Prices

April 21, 2020

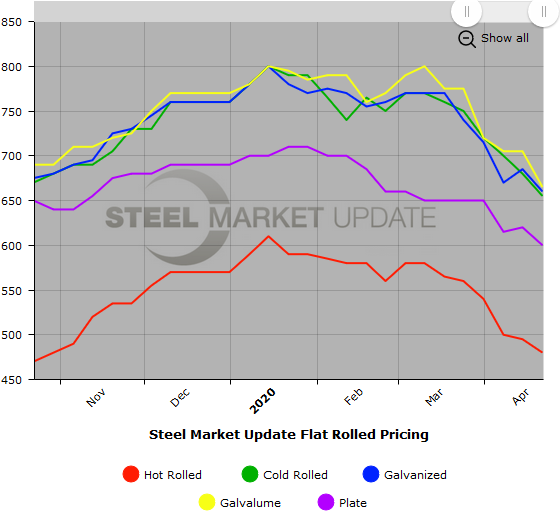

SMU Price Ranges & Indices: The Slide Continues

Written by Brett Linton

Steel buyers reported lower spot offers and transactions on flat rolled and plate products this week. However, the offers varied from mill to mill, and even in some cases varied within the same company but coming from different plants. The number of transactions appear to be lower than in weeks past, and the size of the spot orders appear to be lower as well. SMU was not made aware of any “bottom feeding” (i.e. a large company attempting to buy significant tons well below market pricing). Although at least one service center reported end users “sniffing” by suggesting they would book a rest of the year deal at “X” price. Our Price Momentum Indicator continues to reference spot prices as moving Lower over the next 30 days.

Here is how we are seeing prices this week:

Hot Rolled Coil: SMU price range is $460-$500 per ton ($23.00-$25.00/cwt) with an average of $480 per ton ($24.00/cwt) FOB mill, east of the Rockies. The lower end of our range remained the same compared to one week ago, while the upper end decreased $30. Our overall average is down $15 per ton over last week. Our price momentum on hot rolled steel is Lower, meaning we expect prices to decline over the next 30 days.

Hot Rolled Lead Times: 2-4 weeks

Cold Rolled Coil: SMU price range is $630-$680 per ton ($31.50-$34.00/cwt) with an average of $655 per ton ($32.75/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $10 per ton compared to last week, while the upper end fell $40. Our overall average is down $25 per ton over one week ago. Our price momentum on cold rolled steel is Lower, meaning we expect prices to decline over the next 30 days.

Cold Rolled Lead Times: 4-7 weeks

Galvanized Coil: SMU price range is $620-$700 per ton ($31.00-$35.00/cwt) with an average of $660 per ton ($33.00/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $30 per ton from one week ago, while the upper end fell $20. Our overall average is down $25 per ton over last week. Our price momentum on galvanized steel is Lower, meaning we expect prices to decline over the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $689-$769 per net ton with an average of $729 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 4-6 weeks

Galvalume Coil: SMU price range is $630-$700 per ton ($31.50-$35.00/cwt) with an average of $665 per ton ($33.25/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range declined $40 per ton compared to last week. Our overall average is down $40 per ton over one week ago. Our price momentum on Galvalume steel is Lower, meaning we expect prices to decline over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $921-$991 per net ton with an average of $956 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 5-6 weeks

Plate: SMU price range is $580-$620 per ton ($29.00-$31.00/cwt) with an average of $600 per ton ($30.00/cwt) FOB delivered to the customer’s facility. The lower end of our range declined $10 per ton compared to one week ago, while the upper end decreased $30. Our overall average is down $20 per ton over last week. Our price momentum on plate steel is Lower, meaning we expect prices to decline over the next 30 days.

Plate Lead Times: 3-5 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume and plate price history. This data is available here on our website with our interactive pricing tool. Note that plate prices are not yet available on our website, but we are in the process of adding that dataset. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or 800-432-3475.