Prices

April 19, 2022

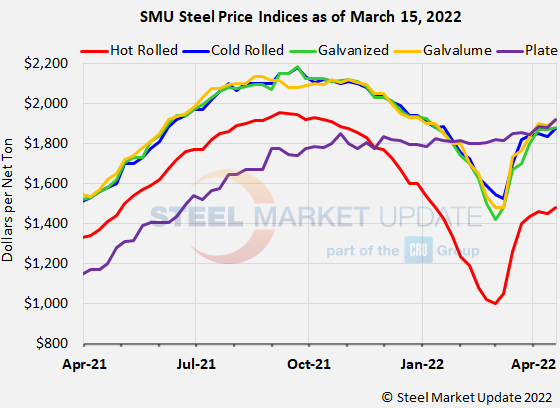

SMU Price Ranges & Indices: All Products Increase $10-30/ton

Written by Brett Linton

Sheet prices rose modestly across this board this week, following slight declines seen last week. Steel Market Update’s check of the market puts benchmark hot-rolled coil prices at $1,480 per ton, up $30 per ton from one week prior. Coated and plate products saw increases as well, moving upwards between $10 and $40 per ton compared to last week.

As one service center executive said, “the panic buying has ceased – folks who are inquiring are purchasing, no one is fishing for prices.” Market participants report mills are controlling their output to support higher prices, with order books full through May. Some anticipate easing scrap prices next month could push for a correction in steel prices.

SMU’s Price Momentum Indicators for all products will remain at Neutral until they establish a clear upward or downward trajectory again.

Hot Rolled Coil: SMU price range is $1,440-$1,520 per net ton ($72.00-$76.00/cwt) with an average of $1,480 per ton ($74.00/cwt) FOB mill, east of the Rockies. The lower end of our range increased $60 per ton compared to one week ago, while the upper end remained unchanged. Our overall average is up $30 per ton from last week. Our price momentum indicator on hot rolled steel points to Neutral until the market establishes a clear direction.

Hot Rolled Lead Times: 4-8 weeks

Cold Rolled Coil: SMU price range is $1,850-$1,900 per net ton ($92.50-$95.00/cwt) with an average of $1,875 per ton ($93.75/cwt) FOB mill, east of the Rockies. The lower end of our range increased $80 per ton compared to last week, while the upper end remained unchanged. Our overall average is up $40 per ton from one week ago. Our price momentum indicator on cold rolled steel points to Neutral until the market establishes a clear direction

Cold Rolled Lead Times: 5-10 weeks

Galvanized Coil: SMU price range is $1,800-$1,960 per net ton ($90.00-$98.00/cwt) with an average of $1,880 per ton ($94.00/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $30 per ton compared to one week ago, while the upper end increased $50 per ton. Our overall average is up $10 per ton from last week. Our price momentum indicator on galvanized steel points to Neutral until the market establishes a clear direction

Galvanized .060” G90 Benchmark: SMU price range is $1,897-$2,057 per ton with an average of $1,977 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 5-10 weeks

Galvalume Coil: SMU price range is $1,880-$1,950 per net ton ($94.00-$97.50/cwt) with an average of $1,915 per ton ($95.75/cwt) FOB mill, east of the Rockies. The lower end of our range increased $50 per ton compared to last week, while the upper end remained unchanged. Our overall average is up $25 per ton from one week ago. Our price momentum indicator on Galvalume steel points to Neutral until the market establishes a clear direction.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $2,171-$2,241 per ton with an average of $2,206 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 7-12 weeks

Plate: SMU price range is $1,910-$1,930 per net ton ($95.50-$96.50/cwt) with an average of $1,920 per ton ($96.00/cwt) FOB mill. The lower end of our range increased $60 per ton compared to one week ago, while the upper end increased $20 per ton. Our overall average is up $40 per ton from last week. Our price momentum indicator on plate steel points to Neutral until the market establishes a clear direction

Plate Lead Times: 4-8 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.

By Brett Linton, Brett@SteelMarketUpdate.com