Market Data

May 4, 2021

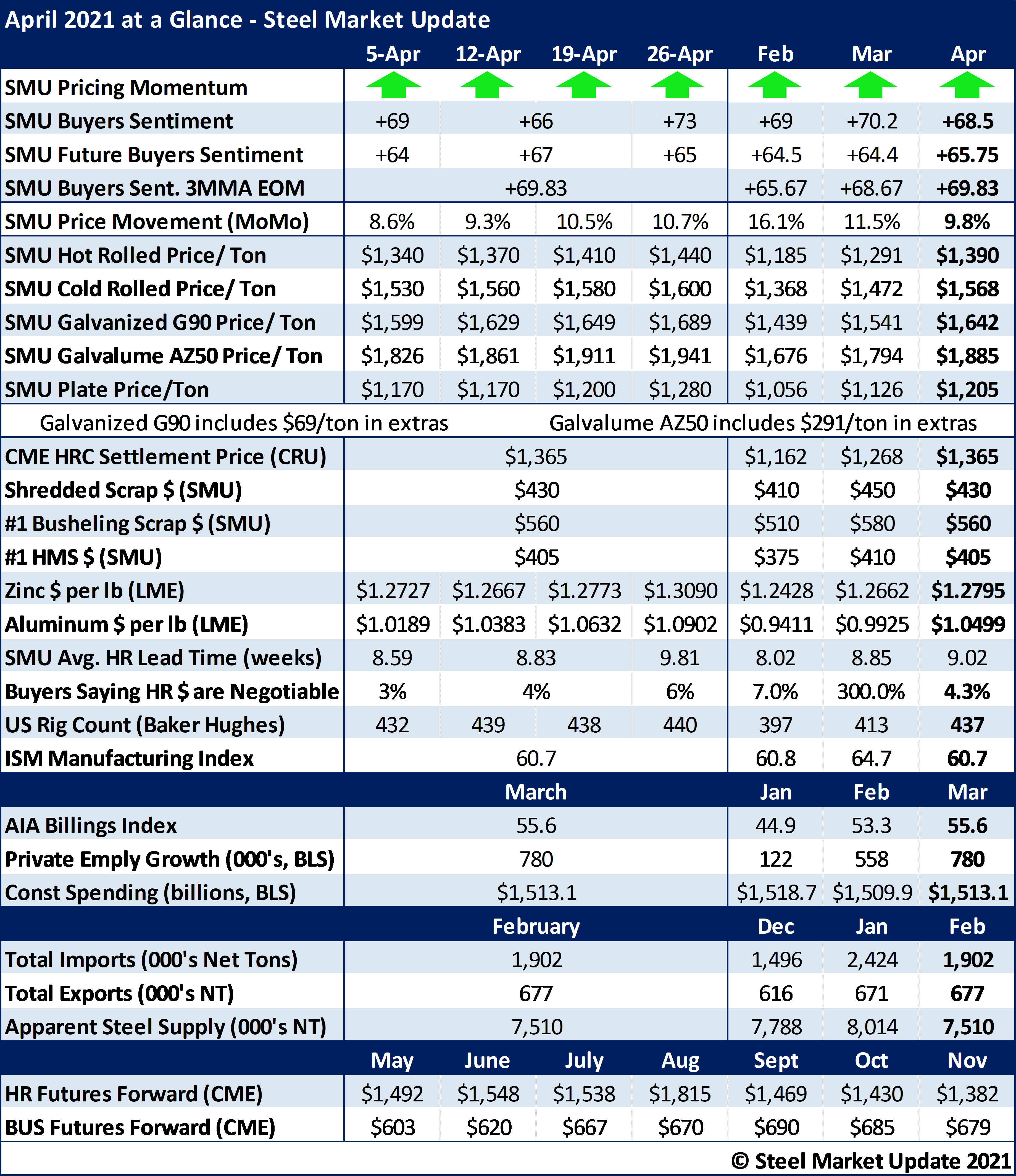

SMU's April At-a-Glance

Written by Brett Linton

Limited supply and strong demand continued to push steel prices higher throughout April, now the eighth consecutive month in which prices have increased. Hot rolled steel prices increased an average of $25 per ton each week, reaching $1,440 per ton by the end of April, exceeding any historical price by far. The SMU Price Momentum Indicator has remained unchanged since the August 2020 adjustment to higher, indicating prices are expected to rise further in the short term.

April scrap prices remained relatively stable versus March, down $5 for HMS and down $20 per ton for shredded and busheling scrap. Click here to view and compare prices within our interactive pricing tool.

Zinc prices picked up speed in the last week of the month, climbing to a two-year high of $1.3186 per pound as of April 30. Aluminum prices also finished the month strong, reaching a multi-year high of $1.1014 per pound. Aluminum prices have risen steadily since May 2020, and are approaching levels not seen in nearly three years. Click here to see a graphic on zinc prices and click here to see aluminum prices.

The SMU Buyers Sentiment Index continues to show a high level of optimism, ending the month at +73. The three-month moving average was +69.83 as of last Thursday, the highest reading since March 2018.

Hot rolled lead times extended further through the end of April, reaching a new record of 9.81 weeks, while the percentage of buyers reporting mills willing to negotiate on HR prices remained miniscule all month.

Key indicators of steel demand overall remained positive, as they have for recent months. The ISM Manufacturing Index indicated further expansion in the economy for the 11th consecutive month, and the March AIA Billings Index, a measure of construction activity, recovered for the third month in a row. In the energy sector, the active drill rig count increased 6% throughout the month. Total U.S. steel imports and apparent steel supply both have shown gains in recent months.

See the chart below for other key metrics in the month of April:

By Brett Linton, Brett@SteelMarketUpdate.com