Prices

July 11, 2014

Apparent Supply of Sheet and Strip Products through May 2014

Written by Peter Wright

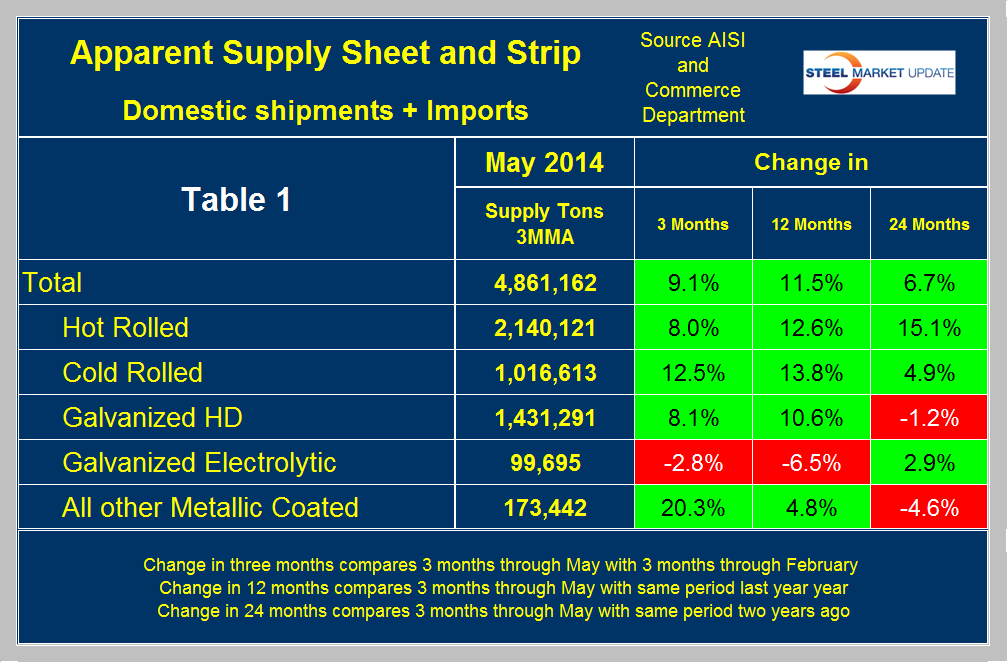

Apparent steel supply is defined as domestic mill shipments to domestic locations plus imports. Sources are the American Iron and Steel Institute and the Department of Commerce. The three month moving average of the total tonnage of sheet and strip supply in the period March through May was 4,603,548 tons, up by 11.5 percent from the same period last year and by 6.7 percent in the same period in 2012.

Table 1 shows the performance by product over three, twelve and twenty four month periods. The only product having negative growth year/year was electro galvanized. Year over year hot band grew by 12.6 percent, cold rolled by 13.8 percent and HGD by 10.6 percent.

