Prices

January 14, 2016

January Imports Trending Toward Low 2 Million Tons

Written by John Packard

The U.S. Department of Commerce updated January 2016 foreign steel import license data earlier this week. For a number of months Steel Market Update has been comparing the data to see how the current month’s numbers compare to prior months in an effort to get a better handle on the trend.

January’s number may be quite telling as we generally see a swell of licenses earlier in the month and if that trend remains the same January may be the first month to come in at the low 2 million net ton level.

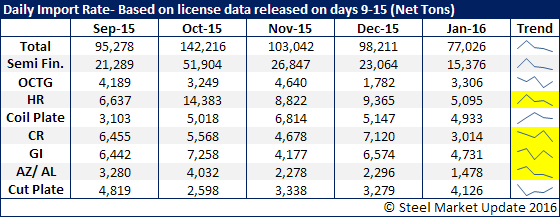

Here is January license rate compares on a daily basis for this point in the month to the last four months of 2015.

We have highlighted hot rolled, cold rolled, galvanized (GI) and “other metallic” (most being Galvalume or AZ, the AL is aluminized which is also included in the “other metallic” totals). Each of the products are trending lower at this point in the month, most likely due to the trade suits as they start to come to a head.

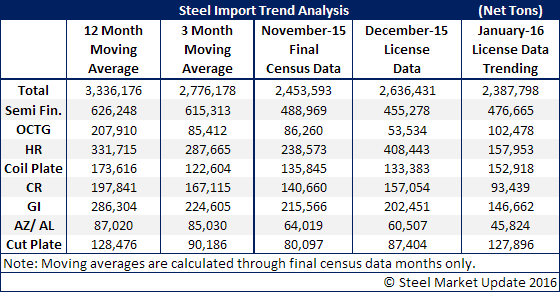

At the moment, January 2016 is trending toward a 2.2-2.4 million ton month (see below). Hot rolled numbers are trending dramatically. Galvanized is also well below the 3 month and 12 month moving averages.

We will need to watch the trends carefully as we go out a couple of months into 2016 as the domestic mills move to increase prices at the same time they are also increasing the spread between the foreign price offers and domestic offers (and expectation of continued price increases).

We have already heard from buyers that the Indian mills are coming back into the market “in a big way.” SMU will try to understand what that means and report on it in the days and weeks ahead.