Prices

September 10, 2013

Net Imports & Exports for July

Written by Peter Wright

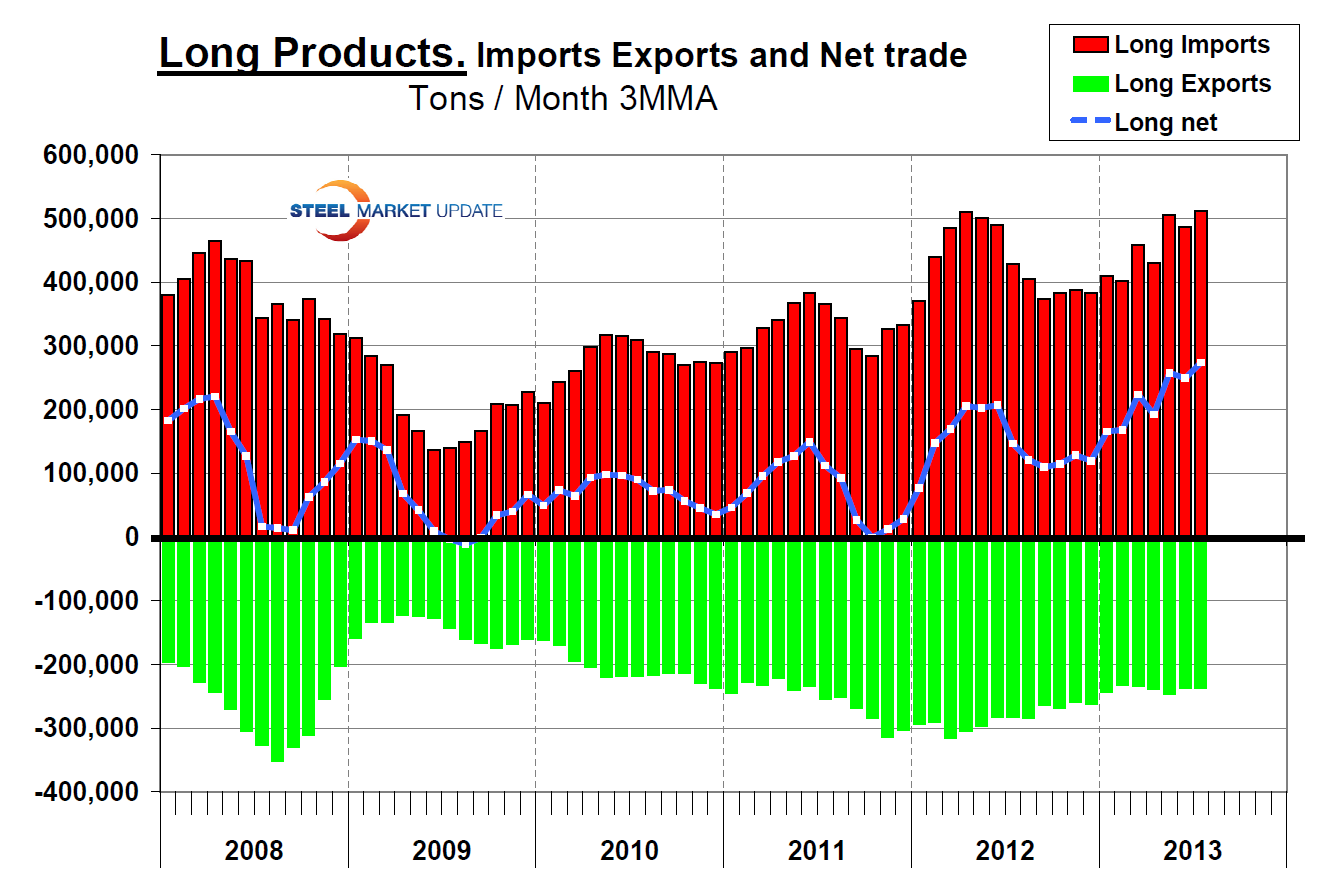

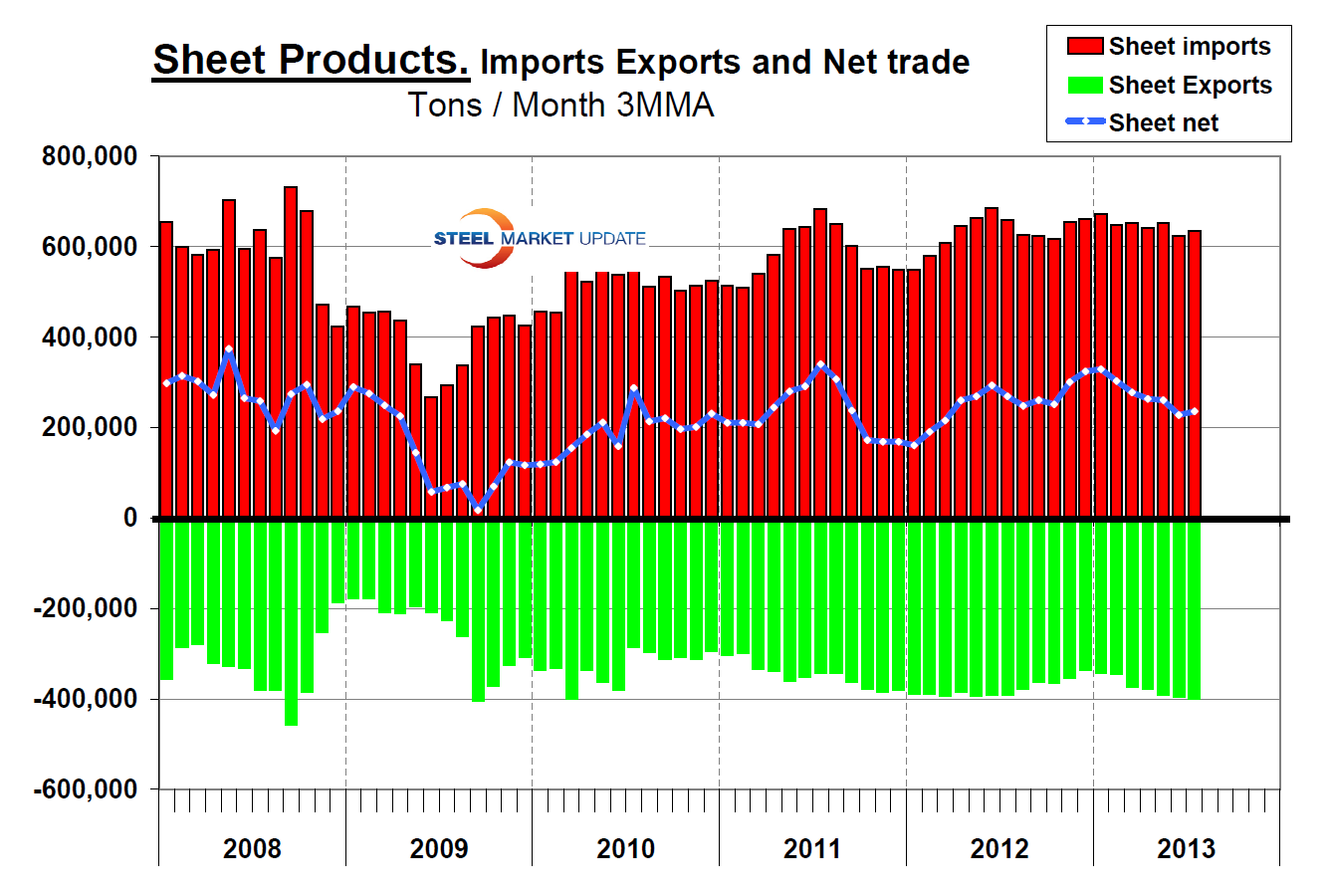

Year to date through July, net imports of steel sheet products have been steadily declining as those of long products have been steadily increasing, (Figures 1 and 2). Net imports are defined as imports minus exports and at times can be negative for individual products when exports exceed imports. In the case of flat rolled steel sheet products net imports in 2013 year to date compared to 2012 are up but on a monthly basis the change during the course of 2013 has been a steady improvement as steel imports declined and steel exports increased. In the case of long products, imports surged in the spring and early summer of both 2012 and 2013 and through July 2013 have yet to decline. During the course of 2013 net long product imports have risen.

