Prices

March 29, 2016

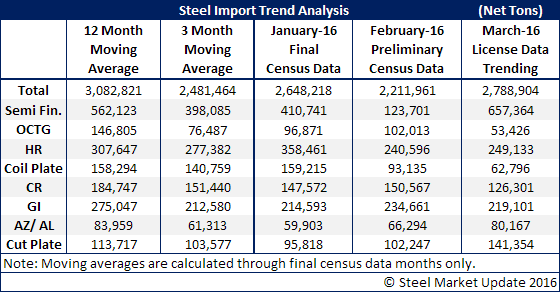

March Imports Trending Toward 1 Million Fewer Tons than Last Year

Written by John Packard

When looking at the import license data it is important to put the data into some sort of context. At this time, SMU expects March 2016 foreign steel imports to total 2.4-2.6 million tons. If correct, March foreign steel imports would be higher than the month of February Preliminary Census numbers by approximately 300,000 tons. Foreign steel imports totaled 3,615,960 net tons during March 2015.

In the table provided below SMU has extended the daily average rate for licenses through the 29th of March to come up with the “Trending” number referenced. We are of the opinion that when all the dust settles the final March total will be a couple of hundred thousand tons less than our trending number.

License data can be misleading and the data from the month of February is a good example. License requests totaled 202,181 tons (net tons) more than the Preliminary Census number recently released.

The big discrepancy in the February number was created by there being 267,200 tons more license requests for semi-finished steel (slabs) than what was actually delivered into the U.S.

We believe this may well be the case again in March but, even so, imports of slabs are expected to be 350,000-450,000 greater than what was received during the month of February 2016.

In our “Trend” report below we find some of the numbers quite interesting. The following products are well below both their 12 month and 3 month moving averages: OCTG, HR, coiled plate and cold rolled. Galvanized was below its 12MMA but higher than its 3MMA.

For those of you who watch the US Department of Commerce website for the license, preliminary and final census data – remember that US DOC site is in metric tons. We have converted all the tonnage shown to net tons (2,000# = 1 net ton).