Distributors/Service Centers

February 22, 2015

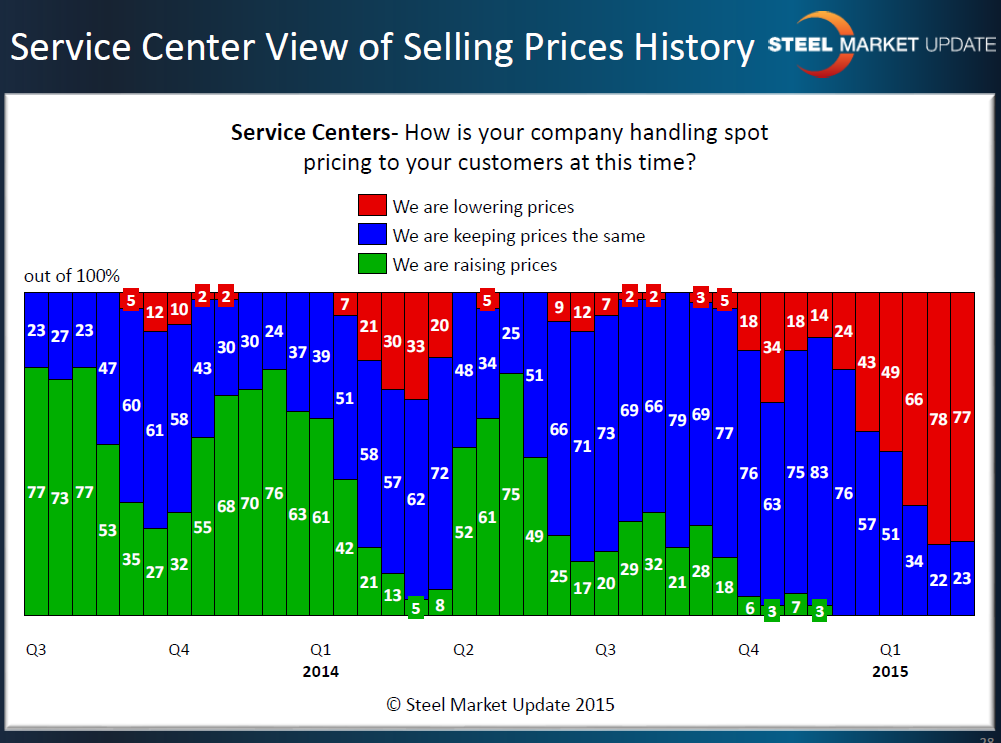

Service Center Spot Prices at Point of Capitulation

Written by John Packard

It is no secret, the U.S. flat rolled steel service centers are over-inventoried and mill spot prices are falling. In order to take advantage of the lower pricing, distributors must move off any excess inventories which Steel Market Update has calculated to be approximately 1.145 million tons as of the end of January. (Note: the service center Apparent Excess/Deficit analysis and forecast is part of our Premium level service.)

The result of the destocking at the service centers is that spot prices to their end customers are also falling. The distributors are very close to, or in, something we call “capitulation.” This is the point where the service center industry essentially has given up hope as spot prices spiral out of control. In the past we have identified the point of capitulation to be when 75 percent or more of our service center respondents are reporting that their company is lowering spot prices.

We reached that point at the beginning of February when 78 percent of the distributors responding to our survey reported they were lowering prices. This trend continued this past week with 77 percent of the SC respondents reporting the same.

Capitulation is important to us, as we see it as a point when service centers will support an attempt to move prices higher by the domestic mills.

However, in the past we did not have the extreme example of foreign tonnage flooding into the market. The foreign tonnage has a tendency to dampen any attempts by the domestic mills to announce increases.

It is SMU opinion (and I stress the word opinion here) that we will see capitulation at the service centers for a few more weeks as they move to reduce excess inventories. This is something we will probe on Tuesday of this week when we participate in the HARDI steel conference call and we will report what we find in Tuesday evening’s issue of Steel Market Update.