Prices

June 30, 2019

CRU: Iron Ore Prices to Fall Back Below $100 Per Ton

Written by Tim Triplett

By CRU Analyst Erik Hedborg

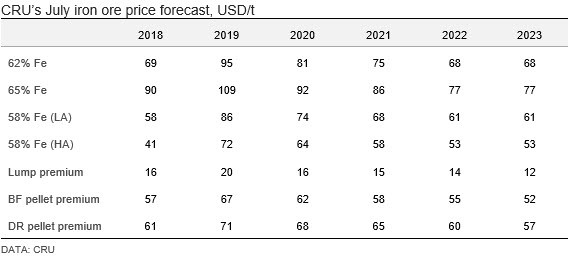

The iron ore price averaged $106 /t in June, which brings the 2019 year-to-date price as high as $90 /t. However, in the second half of the year, we see a few bearish factors that will contribute to prices being lower than they are today.

Those factors include:

• Demand contraction in China, Europe and JKT.

• Improving supply, particularly from Brazil.

• Margins remaining at 5–10 percent, which will keep steelmakers from restocking.

• Higher Chinese iron ore production in 2019 H2 as mine investments start to pay off.

At the same time, there are factors in place that will limit the downside to iron ore prices:

• With recent Rio Tinto losses, Australian supply is only expected to grow marginally in 2019 H2.

• Weaker supply of medium-grade iron ore as Rio Tinto reduces output of its PBF product.

• Low inventory levels at Chinese ports mean reduced ability for ports to act as an extra source of supply.

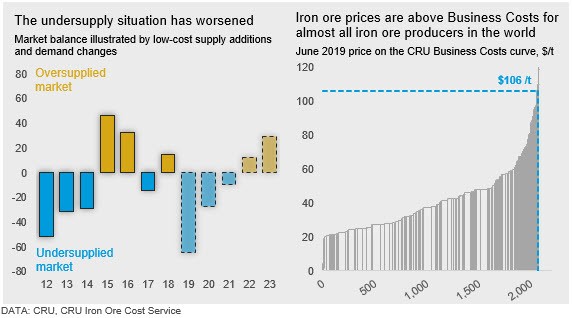

By revisiting our supply displacement model, where we assess iron ore demand changes together with changes to low-cost supply that will either displace volumes from the market or induce new supply to enter the market, we can see that the 2019 supply deficit has increased compared with our previous forecast. This is primarily due to Chinese steel production being stronger than expected and low-cost supply losses from Rio Tinto. In fact, the market is even more undersupplied than during the 2010–2014 boom years. However, reduced production costs have since lowered the cost curve, which explains why prices are still way below the 2010–2014 levels.

Price Volatility to Continue

The supply tightness means the iron ore market is currently very sensitive to any further supply disruptions. Low inventories throughout the supply chain make the situation even worse as there are very few remaining supply options in the market. Therefore, we have, in the past months, seen the market react strongly to any negative news on the supply side. This is likely to continue in the second half of the year.

Fundamentally, we are also in a situation where almost all iron ore producers modelled in CRU’s Iron Ore Cost Model are profitable, with some of the lowest-cost producers currently enjoying free cash flow, pre-tax margins as high as 70–80 percent. By looking at the cost curve above, we can see that the higher end of the cost curve, where prices currently sit, is exceptionally steep. This means price volatility should be a normal state in such a market, as any small changes to either demand or supply will generate rapid price moves in either direction.

July Prices to Stay High, But a Correction Will Come

On the supply side, there is another important short-term issue on the horizon. July, together with February, are typically the weakest months of the year for Port Hedland shipments. February is typically weak due to weather issues, but July is weak because both BHP and FMG run their systems very hard at the end of their financial year before carrying out maintenance in July. There has been talk in the market about BHP’s maintenance being more extensive this year, especially since it is the first time the company has reached its 290 Mt/y nameplate capacity after a very strong Q2 performance. Therefore, CRU will closely monitor BHP’s shipments in the next month.

Together with the uncertainty regarding Rio Tinto’s supply situation, Australian shipments in July could be much weaker than in previous years. However, this will be partly offset by stronger Brazilian shipments and May departures from Brazil will start arriving in China at end-June. At the same time, we see a gradual increase of Chinese domestic production in Q3, although the supply increase will be limited by environmental and safety compliance. Our sources in China have mentioned the instigation of a widespread licensing and permit process throughout the country, which is slowing down the Chinese supply response.