Prices

June 30, 2019

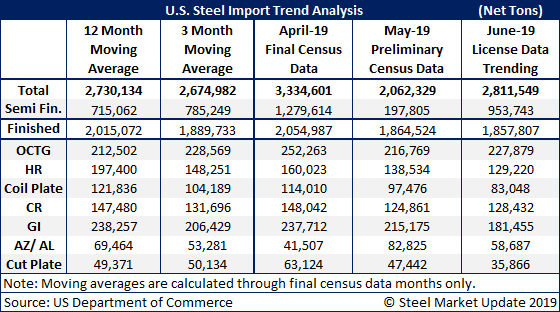

Steel Imports Saw Big Drop in May

Written by Brett Linton

U.S. steel imports saw a big drop in May, from unusually high levels in April, according to preliminary Census data. Total steel imports declined to less than 2.1 million tons in May from more than 3.3 million tons in the prior month. Imports were down significantly from April in all product categories except for Galvalume. May imports were far below the average for the past year of about 2.7 million tons.

Accounting for much of the difference were semi-finished imports of just 197,000 tons in May, down sharply from 1.3 million tons in April. Domestic steelmakers appear to have cut back on slab purchases as they attempt to do a better job of matching production with demand in pursuit of higher steel prices.

Based on import licenses almost through the end of June, however, steel imports have rebounded to as much as 2.8 million tons, including 954,000 tons of semi-finished steel, after the down month in May.