Plate

September 16, 2018

Shortage of Imports Affecting Supply of CTL Plate

Written by John Packard

Steel Market Update was speaking with one of the plate mills regarding their maintenance schedules and order books, which we reported on in Thursday evening’s issue of our SMU newsletter. During the conversation, there was a discussion about what was causing the tightness in the marketplace, and the mill mentioned the drastically lower plate imports in 2017 and 2018 compared to what was seen in 2014-2015.

An executive with one of the plate service centers told us, “Price drivers and supply – I’m possibly in the minority that believe that while Section 232 has given a boost to plate prices, it all started the year prior with the 12 AD/CVD case rulings. That knocked many out long before 232, and while I can see something with Mex/Canada and the EU getting done in the next six months, I still don’t believe it will result in a rush of imports. The major importers we will see in the next six months will be the Ukraine, and of course Korea.”

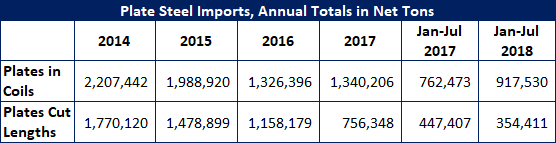

We decided to do a quick analysis ourselves to see what we could learn from the numbers:

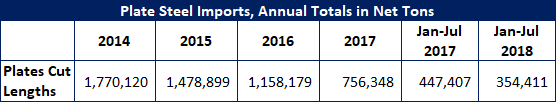

As you can see, 2014 was the peak for cut-to-length steel plate imports at almost 1.8 million net tons. In 2015 and 2016, the numbers dropped to 1.5 million and 1.1 million net tons. With the introduction of dumping suits and the threat of a Section 232 investigation, plate imports plummeted during 2017.

The table above compares the first seven months of 2018 with the same time period in 2017. This year is already running approximately 100,000 net tons below year-ago levels.

We did not include plates in coils for our analysis as those numbers can be very misleading as many tons of hot rolled are captured in the numbers.