Prices

February 23, 2016

SMU Price Ranges & Indices: No Change

Written by John Packard

Steel Market Update asked steel buyers how they were seeing the flat rolled steel market so far this week. One large Midwest based service center told us, “Eerily quiet.” Other buyers basically provided the same guidance. Hot rolled order books continue to be weak to moderate while cold rolled and coated lead times are extended at most mills. At this point, no one seems to overly concerned about the mill order books, lead times or the potential for higher flat rolled steel prices. Many buyers (not all) are convinced the market is “range bound” and destined to stay that way for much of the first half 2016.

However, history tells us that “range bound” markets tend to be few and far between…

One of our mill sources told SMU earlier today, “Never in a million years have I seen a high up domestic [steel mill] exec who has the foresight to argue for stability and spread management instead of constant increases.” He went on to say, “I think a couple of mills are trying to push pricing up without an announcement. Just to see if it flies.” He then continued with a comment about the spread between hot rolled and cold rolled/coated steels, “My theory on the HR gap is that CR and coated are priced where they should be, and HR is out of whack. I keep hearing that the gap can’t be maintained…why? You can’t really go out an buy bands and convert them to CR… CR will only fall as soon as the mills open up more capacity or until imports pound us.”

A large hot rolled buyer told us that the range we have been publishing continues to exist. However, for large buyers, “High end realistic is $400. Of course there are USS and AK who are quoting really high but getting no orders.”

In this evening’s HARDI article the wholesalers who buy galvanized steel from the domestic mills spoke about the market being, in their estimation, range bound. While other conversations we have had with service center buyers/executives believe that higher prices may be in our future.

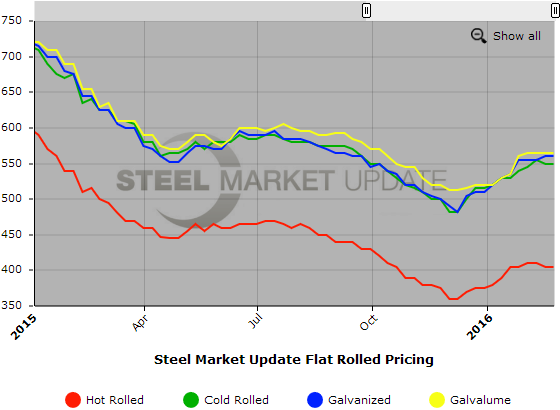

At this moment here is how we see spot flat rolled prices this week (all prices shown are in net tons which are equal to 2,000 pounds):

Hot Rolled Coil: SMU Range is $380-$430 per ton ($19.00/cwt- $21.50/cwt) with an average of $405 per ton ($20.25/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range remained unchanged compared to one week ago. Our overall average is the same as it was last week. SMU price momentum for hot rolled steel has prices rising over the next 30 days.

Hot Rolled Lead Times: 2-5 weeks.

Cold Rolled Coil: SMU Range is $520-$580 per ton ($26.00/cwt- $29.00/cwt) with an average of $550 per ton ($27.50/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range remained unchanged compared to last week. Our overall average is unchanged. SMU price momentum for cold rolled steel is for prices to increase over the next 30 days.

Cold Rolled Lead Times: 5-8 weeks.

Galvanized Coil: SMU Base Price Range is $27.00/cwt-$29.00/cwt ($540-$580 per ton) with an average of $28.00/cwt ($560 per ton) FOB mill, east of the Rockies. Both the lower and upper ends of our range remained unchanged compared to one week ago. Our overall average is the same as it was last week. Our price momentum on galvanized steel is for prices to move higher over the next 30 days.

Galvanized .060” G90 Benchmark: SMU Range is $600-$640 per net ton with an average of $620 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 4-9 weeks.

Galvalume Coil: SMU Base Price Range is $27.50/cwt-$29.00/cwt ($550-$580 per ton) with an average of $28.25/cwt ($565 per ton) FOB mill, east of the Rockies. Both the lower and upper ends of our range remained unchanged compared to last week. Our overall average is unchanged. Like the other flat rolled products mentioned above our price momentum for Galvalume is currently pointing towards an increase in prices over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU Range is $841-$871 per net ton with an average of $856 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 5-9 weeks.

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, and Galvalume price history. To use the graphs interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or by calling 800-432-3475.