Market Segment

April 7, 2020

CRU: Impact of Covid-19 on the Steel Supply

Written by Iris Speelmanns

By CRU Analyst Iris Speelmanns, from CRU’s Steel Monitor

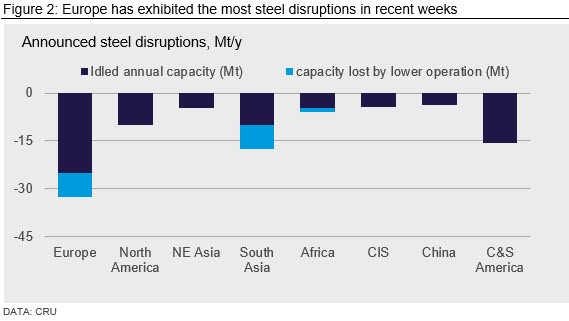

As the Covid-19 pandemic spreads across the world, its effects on the steel industry are growing. In this weekly report, we will be closely monitoring developments in the steel industry with a focus on disrupted hot metal production and capacity utilization and these will feed into our market and price forecasts.

Recent Developments

As the Covid-19 pandemic spreads across the world, steel producers in all regions are taking actions in response to plummeting demand. Please note that we track the dates of the announcements but the cuts themselves, unless stated otherwise, would be expected to be enacted over the following days and weeks.

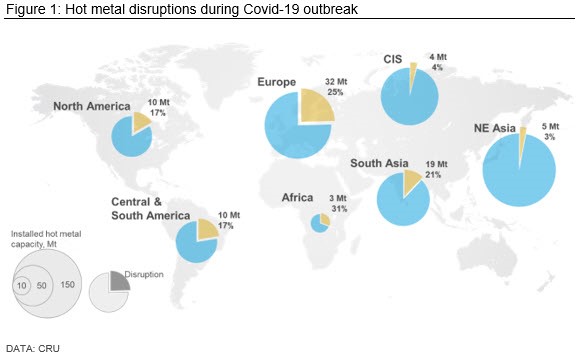

During the last week, many steel mills in the USA and Brazil have announced the idling of blast furnaces (BFs) across their asset base to adjust output. The announced cutbacks in Brazil amount to 14 Mt of annual capacity, which corresponds to 20 percent of total regional capacity.

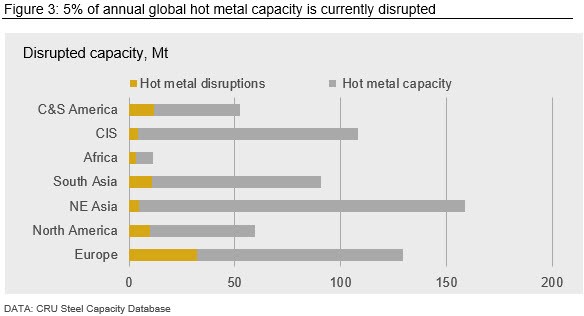

Among all regions, Europe accounts for the largest volume of disruptions. We estimate that 32 Mt of annual hot metal capacity are affected by the measures producers are taking in response to demand loss. In addition to this, we estimate that a further 22 Mt/y of steelmaking capacity is currently offline because all Italian EAF producers and non-operational after being ordered to close. In Italy, Ilva at Taranto and Arvedi in Cremona have both been exempted from the closure due to the nature of their operations. Other major European producers are running at lower levels.

In South Asia, the Indian government has imposed a national, 21-day lockdown until April 14 to contain the spread of Covid-19. Although steelmaking is exempt from the lockdown because it is considered an essential service under “Essential Services Management Act 1981,” several steelmakers have unilaterally suspended downstream operations in the face of poor demand, and utilization rates of BFs have been reduced sharply.

A similar case holds true for many African countries (e.g. South Africa, Egypt in particular) where producers are reducing or suspending operations due to curfews and lockdown measures.