Prices

December 11, 2013

Shipments of Sheet and Strip Products in October 2013

Written by Peter Wright

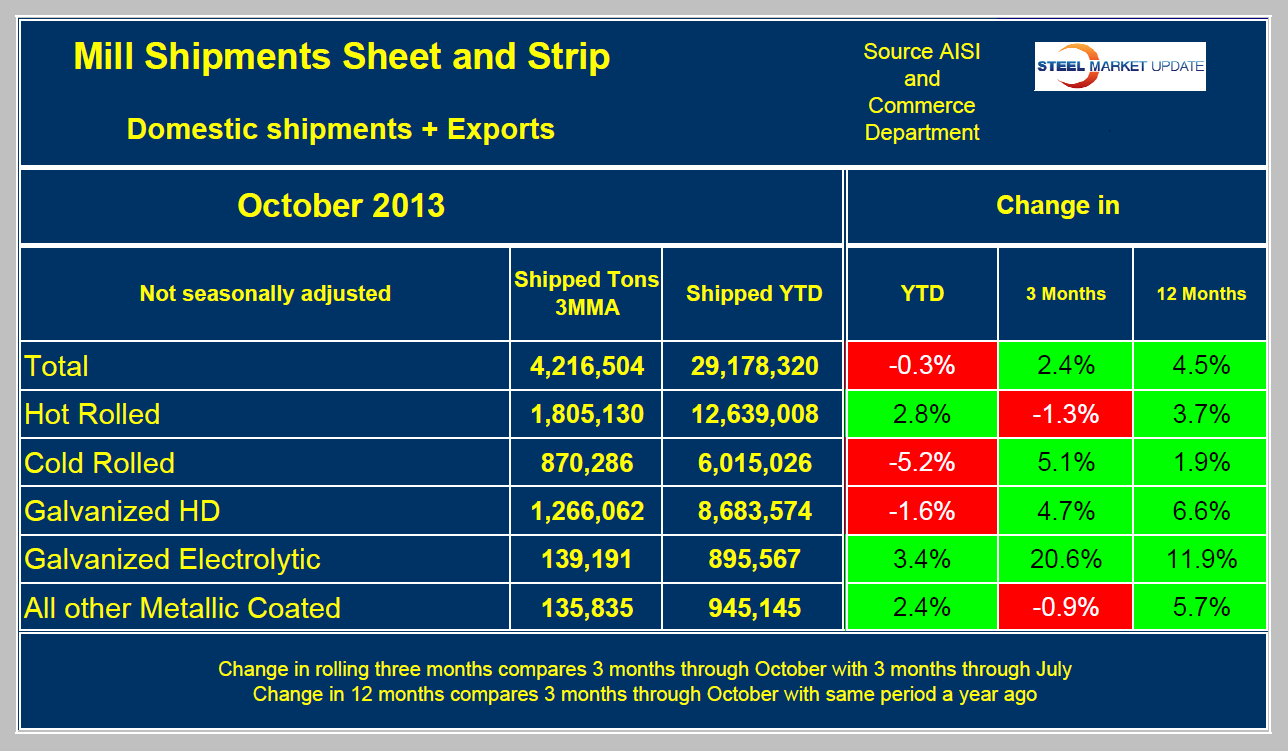

Shipments of sheet and strip products in the first 10 months of 2013 were 29,178,320 tons, a decrease of 0.3 percent from the same period last year. Shipments in the three months August through October averaged 4,216,504 tons / month, an increase of 2.4 percent from the previous 3 months May through July and an increase of 4.5 percent from August through October last year (Table 1).

