Prices

January 9, 2015

November Steel Exports Analysis

Written by Brett Linton

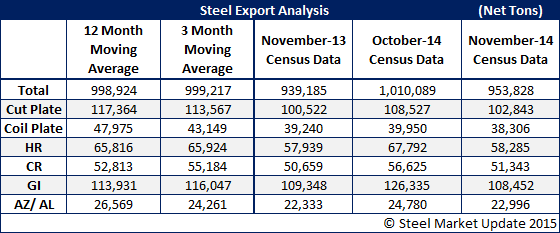

With the higher value of the U.S. dollar versus other steel trading nation’s currencies, we are seeing exports of steel in November as down slightly over October. November steel exports totaled 953,828 net tons (865,299 metric tons), down 5.6 percent over October but up 1.6 percent from November 2013 (all products). Here is a breakdown of flat rolled and plate exports for the month of November:

Cut plate exports declined 5.2 percent from October to November to 102,843 tons, but were up 2.3 percent compared to levels one year prior.

Exports of coiled plate were 38,306 tons in November, down 4.1 percent month over month and down 2.4 percent year over year.

Hot rolled steel exports declined 14.0 percent month over month to 58,285 tons but were up 0.6 percent from November 2013 levels.

Exports of cold rolled products were 51,343 tons in November, down 9.3 from October but up 1.4 over the same month last year.

Galvanized exports dropped 14.2 percent month over month to 108,452 tons. Compared to one year ago, November levels were down 0.8 percent.

Exports of all other metallic coated products came in at 22,996 tons, a 7.2 percent decrease from last month but a 3.0 percent increase compared to one year ago.

Below is an interactive graphic of our Steel Exports History by Product, but it can only be seen when you are logged into the website and reading the newsletter online. If you need any assistance logging in or navigating the website, contact us at info@SteelMarketUpdate.com or 800-432-3475.

{amchart id=”107″ Total Exports- All Products, Monthly, Net tons}