week, now down seven of the last eight weeks.

All of SMU’s sheet and plate steel price indices declined this week, easing by $30-40 per short ton (st) on average since early May. Prices continue to slide lower as buyers remain on the sidelines, wary of holding much excess inventory and expecting further declines.

The price spread between hot-rolled coil (HRC) and prime scrap narrowed again in May, according to SMU’s most recent pricing data.

US steel imports rebounded from February to March, rising to the second-highest monthly rate witnessed in the past ten months, according to final data recently released by the US Commerce Department. April license data shows that gain has likely been erased, with trade falling to the lowest rate of the year and several product categories hitting multi-year lows.

Domestic hot-rolled (HR) coil prices moved lower this week, now down six of the last seven weeks. Recent price erosion has been seen in offshore markets, keeping the price gap between imports and domestic products largely flat week on week (w/w).

Steel buyers said Nucor’s price decrease was a public acknowledgement of what most of the market had already known - that sheet prices were moving lower in a more significant way. The question now is whether mills and service centers will manage the decline or whether prices might fall rapidly, they said.

Sheet and plate lead times held steady this week, according to buyers responding to the latest SMU market survey. This week we saw little change from mid-April levels, with just one product (Galvalume) showing any significant movement.

Nearly two thirds of the steel buyers who responded to this week’s SMU survey say domestic mills are negotiable on spot prices. This increasing flexibility marks a significant shift from the firmer stance mills held in recent months.

Section 232 returned on March 12, and since then, the price gap between offshore and US hot band has tightened.