Plate

May 31, 2022

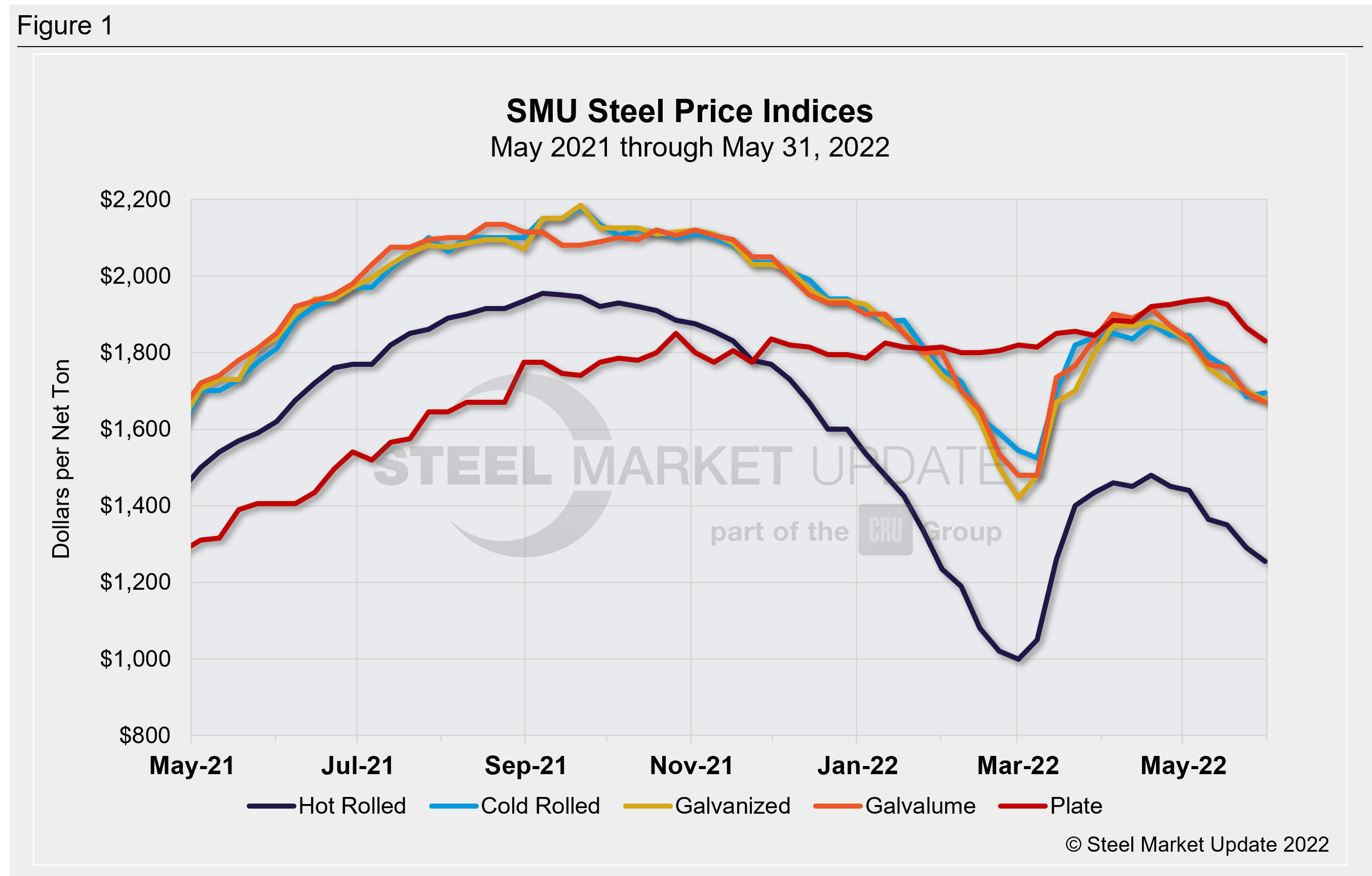

SMU Price Ranges: Sheet, Plate Fall as Bearish Signals Mount

Written by Brett Linton

Sheet and plate prices continued to slip this week on expectations of lower scrap costs in June, increased import competition, and so-so demand, market participants said.

Hot-rolled coil prices were down $35 per ton as were plate prices. Coated products were off by $25 per ton. Cold-rolled prices were up $10 per ton – or effectively unchanged given how high base prices are.

Demand remains patchy depending on region and end market: Energy, heavy equipment, and truck trailer remain on solid footing. But automotive and some construction markets are weak. And mills more exposed to big ports are under pressure to compete against lower-priced imports from a variety of origins, sources said.

There was a consensus that there was no near-term reason for prices to increase, especially as new capacity ramps up and adds to available supply.

All of our price momentum indicators remain at Lower, meaning we expect price to continue to move down over the next 30-60 days.

Hot Rolled Coil: SMU price range is $1,150-$1,360 per net ton ($57.50-$68.00/cwt) with an average of $1,255 per ton ($62.75/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $100 per ton compared to one week ago, while the upper end increased $30 per ton. Our overall average is down $35 per ton from last week. Our price momentum indicator on hot rolled steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Hot Rolled Lead Times: 3-8 weeks

Cold Rolled Coil: SMU price range is $1,630-$1,760 per net ton ($81.50-$88.00/cwt) with an average of $1,695 per ton ($84.75/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range increased $10 per ton compared to last week. Our overall average is up $10 compared to one week ago. Our price momentum indicator on cold rolled steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Cold Rolled Lead Times: 5-10 weeks

Galvanized Coil: SMU price range is $1,600-$1,750 per net ton ($80.00-$87.50/cwt) with an average of $1,675 per ton ($83.75/cwt) FOB mill, east of the Rockies. The lower end of our range declined $50 per ton compared to one week ago, while the upper end remained unchanged. Our overall average is down $25 per ton from last week. Our price momentum indicator on galvanized steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,706-$1,856 per ton with an average of $1,781 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 5-9 weeks

Galvalume Coil: SMU price range is $1,600-$1,740 per net ton ($80.00-$87.00/cwt) with an average of $1,670 per ton ($83.50/cwt) FOB mill, east of the Rockies. The lower end of our range declined $50 per ton compared to last week, while the upper end remained unchanged. Our overall average is down $25 per ton from one week ago. Our price momentum indicator on Galvalume steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,919-$2,059 per ton with an average of $1,989 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 7-9 weeks

Plate: SMU price range is $1,800-$1,860 per net ton ($90.00-$93.00/cwt) with an average of $1,830 per ton ($91.50/cwt) FOB mill. The lower end of our range remained unchanged compared to one week ago, while the upper end declined $70 per ton. Our overall average is down $35 per ton from last week. Our price momentum indicator on plate steel points to Lower, meaning we expect prices to decrease over the next 30 days.

Plate Lead Times: 4-7 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.

By Brett Linton, Brett@SteelMarketUpdate.com