Market Data

February 25, 2018

Steel Mill Negotiations: Mills in the Driver's Seat

Written by Tim Triplett

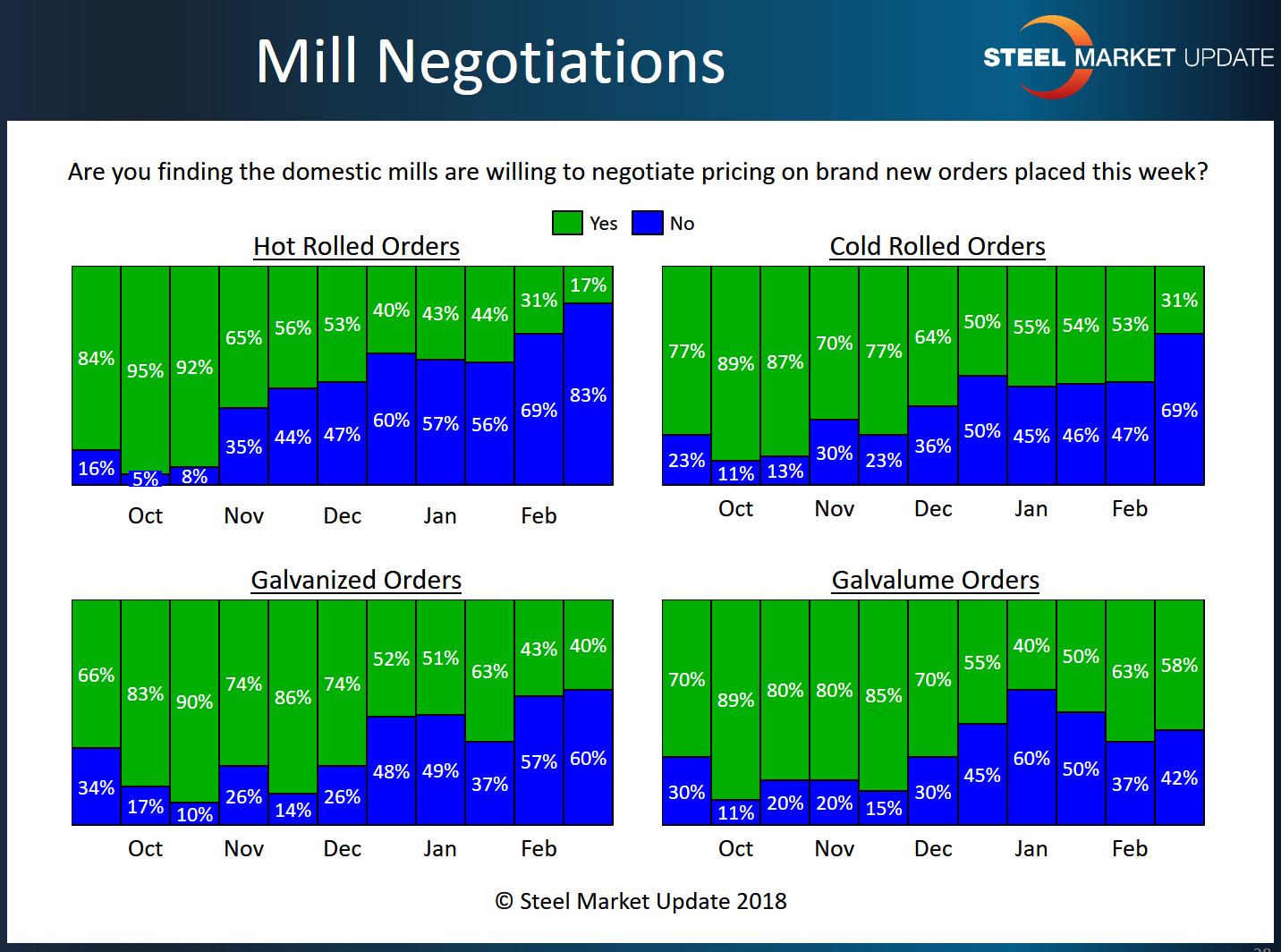

Steel prices have been on the rise for the past four months, so it’s no surprise that steel buyers are reporting mills less willing to negotiate. More than 60 percent of respondents to Steel Market Update’s latest market trends questionnaire say mills are holding firm in price negotiations. About 10 percent say they still find some suppliers willing to talk price. The remainder have had mixed success in negotiating better buys.

By market segment, 83 percent of SMU respondents said the mills are holding firm on hot rolled steel orders, while only 17 percent have found mills willing to negotiate. That compares to 69 percent holding the line and 31 percent open to price negotiations on hot roll two weeks ago.

In the cold rolled segment, 31 percent said they have found some mills willing to talk price, while the majority (69 percent) reported mill prices on cold rolled as non-negotiable.

In the galvanized sector, it’s a 60:40 proposition today. About 60 percent of respondents said the mills are now standing firm on galvanized prices, while 40 percent said some mills are still open to negotiation on coated products. That’s about a 23 percent shift from a month ago when just 37 percent said mills were holding the line.

Most Galvalume buyers (58 percent) reported that mills are still open to price discussions, while 42 percent said mills are unwilling to compromise on Galvalume prices. One month ago, it was a 50-50 proposition whether Galvalume suppliers would have any flexibility on price.

The mills appear to be in the driver’s seat in the current market environment. As one buyer said: “In a conversation yesterday with a major steel mill, I was told we may see a price correction shortly. However, hot rolled black is on allocation and they could not even quote hot-dipped galvanized.”

Note: SMU surveys active steel buyers twice each month to gauge the willingness of their steel suppliers to negotiate pricing. The results reflect current steel demand and changing spot pricing trends. SMU provides our members with a number of ways to interact with current and historical data. To see an interactive history of our Steel Mill Negotiations data, visit our website here.