Overseas

August 24, 2019

CRU: Macro Uncertainty Triggers Global Price Collapse

Written by Tim Triplett

By CRU Principal Economist Lisa Morrison and Senior Analyst Erik Hedborg

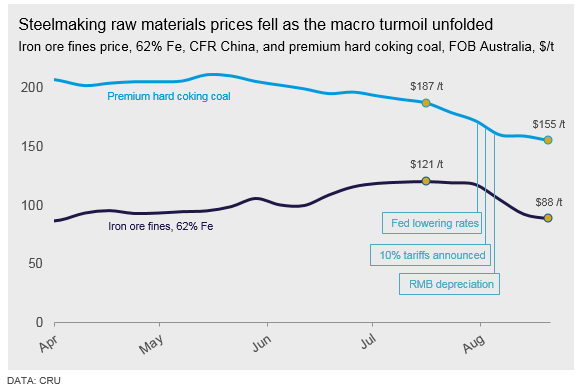

In the past month, we have seen sharp declines in global commodity prices, including steelmaking raw materials. The fall was triggered by an escalation of the U.S.-China trade war, but CRU’s research shows that supply and demand fundamentals in the markets also contributed to recent price falls.

Macro Concerns Dragging Down Global Commodity Prices

In the past month, there have been widespread falls across all commodity markets as the U.S.-China trade war has escalated and fears of a global recession have accelerated after a number of bearish macro data points sent pessimistic signals to markets.

• Wednesday, July 31: The U.S. Federal Reserve lowered its interest rate by 0.25 percentage points in order to boost confidence among consumers and protect the economy against weaker global growth. This was the first time since the global financial crisis that the Federal Reserve has lowered interest rates.

• Friday, Aug. 2: The U.S. government announced 10 percent tariffs on $300 billion worth of Chinese imports to be implemented on Sept. 1, in addition to the 25 percent tariffs on $200 billion worth of goods announced in November 2018. Although around half of the goods targeted by the new tariffs are machinery, CRU’s research shows it will have a limited direct impact on China’s steel industry. On Aug. 13, some of these tariffs were pushed back to Dec. 15.

• Monday, Aug. 5: The People’s Bank of China raised its midpoint reference level for the RMB to 6.9225 against the U.S. dollar. The currency is allowed to fluctuate freely within a 2 percent span of this rate, meaning that the currency was now allowed to be traded above RMB7.00, a level not reached since 2008. The forex markets quickly responded and the RMB is now trading at 7.05 against the U.S. dollar.

Along with trade war concerns, recent macro data shows a significant slowdown in key regions that are important for steelmaking raw materials demand. Japan is the only country that surprised on the upside, but CRU expects this to be merely a temporary rise.

German GDP Falling Yet Again

In Europe, the latest data shows that Germany is experiencing a significant decline in export orders—8.6 percent y/y for 2019—the largest drop in almost a decade. German manufacturing orders have fallen by more than 11 percent in the last 18 months and incoming industrial production data has been weaker than expected, suffering its biggest annual decline in nine years. Germany narrowly escaped a technical recession in Q4 2018 as marginally positive q/q growth followed a decline in 2018 Q3. Growth resumed in 2019 Q1 but contracted by 0.1 percent in Q2. A recession is defined as two consecutive quarters of declining GDP.

India’s Election Fails to Lift Markets

India continues to experience weak growth and the economy has yet to lift following the re-election of the Modi government. India’s manufacturing and mining sectors have shown declining growth and industrial production has continued to slow. For 2019, we expect the country’s industrial output to grow by ~2 percent, well below the ~5 percent growth observed in 2018.

Japan Surprising on the Upside

Japan is the only major economy that has surprised on the upside. The recent release of preliminary Q2 data indicates that the economy expanded 0.4 percent q/q, much higher than consensus. The expansion came on the back of healthy growth in consumer and government spending, as well as investment outlays. That said, we expect that the consumption tax hike planned for October, from 8 percent to 10 percent, will cause the economy to slow down in Q4.