Analysis

October 16, 2022

Final Thoughts

Written by Michael Cowden

I made a contrarian case for optimism in my last Final Thoughts. Our latest survey results indicate I was more contrarian than I realized.

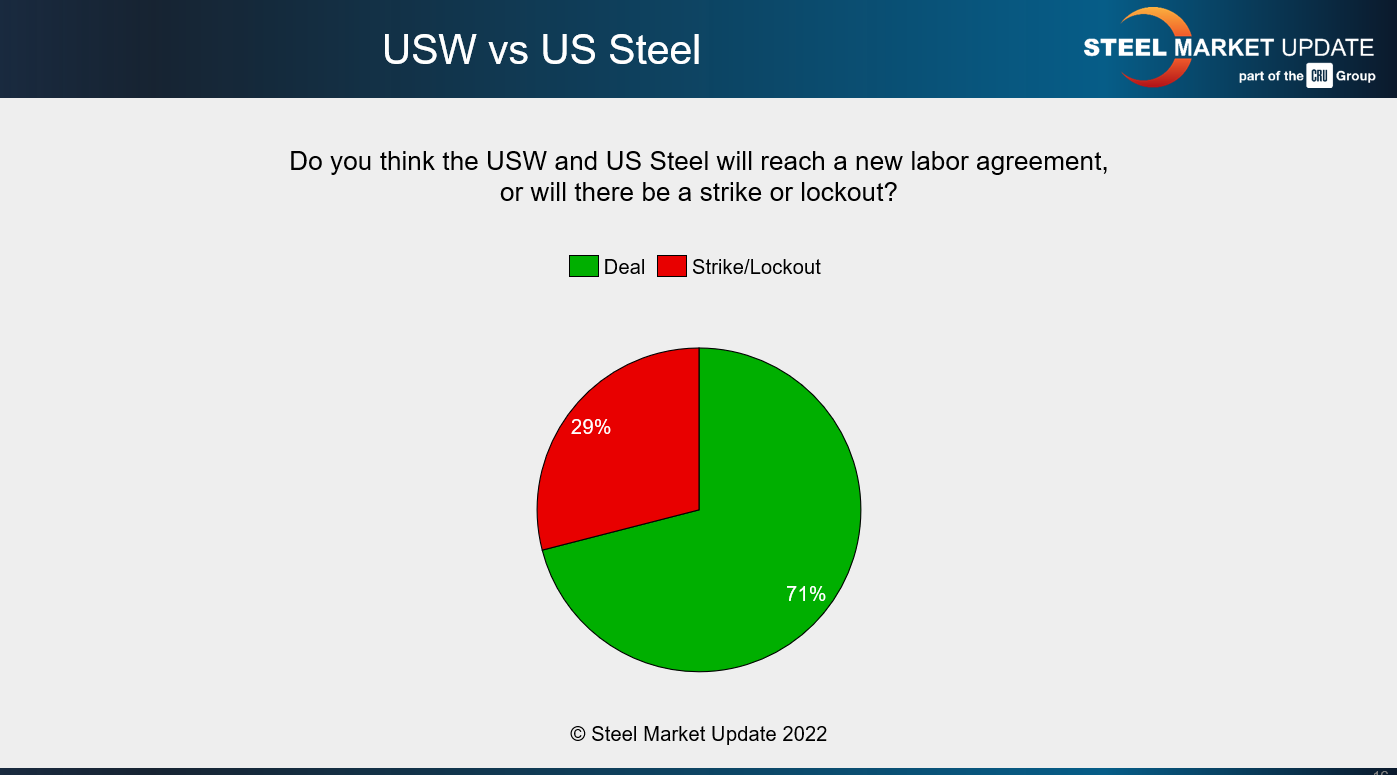

For starters, there has been speculation in both the physical and futures markets that a strike or lockout at US Steel could catch buyers off guard and send prices spiraling upward.

You could make a case that the chance of a strike or lockout increases the longer talks drag on between the Pittsburgh-based steelmaker and the United Steelworkers unions. (Recall that a prior agreement expired on Sept. 1.)

That’s not the base case that most people are working with, according to our latest survey results.

USS-USW Labor Talks

Take a look at the chart below.

Why might people be so confident that there won’t be a labor-related work stoppage?

I’ve talked to US Steel customers who have said that company sales representatives have dismissed the heated rhetoric from the USW as just bluster. And the union in recent updates to members has subtly shifted its language from saying that there has been “no significant movement” to more recently saying that there has been “some progress.”

