Prices

April 6, 2017

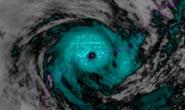

Cyclone Debbie Disrupts Met Coal Exports

Written by Sandy Williams

Cyclone Debbie passed through Australia’s metallurgical coal region last week doing minimal damage to the mines and ports but shut down railway lines. Damage to the major coal carrying Goonyella rail corridor was extensive and may take as long as five weeks to repair. Australian companies estimate 15-20 million tonnes of met coal may be impacted.

The cyclone coincided with dropping met coal prices which were down by half to $151.50 mt FOB March 24 compared to the November 18 prices of $310/mt FOB Australia. China, Australia’s biggest market for coal, shifted to US sources to fill the shortfall. American coal companies are reportedly overwhelmed with inquiries from Asian customers.

On Monday, USB said spot price could jump by $100 per ton. By Tuesday, Steel Index reported met coal jumped to $176.80, after a 15 percent increase the day before. Platts Index reported coal soared to $241 today, April 6.