Prices

February 15, 2022

SMU Price Ranges & Indices: Yet Another Big Drop

Written by Brett Linton

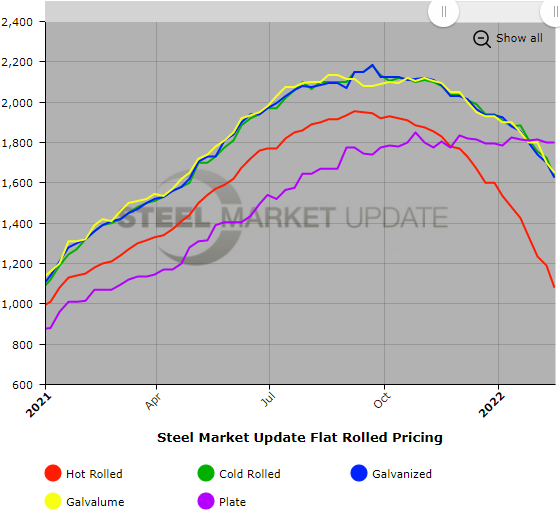

Steel prices saw another big drop this week, taking the benchmark price for hot rolled below $1,100 per ton for the first time since January 2021. Cold rolled and coated products registered double-digit declines as well, while plate prices appear to be holding their own, according to Steel Market Update’s check of the market on Monday and Tuesday. Steel mill lead times have gotten about as short as they can, but steel prices have a way to go before supply and demand shake out. SMU’s Price Momentum Indicators continue to point lower for flat rolled products over the next 30 days and neutral for plate until the trend there becomes clearer. At least one industry veteran sees an end to the price correction coming: “Global competition is fading away quite fast on all products, and a bottom seems to be forming. COVID is waning, pull-though is improving and there’s a more settled market on the horizon. But we will still see some squishiness for a while as inventories and production are adjusted and digested.”

Hot Rolled Coil: SMU price range is $1,020-$1,140 per net ton ($51.00-$57.00/cwt) with an average of $1,080 per ton ($54.00/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $100 per ton compared to one week ago, while the upper end declined $120 per ton. Our overall average is down $110 per ton from last week. Our price momentum on hot rolled steel is at Lower, meaning we expect prices to decrease over the next 30 days.

Hot Rolled Lead Times: 2-6 weeks* (preliminary ranges from our ongoing market survey, final lead times data will be released on Thursday)

Cold Rolled Coil: SMU price range is $1,560-$1,700 per net ton ($78.00-$85.00/cwt) with an average of $1,630 per ton ($81.50/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $140 per ton compared to last week, while the upper end decreased $50 per ton. Our overall average is down $95 per ton from one week ago. Our price momentum on cold rolled steel is at Lower, meaning we expect prices to decrease over the next 30 days.

Cold Rolled Lead Times: 4-9 weeks*

Galvanized Coil: SMU price range is $1,550-$1,700 per net ton ($77.50-$85.00/cwt) with an average of $1,625 per ton ($81.25/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $100 per ton compared to one week ago, while the upper end decreased $50 per ton. Our overall average is down $75 per ton from last week. Our price momentum on galvanized steel is at Lower, meaning we expect prices to decrease over the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,637-$1,787 per ton with an average of $1,712 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 3-10 weeks*

Galvalume Coil: SMU price range is $1,600-$1,700 per net ton ($80.00-$85.00/cwt) with an average of $1,650 per ton ($82.50/cwt) FOB mill, east of the Rockies. The lower end of our range remained unchanged compared to last week, while the upper end decreased $100 per ton. Our overall average is down $50 per ton from one week ago. Our price momentum on Galvalume steel is at Lower, meaning we expect prices to decrease over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,891-$1,991 per ton with an average of $1,941 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 6-9 weeks*

Plate: SMU price range is $1,780-$1,820 per net ton ($89.00-$91.00/cwt) with an average of $1,800 per ton ($90.00/cwt) FOB mill. Both the lower and upper ends of our range remained unchanged compared to one week ago. Our overall average is unchanged from last week. Our price momentum on plate steel remains at Neutral until the market establishes a clear direction.

Plate Lead Times: 4-8 weeks*

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.