What did survey respondents have to say about a potential strike or lockout at US Steel?

“If history has taught us anything, there will be a lot of smoke here but no fire.”

“Based on conversations with US Steel commercial, there is a more positive outlook.”

“Too much at stake for the USW, and USS can lose the production.”

“Steel supply is plentiful and will strengthen the USS position.”

“Seems no rush to make a deal on USS side.”

Still, I think it’s worth thinking about a few things if there were a strike or lockout:

• How much buffer stock do automakers and other big manufacturers have?

• How much of US Steel’s customer base could be served from its non-union Big River Steel mill in Arkansas?

• To what extent could production at Gary Works in Indiana continue with managers and temporary workers?

• How might US Steel’s competitors – think the likes of Cleveland-Cliffs, ArcelorMittal and Stelco – respond in the event of a work stoppage?

Buyers Predict Further Price Declines

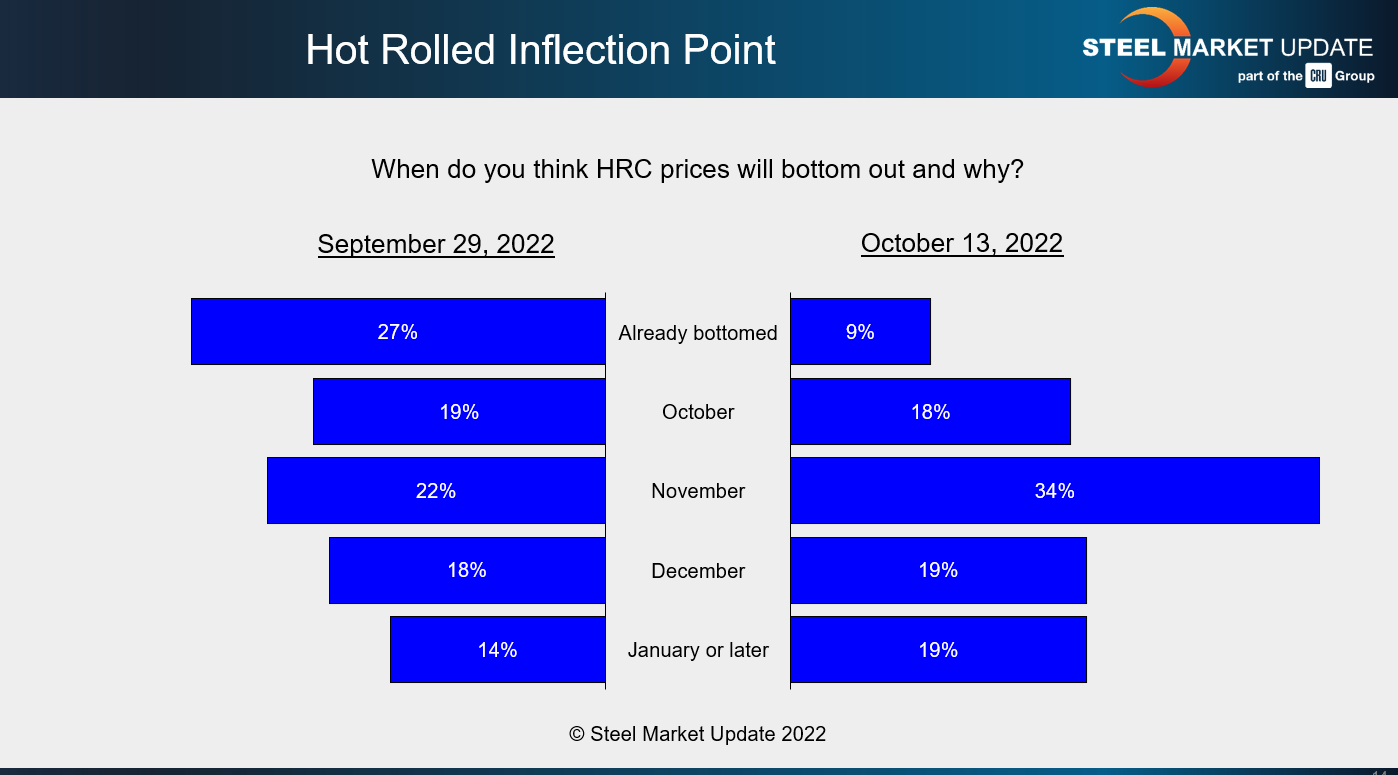

The consensus that there won’t be a strike or lockout at US Steel might partly explain why many buyers no longer think that prices have bottomed:

In our last full survey in late September, 27% of respondents said they thought that prices had already bottomed. Now only 9% think that. The most common response now is that prices won’t bottom until November.

