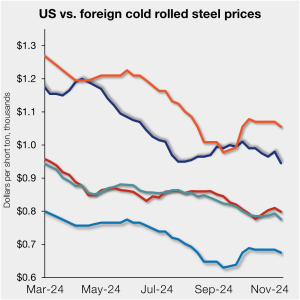

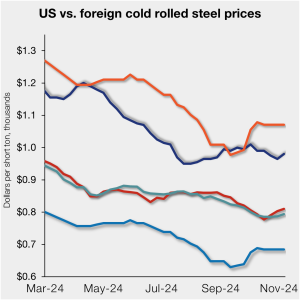

Domestic, offshore CRC prices diverge

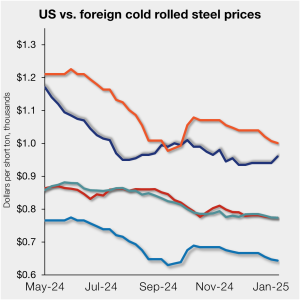

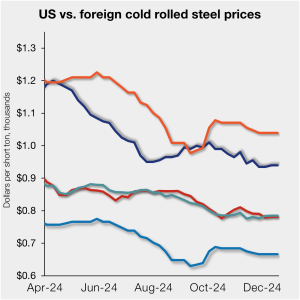

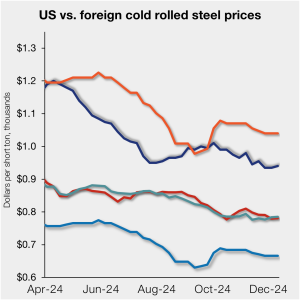

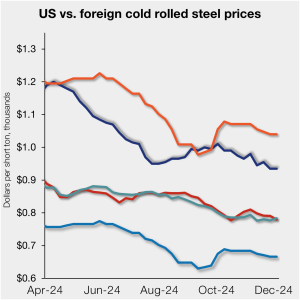

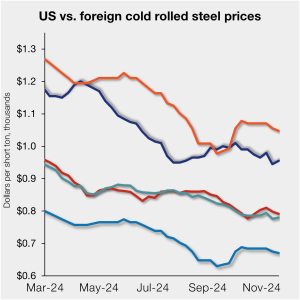

The price spread between US-produced cold-rolled (CR) coil and offshore products on a landed basis widened in the week ended Jan. 10.

The price spread between US-produced cold-rolled (CR) coil and offshore products on a landed basis widened in the week ended Jan. 10.

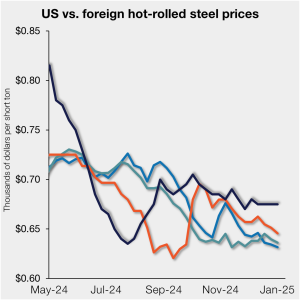

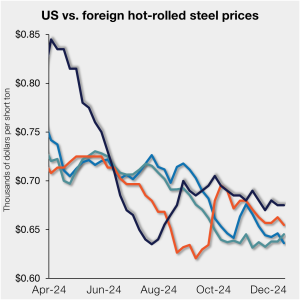

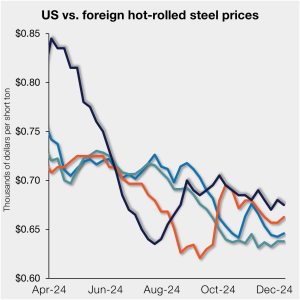

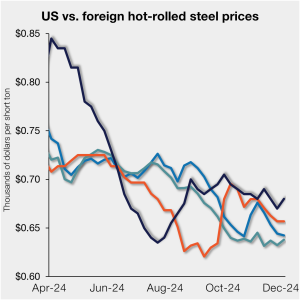

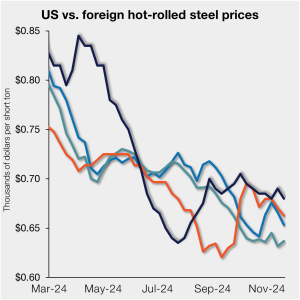

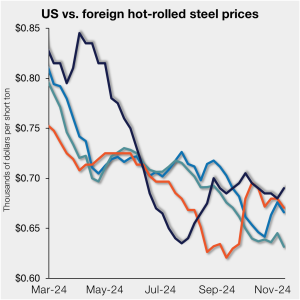

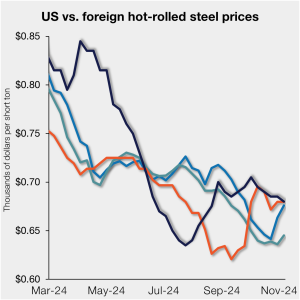

Hot-rolled (HR) coil prices ticked up in the US last week, while tags in offshore markets were mostly unchanged. The result: US hot band is more expensive than imports on a landed basis.

Steel Manufacturers Association (SMA) President Philip K. Bell will join SMU for our first Community Chat of 2025. We’ll talk about what to expect from the incoming Trump administration, the changing trade and tariff landscape – and what it all means for domestic steelmakers, service centers, and manufacturers. Don’t miss out! Mark your calendar for Jan. 15 at 11 am ET.

