Prices

May 8, 2014

U.S. Steel Exports Rebound in March

Written by Brett Linton

The following is reprinted from AIIS March Export Press Release:

March Important Canadian and Mexican Markets Show Strong Gains

U.S. steel exports expanded significantly in March, though they remained below the levels of a year earlier.

Following a dip in February, when many parts of the United States were still suffering the impact of a harsh winter, exports responded well to the milder weather that followed, surging 15 percent in March. This increase put the monthly export total at more than 1 million tons for the first time since October. Canada, which receives more than half of all U.S. steel exports, boosted its total by more than 17 percent compared to February, while Mexico, which accounts for about one-third of the nation’s steel exports, brought in nearly 14 percent more than it did the previous month. Exports to European Union countries grew by more than 12 percent during the month, but they still represent less than 3 percent of the total.

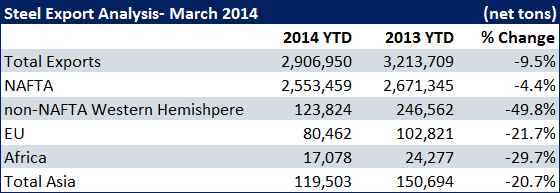

While exports to both Canada and Mexico showed nominal increases over March 2013, total steel exports were down 5.5 percent from a year earlier, as exports to many smaller trading partners dropped precipitously, including a nearly 25 percent year-over-year decline for European Union countries. The U.S. is seeing strong growth in exports to Venezuela, China and Brazil compared to 2013, however. While those nations account for just 3.6 percent of the country’s exports, that percentage is 2½ times larger than it was a year ago. Year-to-date exports to those three countries have also increased – by a factor of five, in Venezuela’s case – even as weak January and February numbers produced a 9.5 percent drop in total exports for the first three months of the year.

The strong recovery in steel exports to Canada and Mexico in March bodes well for the next several months, as it indicates that the slow start to the year had much to do with snow-related logistical problems. In addition, a strong showing in major developing countries could indicate that U.S. steel is becoming more of a factor outside North America. This trend could accelerate if the situation in Ukraine leads to tighter sanctions on Russia.

Total steel exports in March 2014 were 1.040 million tons compared to 904 thousand tons in February 2014, a 15 percent increase, and an 5.5 % percent decrease compared to March 2013. According to year-to-date figures, exports decreased 9.5% compared to 2013 or from 3.214 million tons in 2013 to 2.907 million tons in 2014.