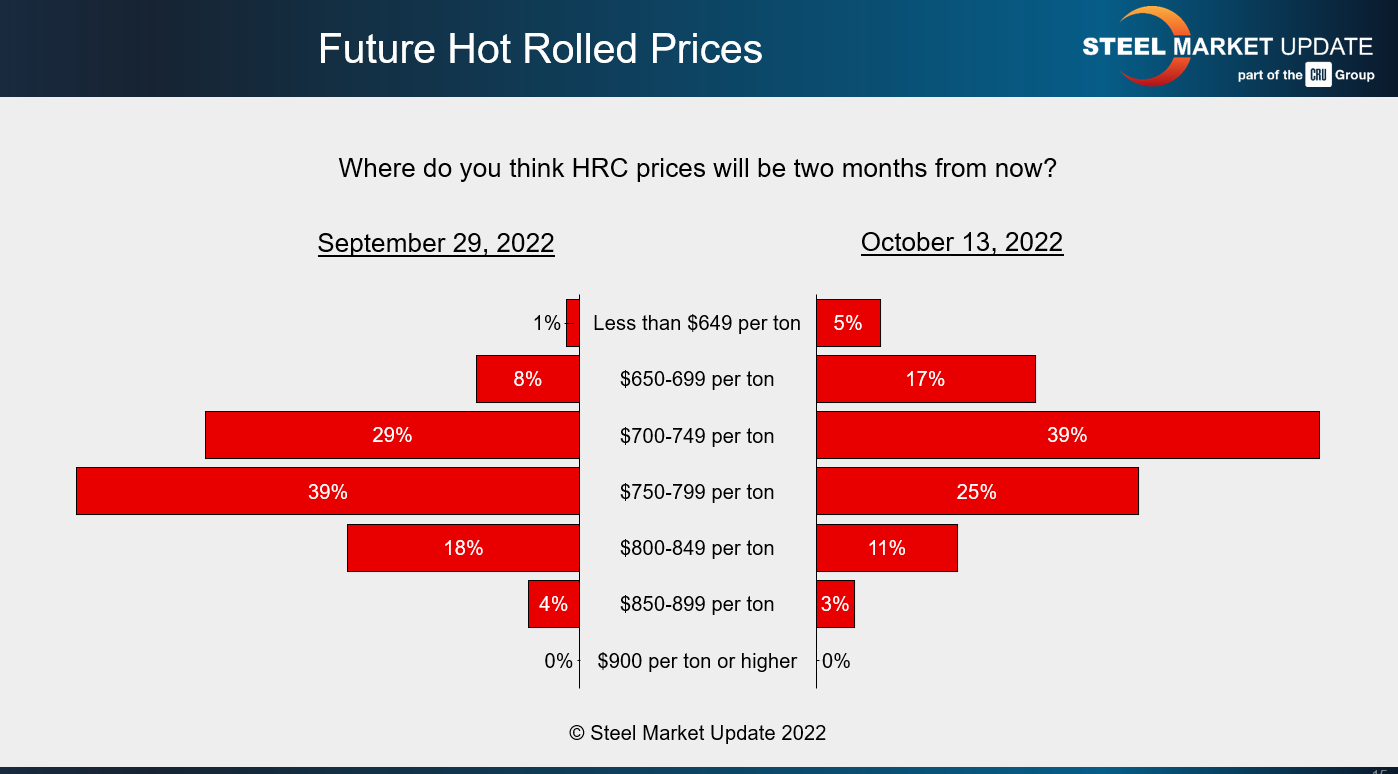

We’ve also seen survey respondents lower their expectations for hot-rolled coil prices:

Back in September, 39% of survey respondents predicted that HRC prices would be $750-799 per ton two months later. Now, 39% think prices in two months will be in the range of $700-749.

Also notable is that we’ve seen a significant increase in the number of people predicting that prices will fall below $700 per ton. Twenty-two percent of respondents think that threshold will be broken now, up from just 9% in our last survey.