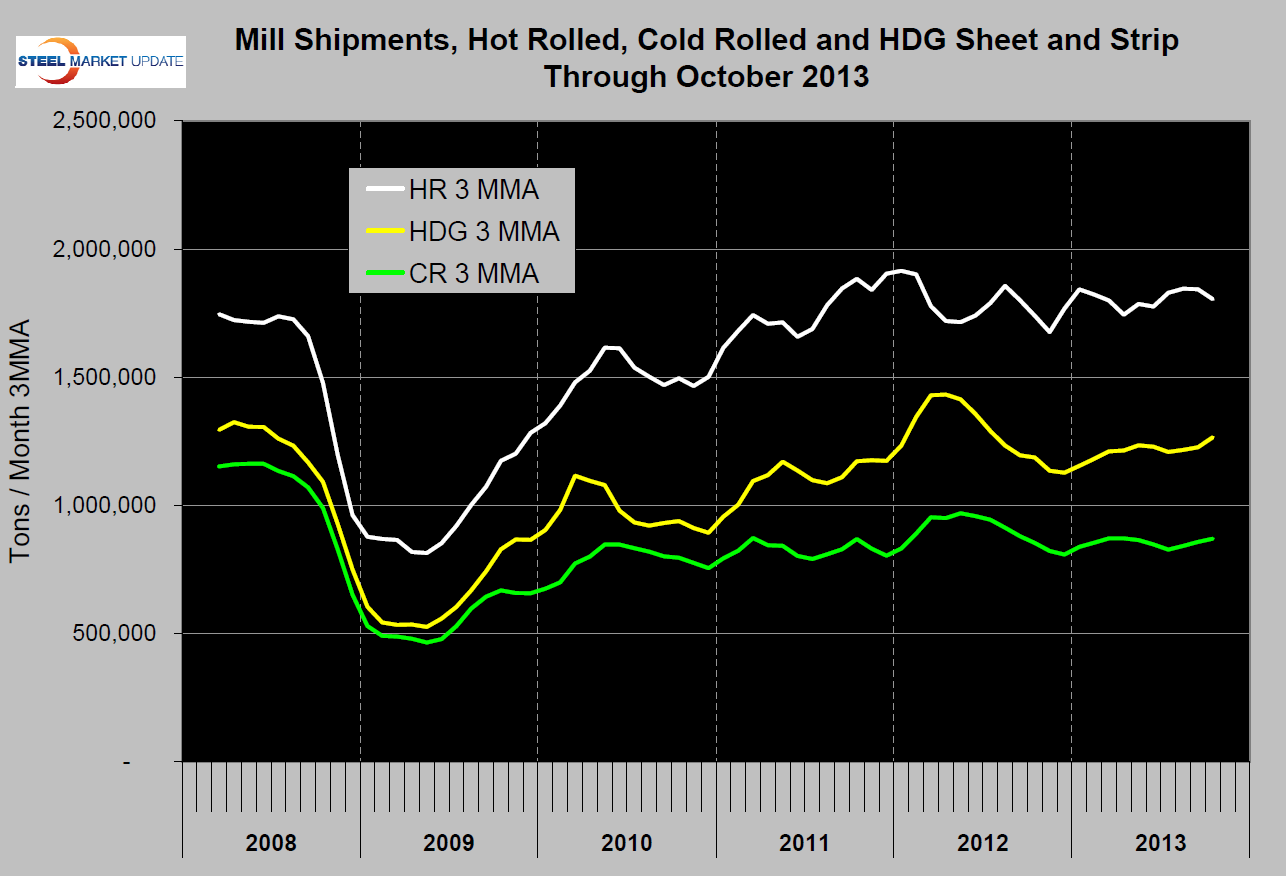

Cold rolled had the worst year to date performance, being down by 5.2 percent but, in the most recent three months, picked up 5.1 percent compared to the period May through July. Electro galvanized had the best performance in all three time frame comparisons. Figure 1 shows that following the post recession recovery, hot rolled has been little changed for two years. Shipments of hot dipped galvanized sheet and strip declined strongly in Q2 through Q4 last year but have made up a third of that loss this year. All coated products combined, including HDG, EG and other which is mostly galvalume totaled 4,383,5491 tons in 3 months through October, up by 5.5 percent from the May through July time frame. Cold rolled has been improving slightly this year after declining in the 2nd half of 2012. These figures are shipments to domestic locations plus exports based on the AISI AIS10> and Commerce Department trade reports.