Prices

April 11, 2017

Cold Rolled Import Analysis 2009-YTD

Written by John Packard

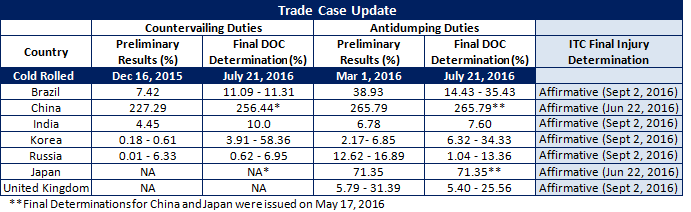

In July 2015 the domestic steel mills filed Antidumping (AD) and Countervailing Duties (CVD) against seven countries: Brazil, China, India, Korea, Russia, Japan and the United Kingdom.

The final determinations were affirmed by the ITC in late June (Japan, China) and early September (all others) 2016. Antidumping deposit rates ranged from zero (Japan & UK) to a high of 256.44 percent (China) while Countervailing Duties ranged from 1.04-13.36 percent (Russia) to a high of 265.79 percent (China).

So, how did the suits affect cold rolled imports and especially the seven named countries?

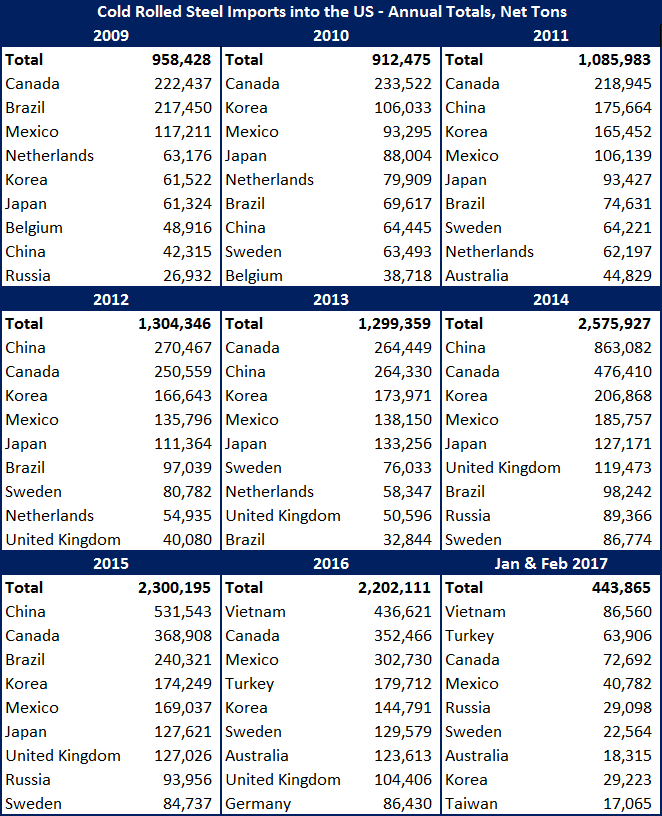

Since 2009 the biggest single year for cold rolled imports was 2014 at 2,575,927 tons. The suits were filed mid-year 2015 which was the second largest year for imports at 2,300,195 tons. Last year (2016) cold rolled imports barely moved, coming in at the third highest level with 2,202,111 tons.

Based on the first two months, 2017 is on pace to become the biggest year for cold rolled imports. At the current pace, the U.S. would import 2,663,190 tons.

The Good, The Bad and The Ugly

In the following tables you can see the growth of the Chinese exporting cold rolled to the United States. In 2009 the Chinese sent 42,315 tons. By the time we reach 2012 The Chinese became the single largest exporter of CRC to the U.S. with 270,467 tons. By the time we reach the year prior to the trade suits China grew their exports of CRC to 863,082 tons. In the twelve months after the suits (2016) Chinese exports of CRC were negligible.

In 2016 Brazil exports of CRC were negligible having peaked in 2015 at 240,321 tons.

India also disappeared from the leader board (not that they were ever in the top 9 exporting countries).

Korea has not dropped out of the top 9 CRC exporting countries in any of the years shown. They are on pace to exceed 2016 tonnage levels should the first two months be an indication of what we should expect for the remainder of the year.

Russia was never a huge player having only been in the top 9 countries twice (2014, 2015) since 2009. The Russians are on pace to become one of the top 5 countries to export CRC to the U.S. in the current calendar year.

Japan had been fairly consistent with the number of tons they were shipping to the U.S. markets but the trade suits have eliminated them as a major player in the U.S. market.

The United Kingdom came on as a major exporter of CRC to the U.S. in 2014 (119,473 tons). The trade suits have apparently knocked them out as a major exporter so far this year.

Instead of eliminating cold rolled imports the names on the top 9 list have changed. Vietnam is becoming the new China. Vietnam is on pace to exceed 500,000 tons during calendar year 2017. This from a country that shipped essentially zero tons to the U.S. prior to 2016. In 2015 Vietnam was not in the top 9 exporting countries and the following year they were at the very top – the number 1 exporter was Vietnam. So far this year Vietnam is keeping the tons flowing.

The other countries growing at the expense of the few countries knocked out of key positions due to AD/CVD suits are: Vietnam, Turkey, Mexico, Sweden, Australia and Taiwan.