Prices

April 26, 2015

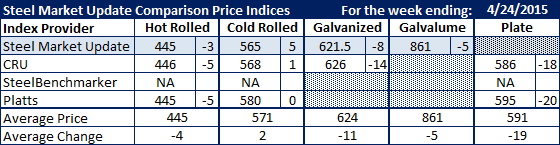

Comparison Price Indices: Finally at Bottom?

Written by John Packard

The slippage in flat rolled steel prices continued this past week but we are seeing signs that the end to the slide “may” be close.

Hot rolled prices dropped $3 (SMU) to $5 (Platts and CRU) per ton with only $1 separating the indexes from one another. We normally see the indexes tightening up the range between one another when numbers start to firm or, perhaps better stated, when the mills begin pushing back and not giving up $10 per ton or more from the prior week.

Cold rolled prices actually rose on the SMU and CRU indexes while Platts remained stable. The variance between SMU and CRU was $3 per ton and Platts continues to see the market $12 to $15 per ton higher.

Galvanized and Galvalume numbers continue to adjust but the good news for those looking for a bottom, is CRU and SMU now have $4.50 per ton separating the two indexes.

Plate prices continue to drop by double digits but the spread between CRU and Platts tightened.

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

CRU: Midwest Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.

Note that SteelBenchmarker produces numbers twice per month. On the weeks they produce numbers we will include them in the average. The weeks where they do not produce numbers (NA = not available) we will not include their outdated numbers in the CPI average.