Market Data

July 5, 2022

SMU's June at a Glance

Written by Brett Linton

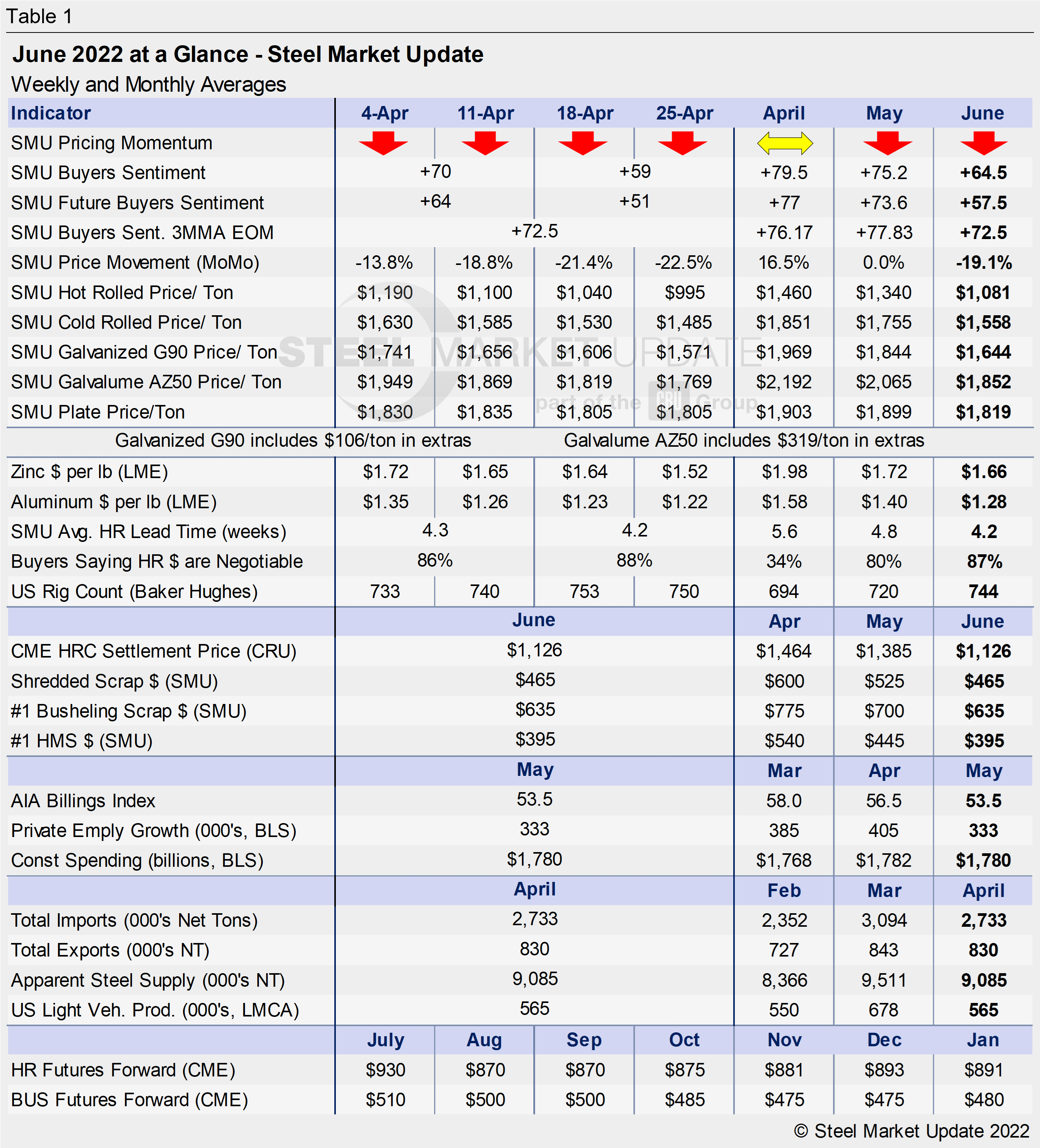

Steel prices continued to ease each week throughout June, following declines in May as well. Hot rolled prices were $1,190 per ton ($59.50 per cwt) the first week of June. Prices then slipped between $45 and $90 each of the following weeks, with the SMU index averaging $995 per ton as of last Tuesday. (This was the first time our HR index fell under $1,000 per ton since the last week of December 2020.) The SMU Price Momentum Indicator for all products remains at Lower since our May adjustments, meaning we expect prices to decline over the next 30 days.

Raw material prices declined further from April’s historical highs. Scrap prices fell $50-65 per ton from May to June are now at levels last seen in late 2021 and early 2022. Click here to view and compare prices using our interactive pricing tool.

Zinc spot prices trended downward throughout the entire month of June per Kitco, starting the month at $1.78 per pound and falling to a near nine-month low of $1.42 per pound as of last Friday. The same goes for aluminum prices, which declined from $1.36 per pound at the beginning of the month to $1.21 per pound as of last Friday. The last time aluminum prices were this low was late December 2021.

The SMU Buyers Sentiment Index remains strong but has been easing since April, with optimism declining from +70 in early June to +59 at the end of the month. Viewed as a three-month moving average, buyers’ sentiment fell from +76.33 in early June to +72.50 at the end of the month. Future sentiment readings remain positive, but there are signs of cracks emerging. The future sentiment index slipped to +51 as of late June, the lowest level recorded since August 2020.

Hot rolled lead times peaked in mid-April at 5.8 weeks. They declined throughout May and June and stood at 4.2 weeks by the end of the month. The percentage of buyers reporting that mills are willing to negotiate on hot-rolled coil prices remains high. Through late June, 88% of buyers reported that mills were willing to talk price to secure an order, relatively unchanged since mid-May. A history of HRC lead times can been found within our interactive pricing tool.

Key indicators of steel demand remain positive overall. The AIA Billings Index indicated that construction activity slowed in May but remained strong, and the energy and automotive sectors continue to improve. April final import and export volumes are in line with recent months, with apparent steel supply remaining over 9 million tons.

See the chart below for other key metrics in the month of June:

By Brett Linton, Brett@SteelMarketUpdate.com