Market Segment

July 21, 2020

SDI: Demand Saw Trough in Q2, Improvement Ahead

Written by Sandy Williams

The trough for steel volume, particularly for flat rolled steel, has passed and the second half looks promising, said Steel Dynamics CEO Mark Millett. Back orders are strong and order intake rates have picked up due to increasing demand as businesses resume operations following COVID-19 shutdowns.

“It is still not possible to determine the full scope of the negative impact COVID-19 will cause to global economies and the related impact to domestic steel demand,” said Millett. “As states continue to determine their reopening guidelines and many steel consuming businesses have resumed operations, we anticipate steel and metals recycling demand will improve in the second half of the year compared to second quarter 2020 trough results.”

Energy and general industrial consumers continue to be the weakest sectors, added Millett, and will likely require a longer recovery period.

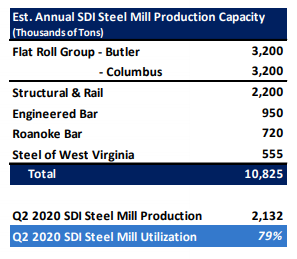

During the second quarter, SDI shipped 765,000 tons of hot rolled and pickled, 132,000 tons of cold rolled, and 900,000 tons of coated steel.

Net sales for the quarter totaled $2.1 billion and net income $75.5 million, down from $2.6 billion and $187.3 million, respectively, in the first quarter of 2020. Net income was impacted by $25 million in refinancing costs and $20 million in costs associated with construction of the new Sinton, Texas, mill.

“Our spirit of excellence was once again evidenced in our strong second-quarter 2020 performance,” said Millett. “Even though earnings were lower than robust sequential first-quarter results, the team’s performance was tremendous within the circumstances.”

Scrap volumes deteriorated during Q2, particularly for prime scrap, as automakers experienced COVID-19 shutdowns. Scrap collection also declined due to stay-at-home mandates. A 55 percent reduction in domestic steel production and the idling of a number of blast furnaces resulted in weak ferrous scrap demand during the quarter. SDI internal scrap shipments to its EAFs increased, helping to keep production flowing, supported by a resilient construction sector. The metals recycling operation posted an operating loss of $6 million for the quarter compared to operating income of $8 million in the first quarter.

Scrap volumes have improved, and SDI expects the recycling platform to return to profitability in the third quarter. Falling scrap prices have normalized although some softness, particularly in prime scrap, is expected in August. Scrap should stabilize at a more normal price for the rest of the year, said Millett, adding that supply is not an issue.

The construction market varied by geographical location during the second quarter with some softness in the Northeast. In long products, the rail backlog is up quarter-over-quarter and continued strength in the sector is expected. Fabricators remained busy during the quarter as large projects continued relatively unabated during Q2. Some smaller projects that were delayed or put on hold because of COVID-19 are not resuming construction. Fabricators are reporting very strong backlogs and optimism for the coming months. Big box store construction is doing well due to an increase in online shopping. Private sector construction is outpacing public construction, but that could change, said Millett.

The automotive industry is ramping back, although still experiencing some supply chain difficulties. Auto is expected to be in good shape for the rest of the year, constrained only by regional issues from COVID. Steel Dynamics’ auto presence is expanding, particularly at its Columbus mill, from European automakers BMW and Mercedes, which were not hit as a hard by the pandemic in Q2 as domestic producers.

On the sheet side, HVAC and appliances are coming back very strong as well, said Millett. Customers report good order book and order input rates and pent-up demand. Inventories are currently lean and imports are expected to be constrained for the rest of the year.

The Sinton, Texas, EAF construction is continuing on time and within budget with completion expected in mid-2021, the company said. Two SDI customers with a combined steel consuming and processing capability of 800,000 tons are locating at the Sinton site and others are expected to reach agreements with SDI in the next few months. The acquisition of a scrap company in Mexico is expected later this year, which will further supply the new mill. The Mexican company has an estimated processing capability of 2 million tons per year.

“I also want to congratulate our Columbus Flat Roll Division team for producing their first prime coil July 9 on their new 400,000-ton galvanizing line,” added Millett. “This is their fourth value-added line investment and will allow them to sell significantly more higher margin products, while also providing a ready hot band consumer base in the South for our anticipated new Texas flat roll steel mill.”