Government/Policy

February 13, 2018

New AD/CVD Investigation on Welded Pipe Imports

Written by Sandy Williams

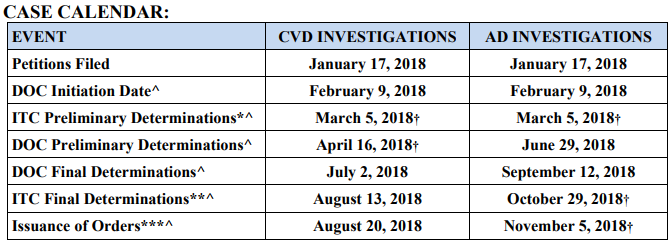

The Department of Commerce announced on Tuesday the initiation of new antidumping duty and countervailing duty investigations on imports of large-diameter welded pipe from Canada, China, Greece, India, Korea, and Turkey.

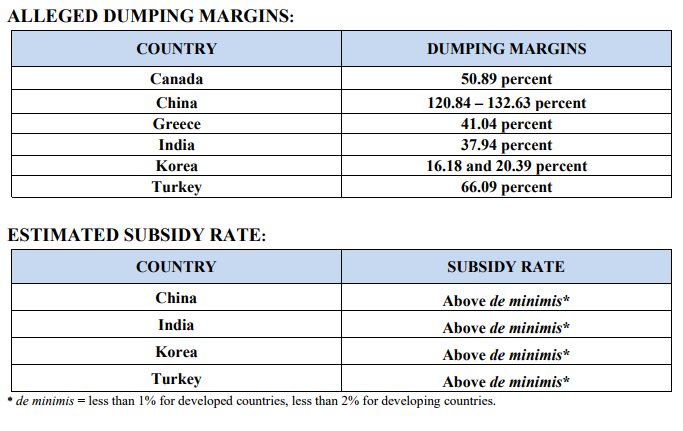

Dumping margins were estimated by the petitioners at 50.89 percent for Canada, 41.04 percent for Greece, 120.84 to 132.63 percent for China, 37.94 percent for India, 16.18 to 20.39 percent for Korea, and 66.09 percent for Turkey.

The petitioners, American Cast Iron Pipe, Berg Steel Pipe, Dura Bond Industries, Skyline Steel, and Stupp Corp., also allege that producers of large-diameter welded pipe from China, India, Korea and Turkey are receiving unfair subsidies from their respective governments.

The product covered by these investigations is welded carbon and alloy steel pipe, more than 406.4 mm (16 inches) in nominal outside diameter (large-diameter welded pipe), regardless of wall thickness, length, surface finish, grade, end finish or stenciling.

In 2016, imports of large-diameter welded pipe from Canada, China, India, Greece, Korea and Turkey were valued at an estimated $66 million, $139 million, $26 million, $70 million, $150.3 million, and $116.1 million, respectively.

Secretary of Commerce Wilbur Ross commented, “This administration has made it clear that we will vigorously administer antidumping and countervailing duty laws.”

In the past year since President Trump took office, AD/CVD investigations have jumped 81 percent compared to the prior year. Commerce has initiated 94 antidumping and countervailing duty investigations and currently maintains 424 AD and CVD orders.

The announcement on welded pipe precedes a meeting scheduled for today between the White House and Congress regarding the Section 232 reports on steel and aluminum imports. Steel producers are calling for strict quotas and tariffs on all imported steel products.

The new AD/CVD investigation was met with concern by the Chinese Ministry of Commerce. “China is concerned about the U.S. side’s serious trade protectionist tendency in the field of steel products,” said Wang Hejun, head of the MOC’s trade remedy and investigation bureau.

Wang said that although it is the right of WTO members to bring forward such investigations, “frequent and excessive protection of the domestic industry cannot serve the original purpose of trade remedy measures, but often creates a vicious cycle.”