Prices

February 11, 2022

Hot Rolled Coil vs Busheling Scrap Prices: Spread Narrowing

Written by Brett Linton

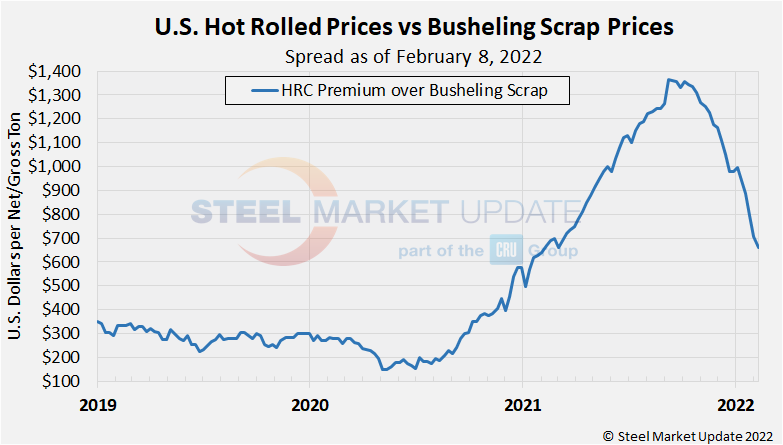

According to the latest Steel Market Update data, the spread between hot rolled coil prices and prime scrap is slowly shrinking from the September 2021 peak. The latest spread is in line with levels seen in early-2021 but two times higher than pre-pandemic spreads.

Last week, the SMU hot rolled price average declined for the 18th consecutive week to $1,190 per net ton ($59.50 per cwt), the lowest price seen in exactly one year. Recall our HRC price average peaked last September at $1,955 per ton, with the upper end of our range topping out at $2,000 per ton. Busheling scrap prices settled last week, down $10 per gross ton in February to $530 per gross ton, following a $80 per ton drop in January. July and August 2021 saw record busheling prices, with prices climbing to $670 per gross ton for those two months.

The price differential between HRC and busheling scrap is now $660 per ton, down from $940 one month prior and down from a high of $1,365 in September 2021. This time last year the spread was identical at $670 per ton, while February 2020 was just $280.

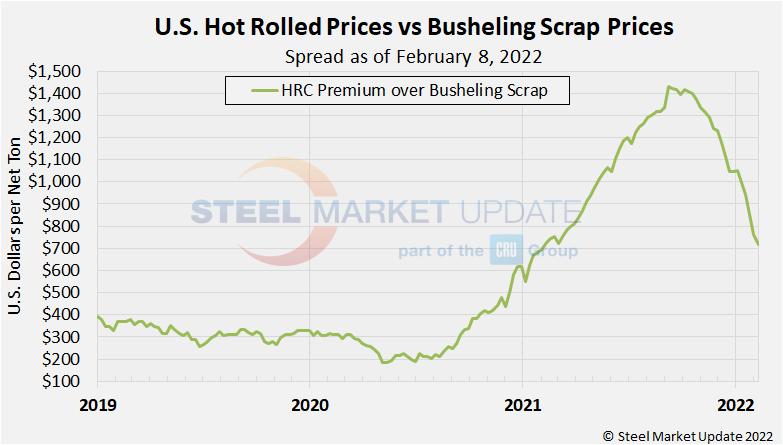

The chart below shows the same hot rolled vs scrap price spread, but with busheling scrap converted to dollars per net ton for an apples to apples comparison. (Public service announcement: Our Interactive Pricing Tool now has the capability to show both steel and scrap prices in dollars per net ton, dollars per metric ton, and dollars per gross ton.).

The latest HR-scrap spread is $717 per net ton, whereas the September high was $1,428 per ton. For comparison, the 2019 average spread was $324 per ton, the 2020 average was $310, and the 2021 average was $1,080.

This comparison was inspired by reader suggestions; if you would like to chime in with topics you want us to explore, reach out to our team at News@SteelMarketUpdate.com.

By Brett Linton, Brett@SteelMarketUpdate.com