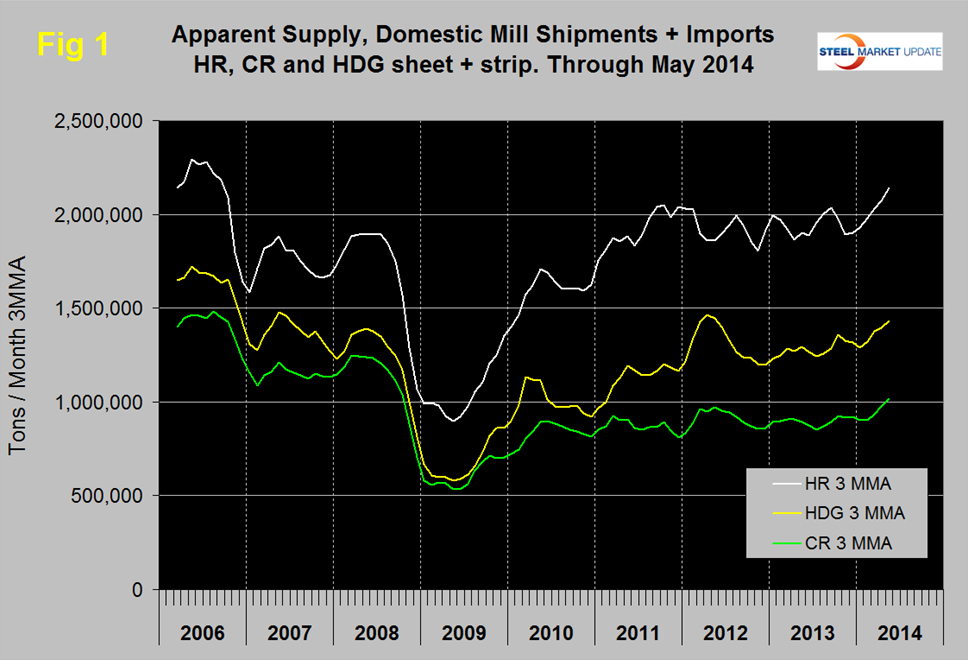

Figure 1 shows the long term supply picture for the three major sheet and strip products, HR, CR and HDG since January 2006. Finally hot band and cold rolled have broken out of the range that has prevailed for over 2.5 years. The three month moving average (3MMA) of hot rolled supply in May was the highest since September 2006 at 2,140,121 tons. Cold rolled supply at 1,016,613 broke through the one million ton level for the first time since October 2008. HDG had a strong bump in H1 2012, declined in H2 2012 and has been steadily improving for 18 months. HDG in three months through May averaged 1,431,291 tons per month.

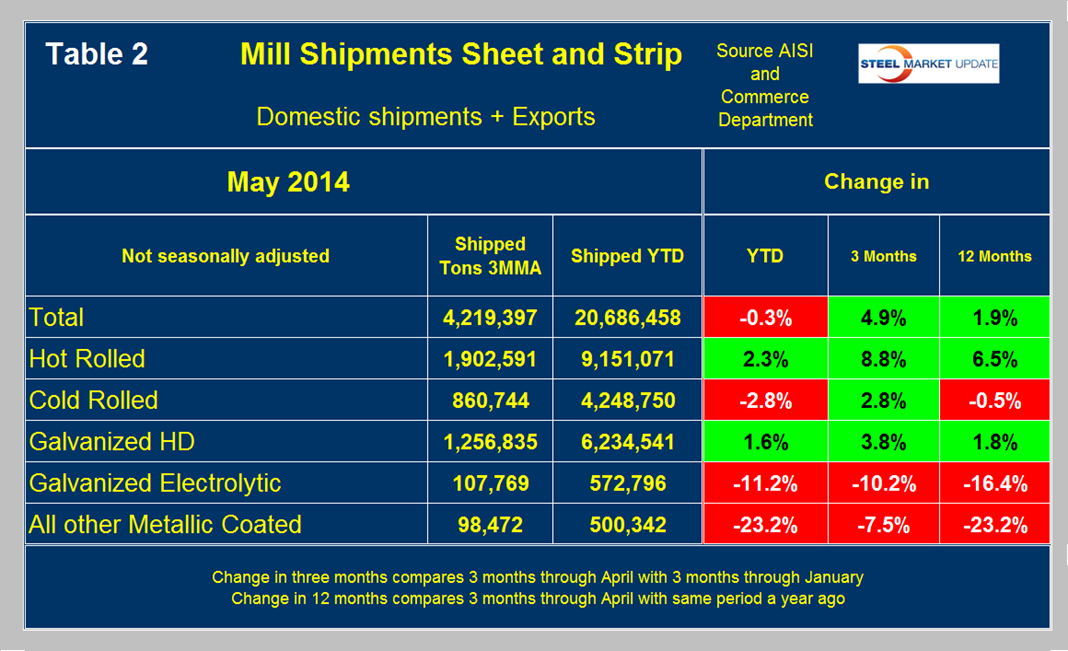

Supply is both domestic shipments plus imports. The supply of sheet and strip products was up by 11.5 percent in March through May as mentioned above but imports took the lions share. On the same time basis mill shipments were only up by 4.9 percent and YTD through May were actually down by 0.3 percent, (Table 2).

