Prices

December 8, 2015

Flat, Long, and Semi-Finished Steel Imports Analysis

Written by Peter Wright

Licensed data for November was reported by the Steel Import Monitoring System of the US Commerce Department on December 4th. At SMU we perform a detailed analysis of this data, an explanation of our methodology is given at the end of this write up.

![]() Total rolled product licensed imports in the single month of November were 2,109,471 short tons down by 9.1 percent from the final October volume. We prefer not to dwell on single months results because of the extreme variability that can occur in individual products. In the comments below we use three month moving averages (3MMA) to get a more representative picture. The 3MMA through November was 2,249,408 tons, down by 5.9 percent from the October 3MMA. On the same basis flat rolled was down by 6.2 percent, long products down by 4.9 percent and pipe and tube down by 8.1 percent.

Total rolled product licensed imports in the single month of November were 2,109,471 short tons down by 9.1 percent from the final October volume. We prefer not to dwell on single months results because of the extreme variability that can occur in individual products. In the comments below we use three month moving averages (3MMA) to get a more representative picture. The 3MMA through November was 2,249,408 tons, down by 5.9 percent from the October 3MMA. On the same basis flat rolled was down by 6.2 percent, long products down by 4.9 percent and pipe and tube down by 8.1 percent.

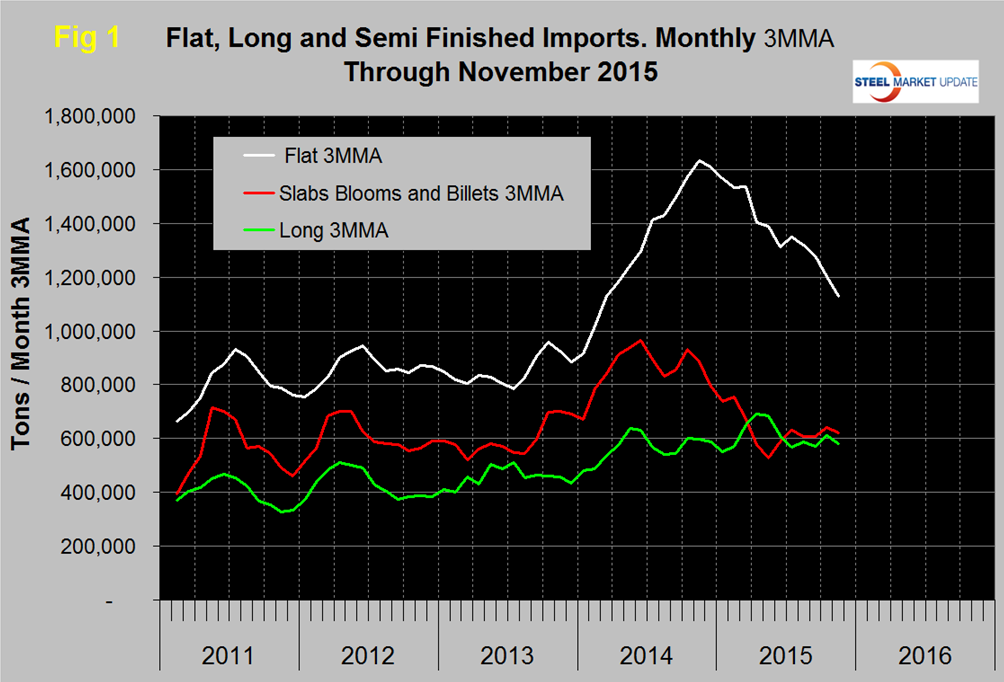

Figure 1 shows the 3MMA through November licenses for semi-finished, flat and long products.

Flat includes all hot and cold rolled sheet and strip plus all coated sheet products including tin-plate plus both discrete and coiled plate. The 3MMA of flat rolled imports peaked at 1,634,000 tons in November last year and has since declined to 1,128,487 tons in November this year. In November last year the 3MMA of semi-finished imports was 884,641 tons, this volume declined to 527,000 tons in May and has maintained a narrow range of just over 600,000 tons for the last five months. Long product imports have been stuck in the range 519,000 tons to 772,000 tons since March last year with no particular trend evident. In November the 3MMA of long product imports was 579,536 tons.

