Prices

January 13, 2019

CRU Forecasts U.S. Sheet Demand, Prices

Written by Tim Triplett

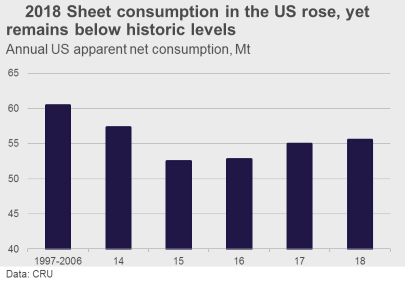

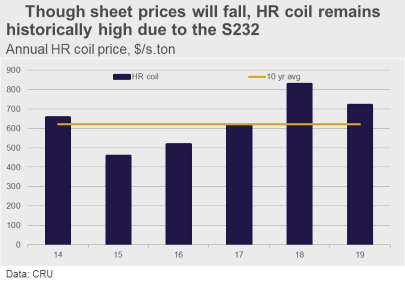

The North American steel sheet market in 2018 was heavily influenced by effects from the Section 232 tariffs. These tariffs greatly increased U.S. sheet prices, while at the same time helped to further reduce imports. Our forecast today calls for a more measured rate of increase for underlying industrial growth, while prices will more closely follow global price trends as the U.S. will remain a net importer.

There are significant risks in our forecast, though, as changes will inevitably come to the S232 tariff, while near-term demand may disappoint due to trade frictions, as well as lower demand from the energy sector. Ignoring downside risks, sheet consumption is forecast to rise by a CAGR of 1.8 percent from 2019-2023.

Our annual price forecast shows a multi-year decline, and without significant new exclusions to the S232 or an outright repeal, HR coil prices will remain higher than the current 10-year average.

Editor’s note: The above brief is from CRU’s Steel Sheet Products Market Outlook, which presents historical data and five-year forecasts of demand, net exports, production and prices for hot-rolled, cold-rolled and coated steel sheet. CRU research is conducted by an exceptional team of leading steel industry professionals who combine rigorous analysis of economic fundamentals with proven expert opinion. CRU’s Steel Sheet Products Market Outlook has become a trusted, leading benchmark for steel prices, forecasts and analysis for the sector, offering unrivalled decision support for all major players across global markets.