Hot-rolled (HR) coil prices were flat in the US this week, while tags in offshore markets were mostly down.

The price spread between US-produced cold-rolled (CR) coil and offshore products on a landed basis was unchanged in the week ended Dec. 20.

The price premium between stateside hot band and landed imports widened slightly this week.

The Commerce Department is raising the import duties on imports of corrosion-resistant sheet and cut-to-length plate from Korea.

The world has had a few shocks recently. The CEO of a major health insurance company was gunned down in Manhattan. The 50-year Assad dynasty in Syria was pushed out less than two weeks after rebels started an offensive. And President-elect Trump is promising tariffs on everything a month before he takes office. But one shock has been taking place for a lot longer than the last few weeks. The 70-year consensus on trade hasn’t just been challenged. It’s been repudiated.

The price spread between US-produced cold-rolled (CR) coil and offshore products on a landed basis was relatively flat in the week ended Dec. 13.

Referred to as ‘apparent steel supply’, we calculate this volume by combining domestic steel mill shipments with finished US steel imports and deducting total US steel exports.

On Monday and Tuesday of this week, SMU polled steel buyers on an array of topics, ranging from market prices, demand, and inventories to imports and evolving market events.

Hot-rolled (HR) coil prices ticked back down in the US this week, while tags in offshore markets were mostly up. Thus, the price premium between stateside hot band and imports on a landed basis tightened slightly.

Monthly imports have remained within a relatively narrow range since June, significantly lower than volumes seen earlier this year, but stronger than late-2023 levels.

The price spread between US-produced cold-rolled (CR) coil and offshore products on a landed basis was flat in the week ended Dec. 6.

Hot-rolled (HR) coil prices ticked back up in the US this week, while tags in offshore markets moved in varying directions. Thus, the price premium between stateside hot band and imports on a landed basis widened slightly. After leveling with import prices in late August, stateside tags have been mostly stable and ahead of imports […]

The price spread between US-produced cold-rolled (CR) coil and offshore products on a landed basis widened slightly in the week ended Nov. 22.

With climbing imports and falling consumption, the Latin American steel industry has had a challenging 2024, according to an Alacero report.

US hot-rolled (HR) coil prices slipped this week, while tags in offshore markets were also largely down. Thus, the price premium between stateside hot band and imports on a landed basis was relatively unchanged.

Import duties on rebar from a handful of countries will continue to be collected for at least another five years.

China is one of the elephants in the room as the transition to Trump 2.0 continues. While the people and policies are still being formulated, it’s possible to detect a strategy for the new Trump administration. I think there are two imperative issues that the new administration needs to balance. The Trump strategy will, I believe, follow the following points. First, trade is one of the issues that got President Trump elected in 2016 and 2024—it nearly got him elected in 2020, save for the pandemic. If President Trump had won in 2020, I might be writing chronicles about the end of his eight years in the White House now instead of projecting what the next Trump administration would accomplish or break. Oh, well—that’s life. Trade will necessarily be a key feature of relations with China for the next four years.

Commerce determined a significant dumping margin for hot-rolled steel imports from Japan's Nippon Steel.

The price spread between US-produced cold-rolled (CR) coil and offshore products slipped in the week ended Nov. 15, on a landed basis.

US hot-rolled (HR) coil prices edged up this week, while tags in offshore markets moved lower. As a result, domestic tags pulled ahead of imports on a landed basis. Since becoming level with import prices in late August, stateside tags had been mostly stable, though they slowly drifted closer to parity over the past month. […]

The Commerce Department determined that, if anti-dumping and countervailing duty orders were allowed to expire, or be ‘sunset,’ the illegal dumping and subsidization of HR imports would be likely to continue at sizeable rates.

The total amount of finished steel to enter the US market in September fell to its lowest level in seven months, according to our analysis of recent Department of Commerce and the American Iron and Steel Institute (AISI) data

The price spread between US-produced cold-rolled (CR) coil and offshore products remained largely flat in the week ended Nov. 8, on a landed basis.

September steel imports were 10% less than August levels, marking the lowest monthly import rate seen this year

US hot-rolled (HR) coil prices moved lower this past week while tags in offshore markets were largely higher. Domestic tags are again nearly level with imports on a landed basis.

Donald Trump has won the US presidential election. The Republican party has re-taken control of the Senate. Votes are still being counted in many tight congressional races. But based on results so far, the Republicans seem likely to maintain control of the House of Representatives. If confirmed, this will give Trump considerable scope to pass legislation pursuing his agenda. What this means for US policy is not immediately obvious. Trump will not be inaugurated until Jan. 20. In the coming weeks and months, he will begin to assemble his cabinet, which may give a clearer signal on his policy priorities and approaches. Based on statements he made during the presidential campaign, we have set out the likely direction of his economic policy here and green policy here.

I joined in a Steel Market Update community chat last week. Predictably, many of the questions concerned the likely results of a Trump or Harris victory in the election. Like most people, I don’t know who will win. But by next week I probably will know. Here is my take, with an emphasis on steel policy. There are a surprising number of similarities between the Democratic and Republican candidates’ positions on steel policy. In part, that is because both candidates are going after the same voters—steel workers, whether unionized or not.