Prices

October 22, 2019

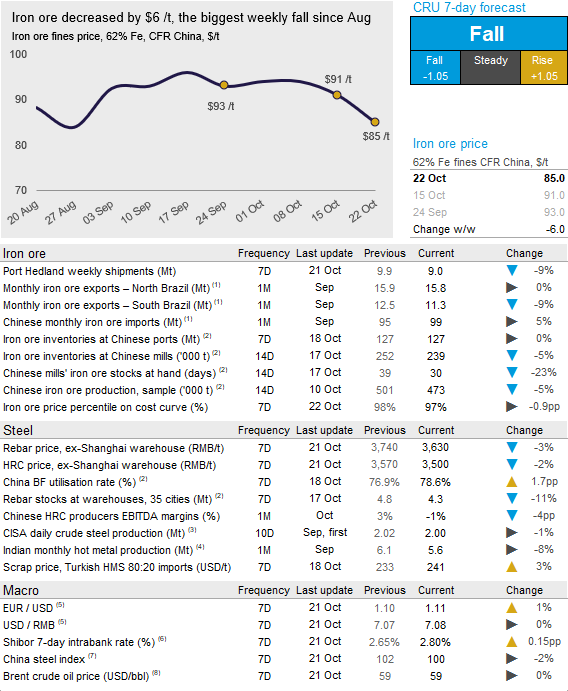

CRU: Iron Ore Dips as Markets Hesitate

Written by Jordan Permain

By CRU Analyst Jordan Permain

The iron ore price suffered its biggest weekly fall since August as market participants showed caution in the face of bearish signals in China. On Tuesday, Oct. 22, CRU assessed the 62% Fe fines price at $85.00 /t, a $6 /t w/w decline.

Despite a w/w increase in nationwide BF utilization rates, the Chinese steel industry is currently not showing positive signs for iron ore demand. Market sentiment is bearish following the announcement of a 6 percent y/y GDP growth for 2019 Q3, which was in line with CRU’s forecast and at the bottom end of the government’s targeted range. Furthermore, there is uncertainty in the market as participants await some indication as to the implementation of WHS capacity restrictions, which will dictate BF utilization rates until March. Steel production has been high and margins are currently low, so if WHS restrictions are weaker than expected this season, as they were last season, then demand for iron ore will be weak.

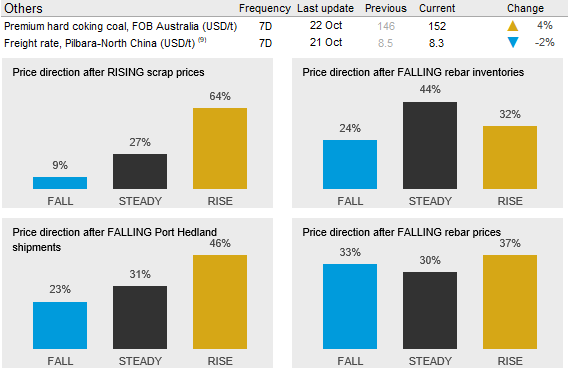

On the supply side, shipments from Port Hedland fell ~9 percent w/w as maintenance from major producers continued. Rio Tinto’s ongoing quality issues have persisted but in better news, we expect that their major maintenance period has finished so will have strong shipments for the remainder of the year. In Brazil, Vale was heard to have suspended activity at its Itabirucu tailings dam. This particular dam had not been impacted before and the issue is expected to remove at least 1 Mt of iron ore from the seaborne market.

We expect iron ore prices to fall in the coming week. Despite the above examples of restricted seaborne supply, Chinese domestic production has been relatively low and port inventories are at the highest point since May 2019, so the market is currently oversupplied considering the subdued forthcoming demand.