Prices

August 2, 2016

HRC Exports to US Decline by AD/CVD Participants Except Korea & Australia

Written by John Packard

By the end of this week, the U.S. Department of Commerce is scheduled to release their final determinations on hot rolled antidumping and countervailing duties against seven countries: Brazil, South Korea, Australia, Japan, United Kingdom, Turkey and the Netherlands.

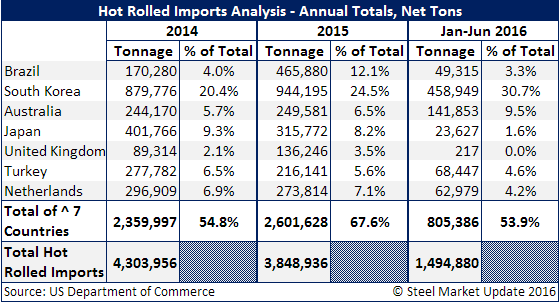

Combined these seven countries represented roughly 55 percent of all hot rolled imported into the United States during calendar year 2014. In 2015 that percentage of the total increased to almost 68 percent. In August 2015 the domestic steel mills filed AD/CVD suits against the seven countries and, even after the March 15, 2016 preliminary determinations were reported by the US DOC with cash deposit rates of 3.97 percent to as high as 49.05 percent, these same seven countries are responsible for 54 percent of the HRC imports for the first six months 2016.

During this AD/CVD process we have actually seen two countries growing their percentage of the imported hot rolled market. South Korea has gone from 20.4 percent in 2014 to 24.5 percent in 2015 and, so far this year, their HRC exports to the United States equate to 30.7 percent of the total tonnage. Australia has also grown their market share, moving from 5.7 percent in 2014 to 6.5 percent in 2015; and for the first six months 2016 they are now 9.5 percent of the HRC import market.

All of the other countries named have tempered or eliminated hot rolled exports to the United States as you can see by the table provided below. Imports of hot rolled peaked in 2014 at 4.3 million net tons. At this moment, based on the first six months of import data it appears HRC imports for 2016 should come in around 3.0 million tons or 1.3 million fewer tons than what we saw during 2014.