Prices

January 31, 2019

Steel Import Data is Back

Written by Brett Linton

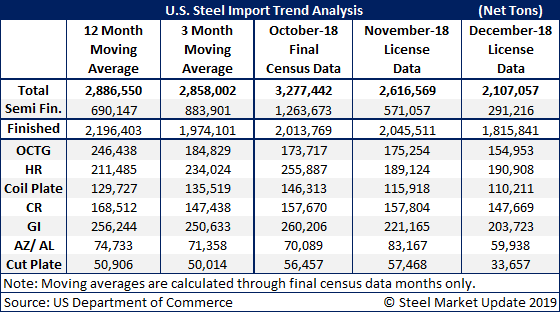

The U.S. Department of Commerce released import license data through the month of December 2018 earlier this week. The December license data is showing a large reduction in semi-finished imports (mostly slabs going to domestic steel mills). SMU believes the lower slab numbers may be due to quotas from Brazil having been reached, thus capping what was being allowed to come in. We believe the January slab numbers will be quite high as the quotas open back up for 1st Quarter 2019. We also saw a reduction in finished steels. Oil Country Tubular Goods (OCTG) imports were much lower than the 12-month and 3-month moving averages. Galvanized imports were down as was Galvalume and cut plate. It will be interesting to see what the January numbers look like when the data is finally available from the USDOC.

To see an interactive history of total steel imports (through October final data), visit our website here. If you need assistance logging into or navigating the website, please contact info@SteelMarketUpdate.com.