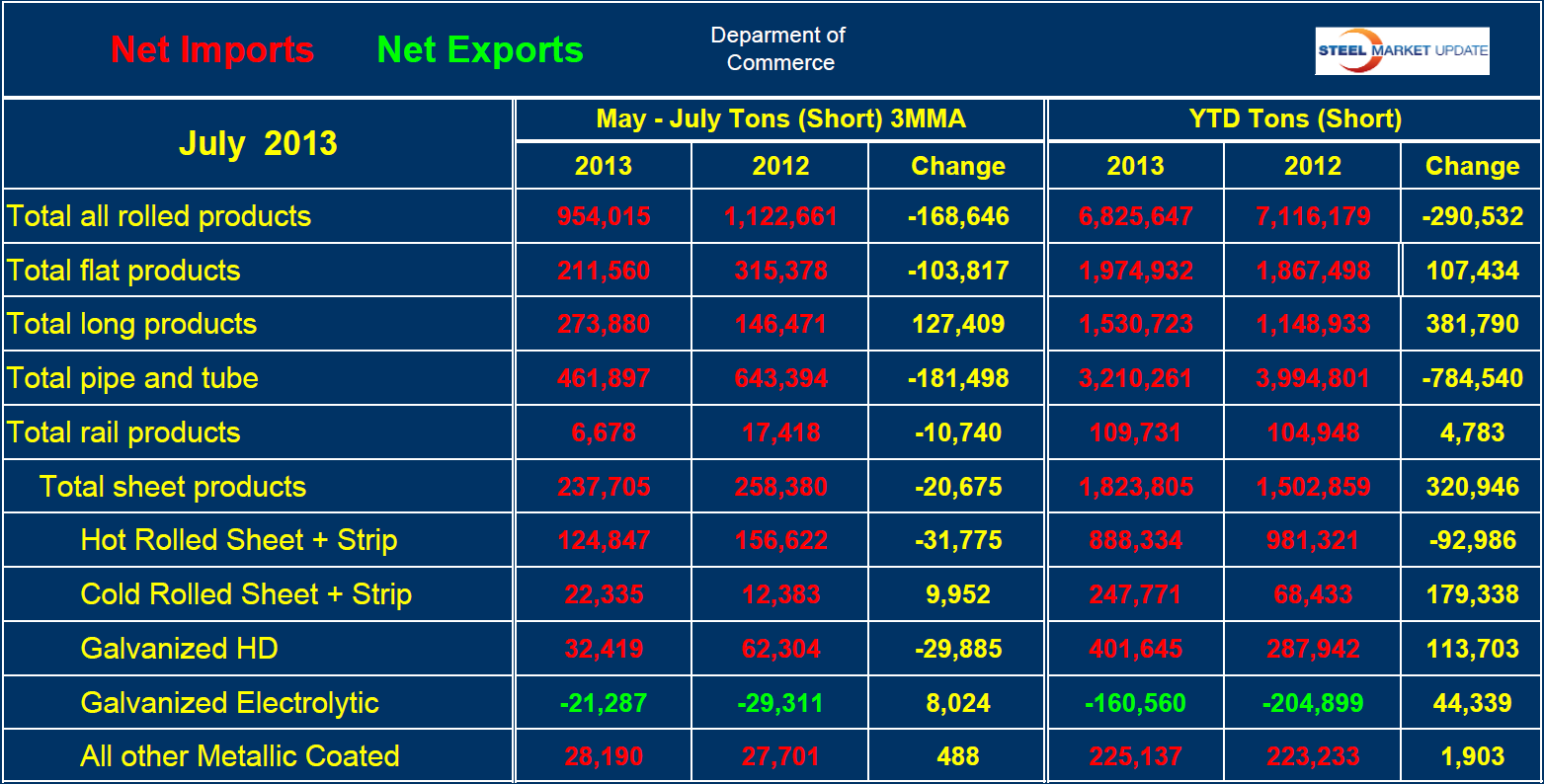

For all hot worked steel products combined, YTD net imports were down by 290,532 tons driven by pipe and tube products which were down by 784,540 tons. Flat products including plate were up by 107,434 tons, long products were up by 381,790 tons. The total of sheet products as a sub category of flat rolled was up by 320,946 tons. Hot rolled was down by 92,986 tons. All other sheet product net imports increased led by cold rolled, up by 179,338 tons.

For all hot worked steel products combined, YTD net imports were down by 290,532 tons driven by pipe and tube products which were down by 784,540 tons. Flat products including plate were up by 107,434 tons, long products were up by 381,790 tons. The total of sheet products as a sub category of flat rolled was up by 320,946 tons. Hot rolled was down by 92,986 tons. All other sheet product net imports increased led by cold rolled, up by 179,338 tons.

Table 1 compares the periods May through July and YTD for 2013 and 2012. Electro galvanized is the only product to have consistently had negative net imports, meaning that exports exceeded imports.

