Prices

October 7, 2014

Port of Houston Update

Written by Sandy Williams

In mid-August, SMU reported on the high influx of steel at the Port of Houston and logistic problems with storage and transportation.

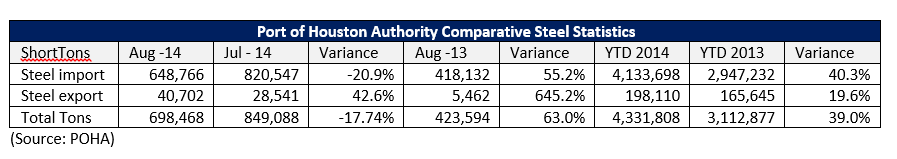

According to Port of Houston data, steel imports continue to be dramatically higher than comparable levels in 2013. Year to date import of steel in August was 4,133,698 tons, 40.3 percent higher than the same period in 2013. At the current rate, steel imports will exceed the 2013 total of 4,653,513 tons by the end of September.

Although August steel imports declined from July by 20.9 percent to 648,766 tons, exports of steel through Houston nearly doubled from the previous month to 40,702 tons, an increase of 42.6 percent m/m.

Combined steel tonnage for both import and export increased year to date as of August 2014 to 4,331,308 tons, an increase of 39.2 percent from the same period in 2013. July tonnage was recorded as the highest level since 2008.

The Houston Port authority said it has seen an increase of steel cargo growth during the first eight months of this year. In August 689,468 tons of steel (imports and exports) moved through the dock.

A logistics company manager told SMU that large quantities of steel products are continuing to come through the port of Houston and Savannah. The product mix includes flat roll as well as steel beams, plate and pipe. “We are receiving new inquiries weekly for quantities of break bulk steel coming through Houston and Savannah.”

Transportation problems have not improved at the port, says our source, “Honestly, if anything, they have gotten worse.” Truck availability, he reports, has dropped 20-30 percent with rates gaining ground for regional freight and OTR. The Houston to Dallas/Fort Worth rates have rocketed to $1100 to $1200 from $750 a few months ago. “Most if, not all, carriers in the regional markets are demanding, and getting $4.00 per mile,” he said.

Savannah is seeing similar price increases with spot rates up 15-20 percent for regional deliveries under 300 miles and 10-15 percent for deliveries over 300 miles. Generally Savannah has a lull in freight which frees up flatbeds, said the logistics manager but so far that has not developed.

“If the volumes of freight and truck availability continues at the current level there will be some significant pricing changes moving into 2015. Increases that will feed inflation throughout the country,” he said.

The sustained freight pricing is not isolated within the steel industry but is happening in multiple industries and has become “a national issue in trucking.”

Rail transport has not been a problem. Better capacity utilization is occurring though new loading plans and configurations such as loading bundled pipe on center beam cars normally used for hauling lumber.

Our port logistics source said that in Houston warehouse space at the port or within close proximity is still at a premium. Inside storage is a problem, especially at the City Docks. Savannah has had less problem, but break bulk operators would have difficulty accommodating a request for temporary inside storage of 100,000+ square feet.