Prices

May 30, 2019

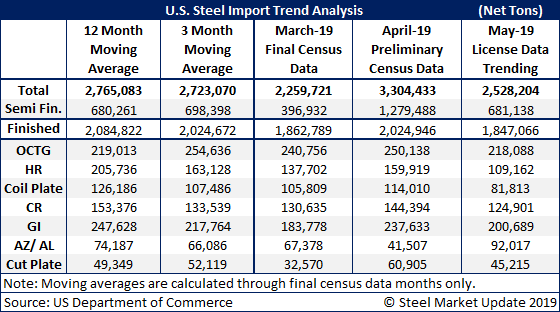

Semi-finished Imports See Big Jump in April

Written by Brett Linton

U.S. steel imports saw a big jump in April, based on preliminary license data from the Commerce Department. Total imports appear to have topped 3.3 million tons, largely due to nearly 1.3 million tons of semi-finished imports. The figures suggest that domestic steelmakers tripled their purchases of foreign slabs in April compared with March. Final Commerce data for April will be released next week.

Steel imports are trending lower in May. SMU’s projection for the month based on average daily import license data forecasts total imports of around 2.5 million tons, slightly below average, as semi-finished imports return to more typical levels.

The Trump administration’s decision to lower tariffs on steel imports from Canada and Mexico, effective May 20, has not had a notable effect on the data yet.