Market Segment

April 12, 2021

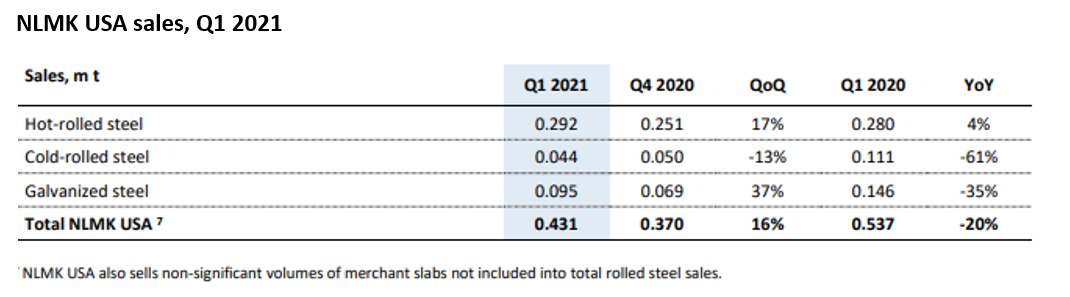

NLMK USA Sales Jump 16% in First Quarter

Written by Sandy Williams

Russian steelmaker NLMK said sales in its U.S. division increased 16% in Q1 2021 to 430 million metric tons. The increase was driven by hot-rolled and galvanized steel. Sales of hot rolled increased 17% from the fourth quarter of 2020 and galvanized steel sales soared 37%. Sales of cold rolled fell 13%.

On a year-over-year basis, sales plunged for both cold-rolled and galvanized steel due to the prolonged strike at NLMK Pennsylvania, which ended in March. Hot-rolled sales gained 4% compared to Q1 2020.

Raw material prices were elevated globally during the first quarter. Scrap prices in the U.S. and EU jumped 29% quarter-over-quarter as a result of limited supply due to seasonality and lower scrap generation from the automotive sector.

Steel prices jumped in all regions as recovering business demand triggered steel shortages. Russian uncoated flat steel and rebar prices soared 44% from the prior quarter and 52% from a year ago. Slab prices (FOB Black Sea) leapt 31% as export demand grew during the quarter. EU flat steel prices rose 34% quarter-over-quarter at the end of March, reaching highs not seen since 2008. U.S. flat rolled prices were up 53% from Q4, reported NLMK.

NLMK Group consolidated sales declined 7% from the previous quarter to 3.9 million metric tonnes and 13% year-over-year. External sales were negatively impacted by a decrease in pig iron sales due to an overhaul of one of the blast furnaces at NLMK Lipetsk as well as an increase in slab shipments to NLMK USA. Unfavorable weather resulted in a stock build-up at Black Sea ports that will be sold in Q2 2021. “Home market” sales were up 4% quarter-over-quarter: 4% in Russia, 16% in the U.S. and 4% in the EU.

Group steel output rose 12% from Q4 to 4.4 million metric tonnes following completion of equipment overhauls and maintenance at the Russia Long Products segment, the company said.