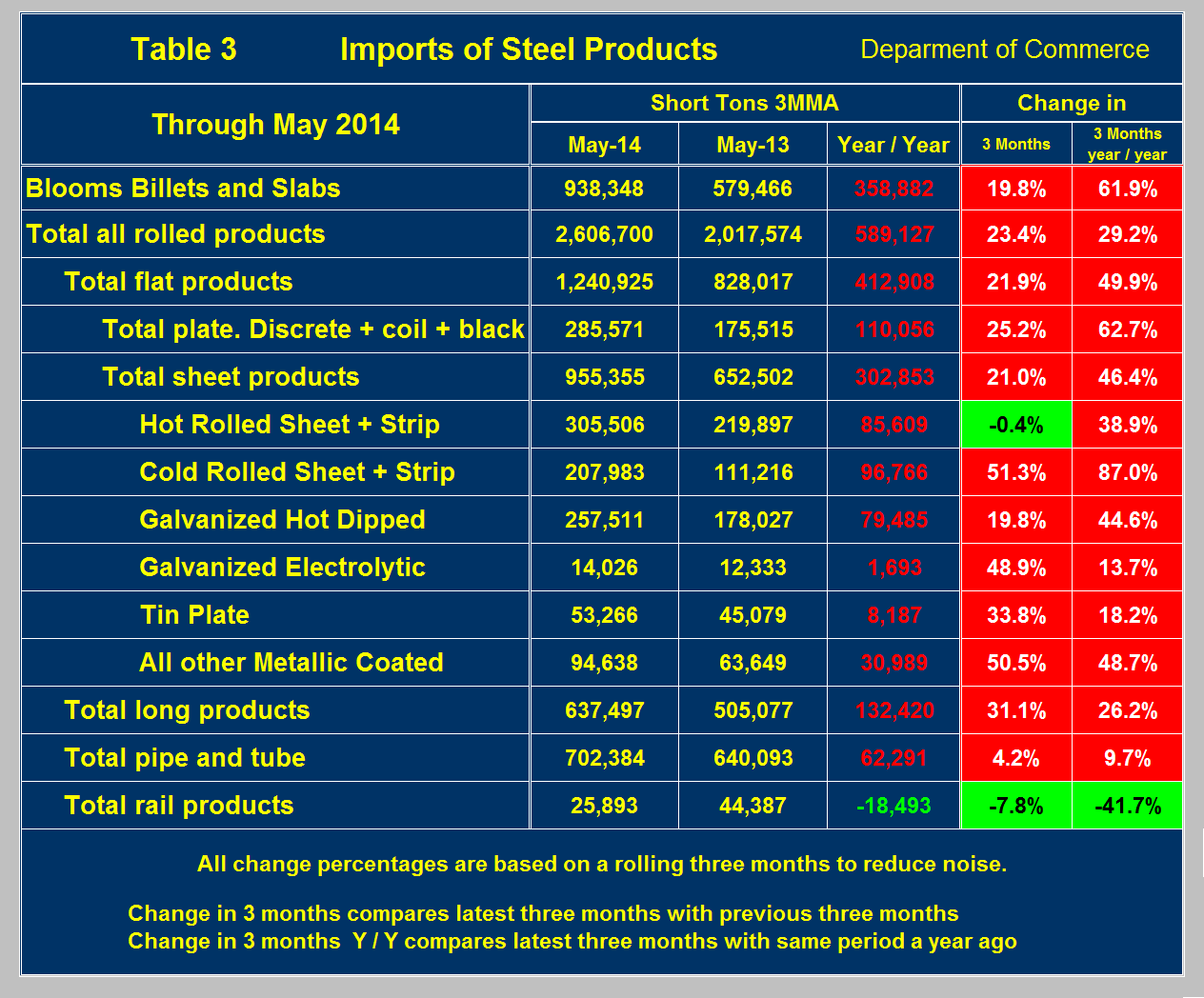

Imports of total sheet products on the other hand were up by 46.4 percent as shown in the right hand column of Table 3, led by cold rolled up by 87.0 percent y/y. Based on the latest license numbers the import situation became worse in June.