Prices

July 5, 2017

Chinese Scrap: Where There's a Will There's a Way

Written by John Packard

The following article was sent to us by one of our steel and scrap trading sources located within China. He has been actively involved in the export of ferrous scrap out of China this year and understands where that market is headed right now (and why). Here is what he shared with Steel Market Update earlier today:

Scrap exports from China have more or less ceased for the past 10-14 days due to government intervention. The reason being BOF mills in China have been procuring domestic scrap at cheap prices. Since April, total export of scrap from China is only around 175-200K tons. However, these export numbers, no matter how minimal they seem, have fueled the domestic price for scrap by 20-30 percent, and the domestic mills are crying foul. Since they are all state owned, they have appealed to the Port Customs to cease and deter exports of scrap and to protect the state owned mills’ interest. As you can imagine, the Customs Bureau has only one option.

The mills’ actions are not even relative to a shortage of scrap availability, but due only to the price increases cutting into their profits. The last time we checked, only 7-10 days ago, their margin was anywhere from RMB500-800/mt on Billets/Debars/Wire Rods etc.. Remind you of someone else in the USA?

Exchange rate use USD1 = RMB6.80.

I totally agree with Philip’s [Hoffman – Article in SMU Sunday, July 2, 2017 issue] comments, as well as the Reuters article.

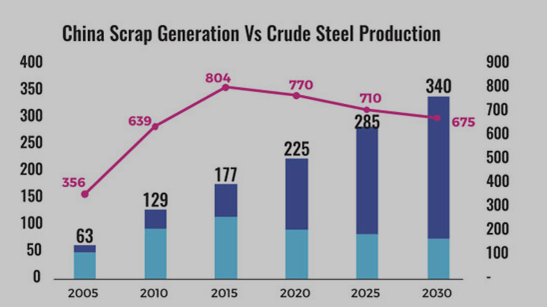

Here is a graph I saw today. Crude steel is the pink line and domestic scrap Is the light and dark blue. The difference in light and dark blue is the Government’s Official Domestic Scrap Assessment in Millions/MTS per annum (light blue) vs. Various Market Assessments in Millions/MTS per annum (dark blue).

We anticipate scrap exports will resume in the next 2-3 weeks as in China, where there is a will, there is a way. Prices domestically have surged to the point of China scrap being too expensive to export at the moment, with Compressed Bundles at RMB1300-1400 and HMS1 and 2 is at RMB1700-1800 ex-scrap yard. These numbers are now 20-30 percent higher than when we first started to export two months ago. Our markets are now holding on purchases to see developments in the coming weeks.