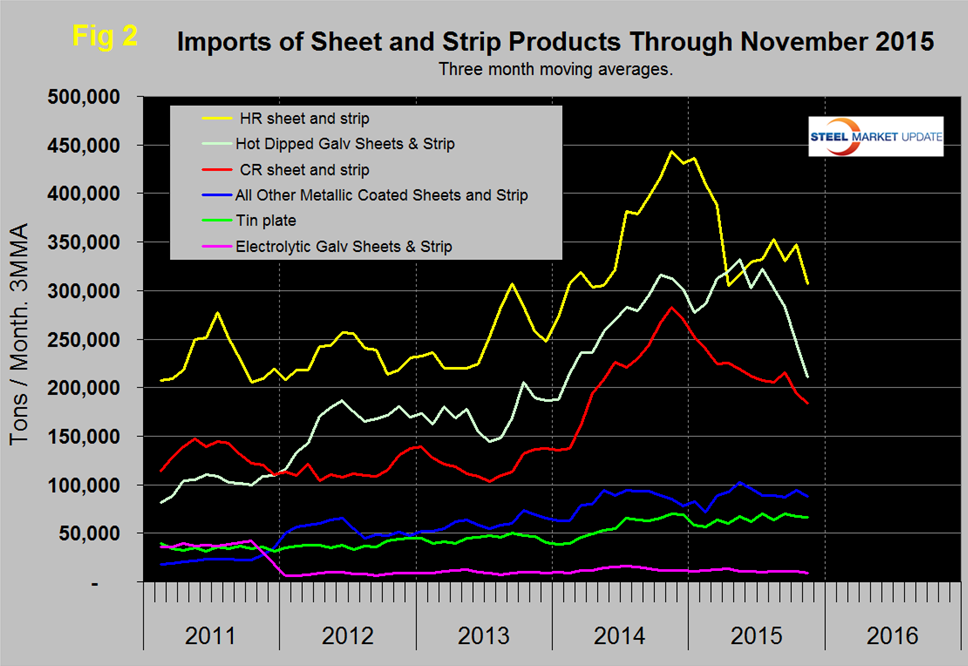

Figure 2 shows the trend of sheet and strip products since January 2011.

Of the big three tonnage items, HR, CR and HDG, the latter has been down most significantly in the last four months with a decline of 34.7 percent since July. Hot rolled is close to where it was in March and Cold rolled has declined progressively since November last year. All other metallic coated (mainly Galvalume) and tin plate have been relatively flat for the last five months. Electro-galvanized has been little changed in three years.

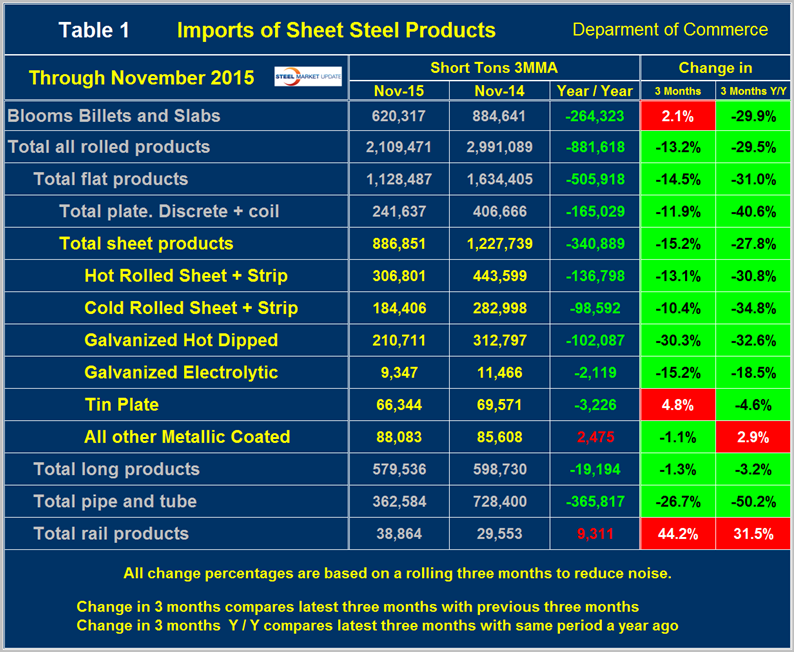

Table 1 provides an analysis of major product groups and of sheet products in detail.

It compares the average monthly tonnage in the latest three months through November with both three months through August (3M/3M) and three months through November last year (Y/Y). Semi-finished slabs, blooms and billets were up by 2.1 percent 3M/3M but down by 29.9 percent Y/Y. The total tonnage of hot worked products was 2,109,471 tons in November on a 3MMA basis, down by 881,618 tons from November last year. The total hot worked tonnage was down by 13.2 percent 3M/3M and down by 29.5 percent Y/Y. These trends indicate that in the big picture the peak of import volume has passed but there are still some short term blips. The color codes in Table 1 for the three month and year over year change show which products are improving and which have still experienced import volume increases in these two time frames. It sometimes seems to us as we write these reports that we are contradicting ourselves but if readers use the tables for short term evaluation and the graphs for long term then our analysis should make sense.

