Prices

August 16, 2015

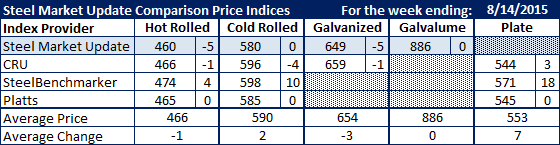

Comparison Prices Indices: Mixed Bag

Written by John Packard

The negative numbers are starting to appear and SMU is hearing from steel buyers that weakness is creeping back into the markets, if only over the short term. However, not all of the indices followed by Steel Market Update saw the market as weakening at all. SteelBenchmarker, in particular, reported bullish results with all of their prices being higher than when they last reported at the beginning of the month (SteelBenchmarker reports prices twice per month only). Platts saw the market as completely flat (which they have been doing for a number of weeks, if not months, now) and CRU reported lower flat rolled pricing on all products except plate.

Benchmark hot rolled saw the SMU and CRU indexes dropping prices, Platts remained the same and SteelBenchmarker saw the HRC market up $4 to $474 per ton… Our CPI average dropped $1 per ton to $466 and would have been $464 per ton if SteelBenchmarker was not considered in the week’s data.

Cold rolled saw similar type results with CRU down $4 per ton, Platts and SMU remaining the same as the prior week and SteelBenchmarker up $10 per ton. The average was up $2 per ton to $590 per ton.

Both CRU and SMU dropped galvanized prices this past week to $659 and $649, respectively. The CPI average declined by $3 per ton.

Galvalume remained unchanged while plate prices rose by $11 per ton (CPI average), mostly on the back of SteelBenchmarker who saw the market as being $18 per ton higher than their last price publication which was at least two weeks prior.

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

CRU: Midwest Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.