Table 1 compares the periods May through July and YTD for 2013 and 2012. Electro galvanized is the only product to have consistently had negative net imports, meaning that exports exceeded imports.

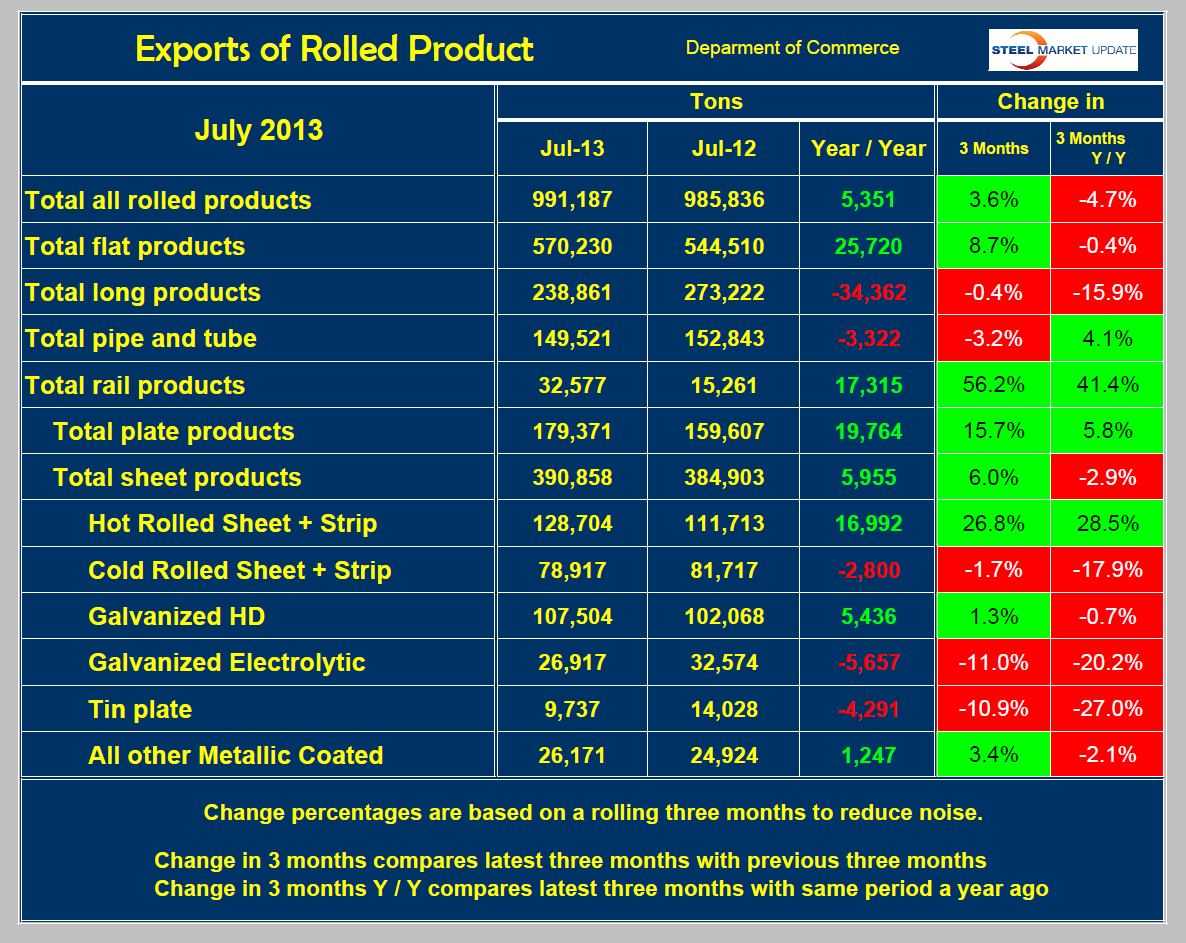

Exports of rolled products, July 2013.

In July 2013, total hot worked steel exports were up by 5,351 tons compared to July 2012. Flat rolled products in total were up by 25,720 tons and long products were down by 34,362 tons. Rail, plate and hot rolled sheet and strip all experienced an increase in export volume in July 2013 compared to July 2012. Table 2 shows the change by product in tons comparing July 2013 and July 2012. It also compares the percent change in the three month periods May through July 2012 and 2013 and in-order to identify the short term change it compares May through July 2013 with February through April 2013. In the sheet market hot rolled exports are up by 28.5 percent in three months through July year over year as all other sheet product exports declined.