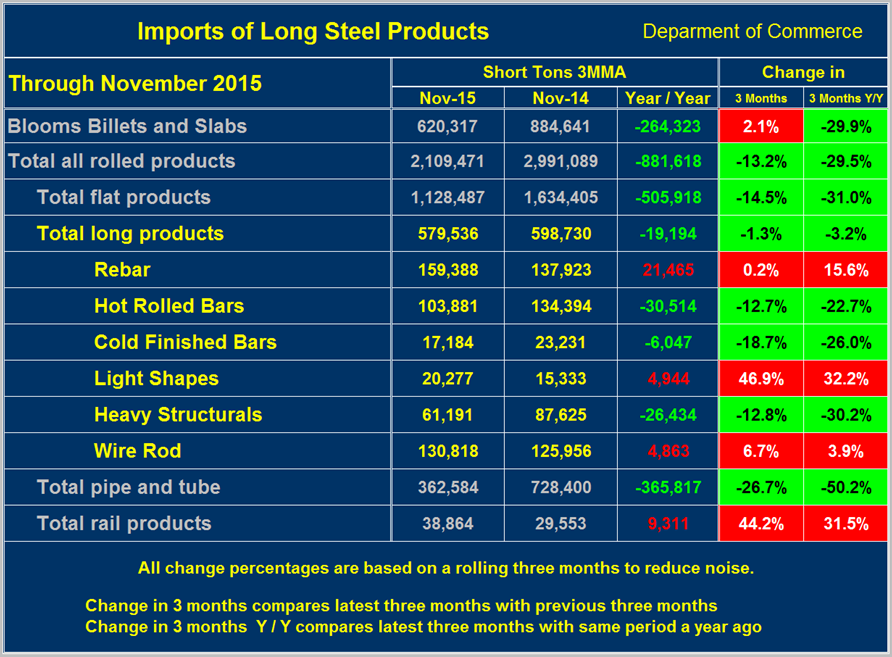

Table 2 shows the same analysis for long products.

For total long products the tonnage was down by 19,194 tons Y/Y which was 3.2 percent. In 3M/3M the volume was down by 1.3 percent. Light shapes had a particularly strong surge in the three months through November 3M/3M and also Y/Y. Other long products ranged from wire rod up 6.7 percent to cold finished bars down 18.7 percent both 3M/3M. Imports of pipe and tube declined by 26.7 percent 3M/3M and by 50.2 percent Y/Y. The rail products numbers were driven by very high volumes in July and September.

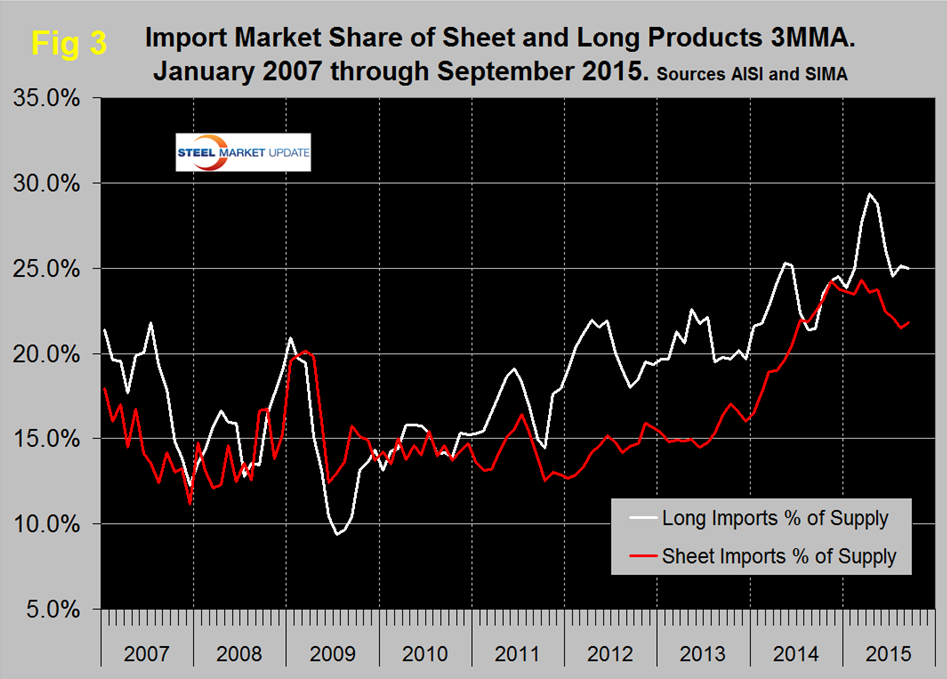

Figure 3 shows the import market share of sheet and long products through September which is the latest data available for total steel supply.

The import market share of sheet products peaked at 24.3 percent in March and fell to 21.8 in September. For long products the import share skyrocketed in January through April then declined sharply in May, June and July with a small uptick in August and flat in September.

Explanation: The SMU publishes several import reports ranging from this very early look using licensed data to the very detailed analysis of final volumes by product, by district of entry and by source nation which is available on the premium member section of our web site. The early look, the latest of which you are reading now has been based on three month moving averages (3MMA) using the latest licensed data, either the preliminary or final data for the previous month and final data for earlier months. We recognize that the license data is subject to revisions but believe that by combining it with earlier months in this way gives a reasonably accurate assessment of volume trends by product as early as possible. We are more interested in direction than we are in absolute volumes at this stage. The main issue with the license data is that the month in which the tonnage arrives is often not the same month in which the license was recorded. In 2014 as a whole our data showed that the reported licensed tonnage of all carbon and low alloy products was 2.3 percent less than actually receipts, close enough we believe to confidently include licensed data in this current update. The discrepancy declined continuously during the course of the twelve month evaluation as a longer time period was considered.