Prices

February 26, 2015

How Low Can Hot Rolled Prices Go?

Written by John Packard

We made a mistake in our most recent issue when we referenced $440 as being the low for hot rolled back in June 2009. That was actually the low for the galvanized base price (noted in the HARDI article in that same issue). The low for hot rolled in June 2009 was $380 per ton or $60 per ton below the galvanized base.

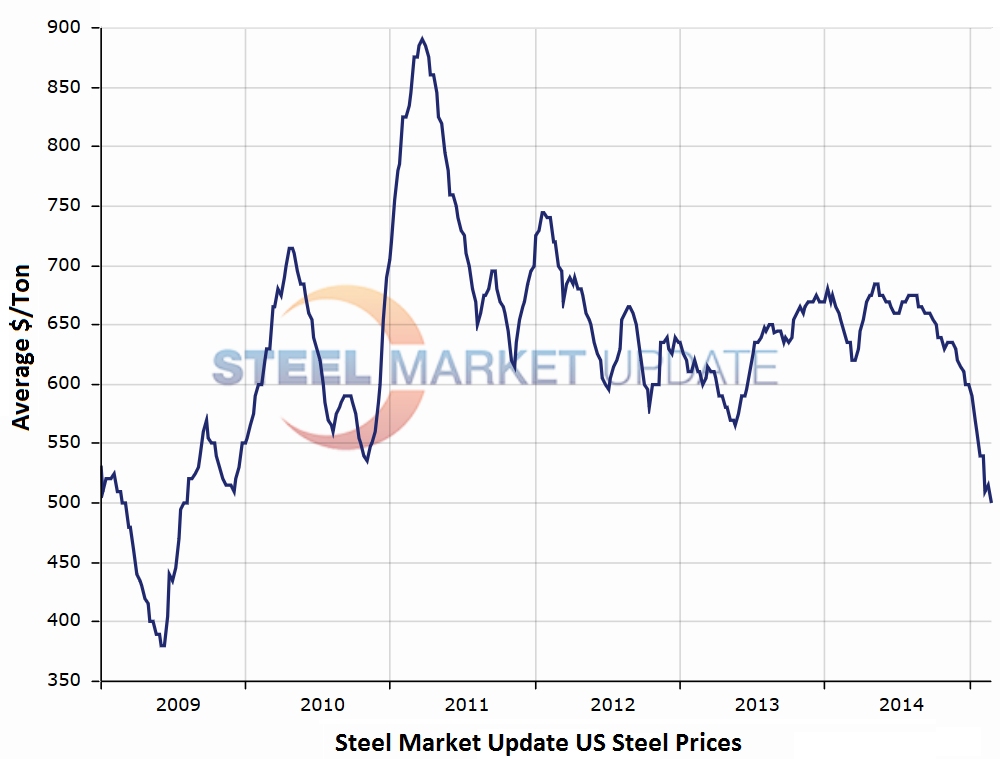

Since we brought up the hot rolled pricing history and some of our readers are asking “how low can prices go” when it comes to HRC, cold rolled and coated products, we thought it might be worthwhile sharing our pricing history going back to January 2009.

As you can see by the graphic, the lowest price point for hot rolled was back in June 2009 when it hit $380 per ton ($19.00/cwt). At that point in time the U.S. was well involved in the teeth of the Great Recession and virtually every company was over-inventoried.

Once the inventory adjustment had been made the HRC numbers jumped to over $550 per ton before the year had ended and then in 2010 rose to over $700 per ton.

The question is what is the risk of another volatile year happening in 2015 and what is different (or the same) now than what existed in 2009 and 2010?

The biggest difference is demand. The Great Recession hit demand on virtually all segments of the flat rolled steel industry. Demand is much stronger in 2015 than it was in 2009 and 2010.

The spot price for iron ore at the beginning of June 2009 was approximately $65 per dry metric ton. By the end of the month it had risen to $78 per dry metric ton. The month averaged $72/dmt. Spot 62% Fe fines this morning was being reported by The Steel Index at $62.50/dmt. This is not too far from the $65 reported at the beginning of June 2009.

SMU opinion, from what we are reading and hearing, is that iron ore will not spike to anywhere near $78 per gross ton any time soon.

Scrap prices saw obsolete grades at $185 per metric ton for heavy melt and $205 per gross ton for shredded scrap back in 2009. We are about $20 per gross ton away from those numbers (and early forecasts are calling for obsolete grades to move sideways to down $20 in March). The question is will scrap jump higher from here and our opinion is not in the immediate future.

One of the big drivers of pricing right now has been the amount of foreign imports arriving into the United States. January hot rolled imports totaled 511,691 net tons which is the highest level seen going back to 2006.

The high level of imports have created an over-inventoried position at the distributors which is pressuring the mill order books.

Lead times continue to be short and Steel Market Update believes that pricing on benchmark hot rolled will continue to be under pressure in the coming weeks.

The SMU Price Momentum Indicator continues to point toward lower prices over the next 30 days.

We don’t think the market will test the $380 lows of 2009. But, we could go down to the mid-$400’s based on the costing analysis we did (and that of World Steel Dynamics) and published in Tuesday evening’s newsletter. If HR prices drop into the mid $400’s then we could see cold rolled and coated base prices dropping into the mid ‘$500’s ($27.00/cwt-$29.00/cwt).