Market Data

December 3, 2020

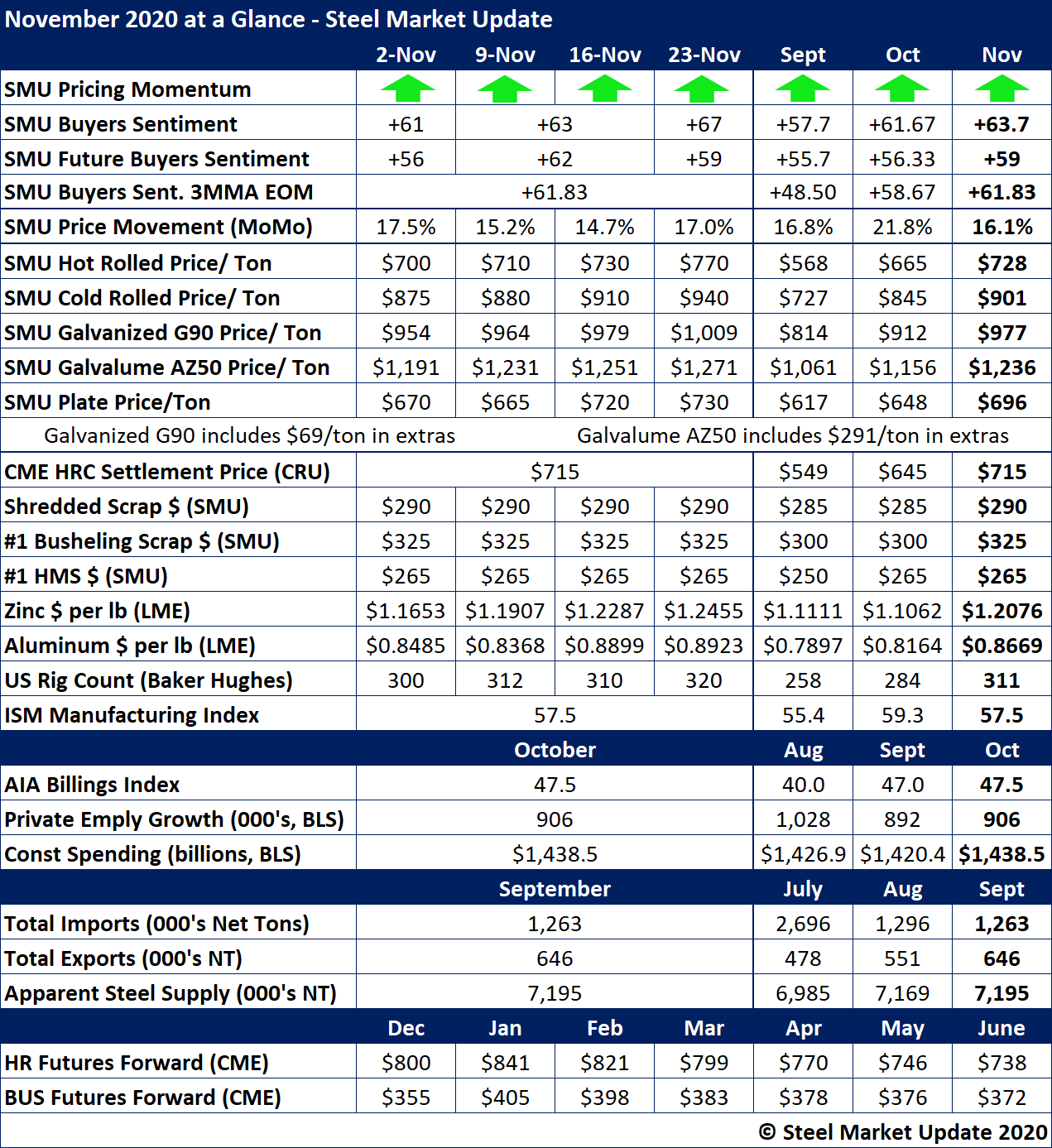

SMU's November At-a-Glance

Written by Brett Linton

Steel prices continued to climb in November on strong demand and tight steel supplies. Steel Market Update’s hot rolled price index reached $770 per ton by the end of November, up 10 percent from the beginning of the month. The SMU Pricing Momentum Indicator remained at Higher, indicating prices are expected to rise further over the next 30 days. Adding to the uptrend in finished steel prices were scrap prices that were steady to $25 higher compared to the month prior. Zinc and aluminum prices both rose by 10 percent from the first day of November and the last, contributing to higher prices for coated steel products such as galvanized and Galvalume.

The SMU Buyers Sentiment Index reached +67 in late-November, continuing it’s upward momentum. Both Current and Future Sentiment remained surprisingly optimistic considering the ongoing pandemic. The three-month moving average reached +61.83 as of Nov. 25, the highest reading since December 2018.

Key indicators of steel demand overall were positive. The ISM Manufacturing Index, now at 57.5, indicated further expansion in the economy. Construction spending increased from September to October, as did the AIA Billings Index and private employment growth. Total U.S. steel imports slightly declined into September, while exports and apparent steel supply increased.

See the chart below for other key metrics in the month of November: