Prices

December 21, 2021

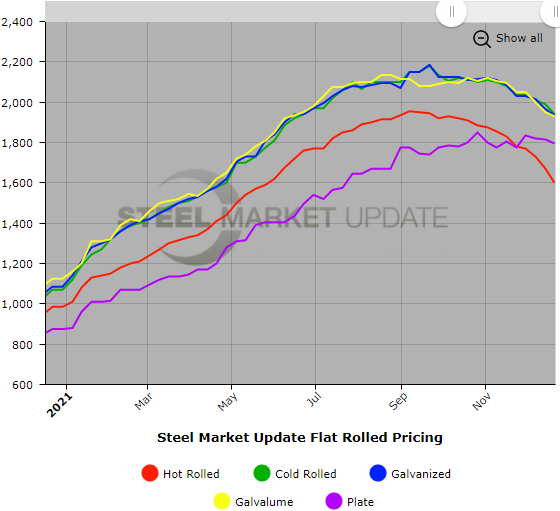

SMU Price Ranges & Indices: Year Ends on a Down Note

Written by Brett Linton

Steel Market Update’s check of the market this week – our last of 2021 prior to the holiday break – shows the benchmark price for hot rolled finishing the year around $1,600 per ton ($80/cwt). That’s down another $70 per ton from last week and a total decline of $355 or 18% since peaking at $1,955 per ton in the first week of September. The HR price has not been this low since the end of May. Likewise, prices for cold rolled and coated products, as well as plate, are down another $20-50 per ton. The downtrend in steel prices has been clear for the past couple of months as the market reacts to seasonally slowing demand, the arrival of low-priced imports and building inventories. What remains unclear is how fast, and how far, steel prices will correct in the New Year. It’s important to note, however, that even after dropping by double-digit percentages, steel prices are still far above historical averages, and the industry’s prospects for 2022 are still positive. SMU’s Price Momentum Indicators are pointing Lower for all flat-rolled products – meaning further price declines are likely over the next 30 days – but the indicator for plate remains Neutral.

Hot Rolled Coil: SMU price range is $1,500-$1,700 per net ton ($75.00-$85.00/cwt) with an average of $1,600 per ton ($80.00/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $80 per ton compared to last week, while the upper end decreased $60. Our overall average is down $70 per ton from one week ago. Our price momentum on hot rolled steel is at Lower, meaning we expect prices to decrease over the next 30 days.

Hot Rolled Lead Times: 3-9 weeks

Cold Rolled Coil: SMU price range is $1,800-$2,080 per net ton ($90.00-$104.00/cwt) with an average of $1,940 per ton ($97.00/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $100 per ton compared to one week ago, while the upper end remained unchanged. Our overall average is down $50 per ton from last week. Our price momentum on cold rolled steel is at Lower, meaning we expect prices to decrease over the next 30 days.

Cold Rolled Lead Times: 5-10 weeks

Galvanized Coil: SMU price range is $1,820-$2,050 per net ton ($91.00-$102.50/cwt) with an average of $1,935 per ton ($96.75/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range decreased $30 per ton compared to last week. Our overall average is down $30 per ton from one week ago. Our price momentum on galvanized steel is at Lower, meaning we expect prices to decrease over the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,907-$2,137 per ton with an average of $2,022 per ton FOB mill, east of the Rockies. Effective this week, we have increased the galvanized extras used in our benchmark prices from $78 per ton to $87.

Galvanized Lead Times: 5-11 weeks

Galvalume Coil: SMU price range is $1,860-$2,000 per net ton ($93.00-$100.00/cwt) with an average of $1,930 per ton ($96.50/cwt) FOB mill, east of the Rockies. The lower end of our range increased $60 per ton compared to one week ago, while the upper end decreased $100. Our overall average is down $20 per ton from last week. Our price momentum on Galvalume steel is at Lower, meaning we expect prices to decrease over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $2,151-$2,291 per ton with an average of $2,221 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 8-10 weeks

Plate: SMU price range is $1,750-$1,840 per net ton ($87.50-$92.00/cwt) with an average of $1,795 per ton ($89.75/cwt) FOB mill. Both the lower and upper ends of our range decreased $20 per ton compared to last week. Our overall average is down $20 per ton from one week ago. Our price momentum on plate steel remains at Neutral until the market establishes a clear direction.

Plate Lead Times: 4-6 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.