Prices

August 6, 2020

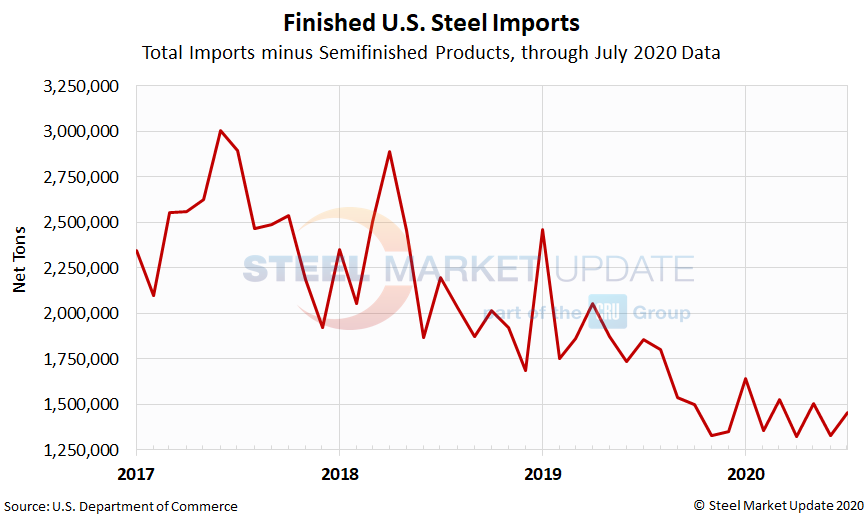

Final June Steel Imports Slip to 12-Year Low

Written by Brett Linton

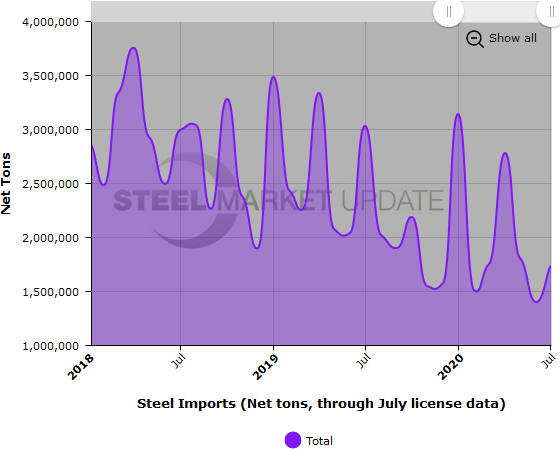

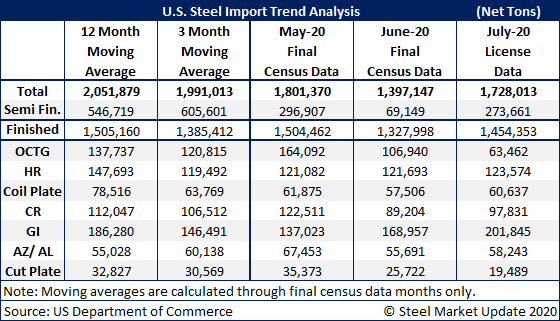

Recently released Census data shows final June steel imports totaled 1.40 million net tons, down 22 percent from May and down 50 percent from March, according to the U.S. Department of Commerce. This is the lowest monthly import level since November 2009 when total imports were 1.38 million tons. This final June figure is just 5,800 tons higher than the preliminary import figures SMU reported in late-July.

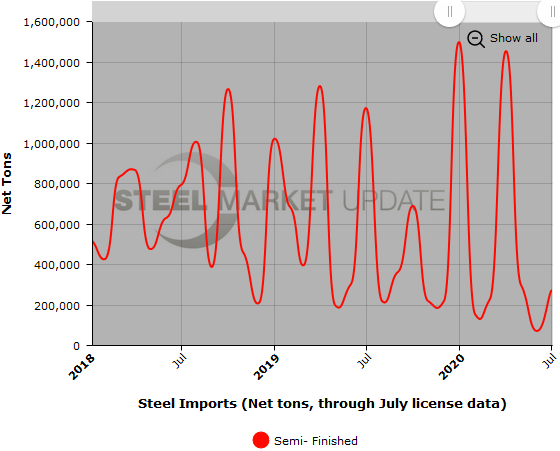

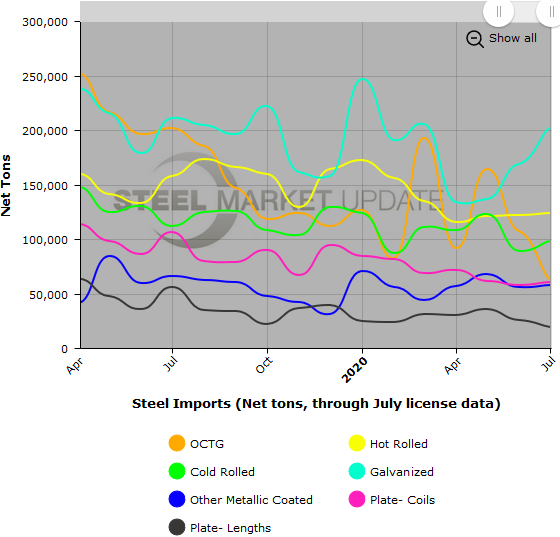

Finished imports in June totaled 1.33 million tons, down 12 percent from May, but flat with April. Imports of semifinished products (mostly slabs) were just 69,000 tons in June, down from 297,000 tons the month prior. This contrasts with April when semifinished imports were at 1.45 million tons as the quarterly quotas for those products had reset.

July import licenses are currently at 1.73 million tons, with 274,000 tons being semifinished and 1.45 million tons being finished products.

Note: The January, May, July and October import figures are unusually high as a result of buyers seeking to max out quarterly quota limits on semifinished products. For the remainder of each quarter, final semifinished imports are significantly lower. Due to these month-to-month swings, SMU has ceased monthly import “trending” projections and now only shows unadjusted figures as reported by the Commerce Department. As shown in the figure below, finished steel import levels are much less volitile and more accurately display the U.S. steel import trend month-to-month.

The three graphics below show total steel imports through July license data. To provide the most clarity, we are only showing a limited time line in each graphic. To see a greater data history and utilize our interactive graphing features, you can visit our website. Contact us at info@SteelMarketUpdate.com if you have any questions.