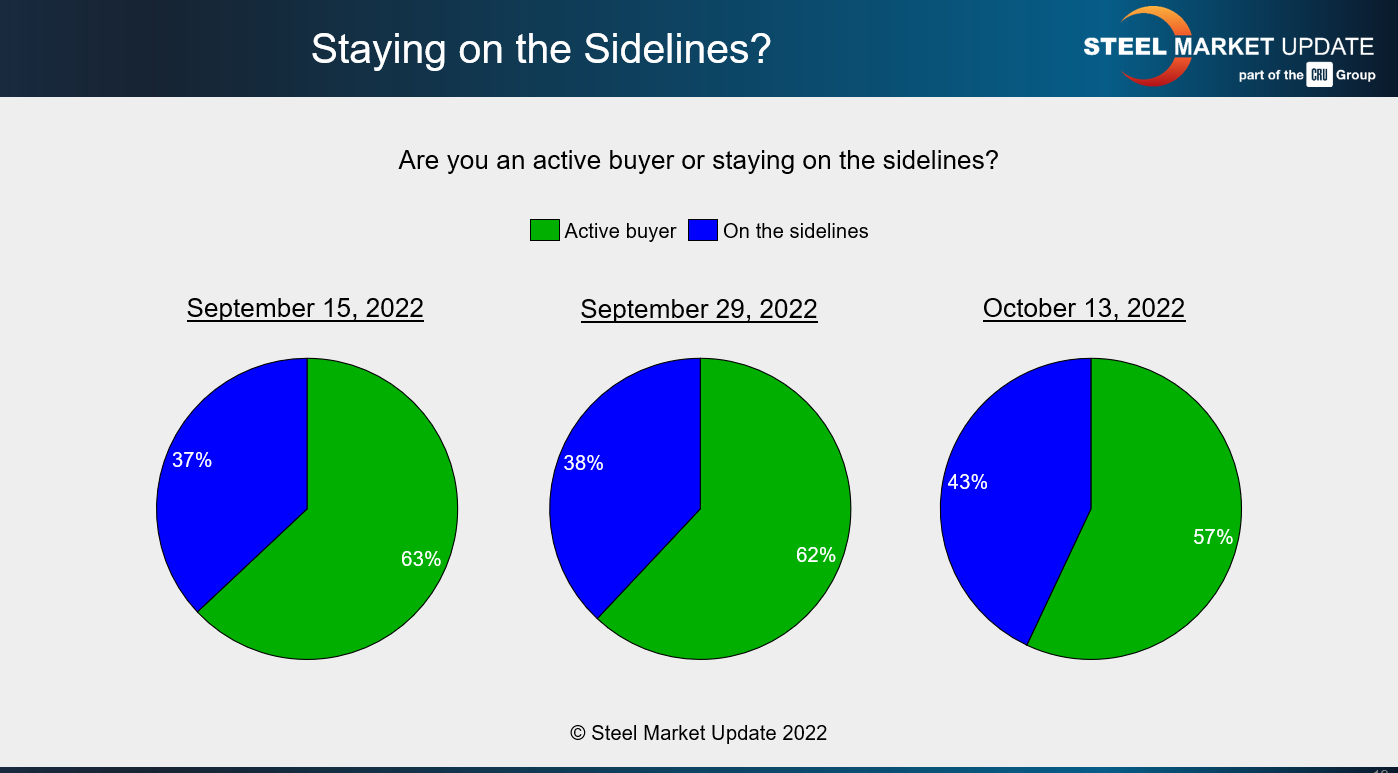

Still on the Sidelines

Probably because steel consumers expect prices to continue to decline, many remain on the sidelines:

Many report that they aren’t buying or are only buying as needed. Here are a few representative comments from our survey:

“Fulfilling contractual obligations, nothing more.”

“Customer demand is low, so we are more focused on managing inventory.”

“Waiting for additional price drops.”

“Actively buying but strictly as needed. Driving down inventory before end of year despite HR pricing looking like it’s bottoming out.”

But that opinion is not unanimous. Some steel consumers remain busy:

“I have to buy because I am as low as I have ever been on coil.”

We’ll be keeping a close eye on prices, lead times, mill negotiations, and sentiment in our next survey – results of which will be released on Oct. 28 – for any signs of an inflection point.

SMU Events

We still have a couple of spots left in our Steel 101 training in Corpus Christi, Texas, next week (Oct. 18-19). The tour of SDI Sinton alone is worth the price of admission. Consider registering if you haven’t already. You can do that here.

Also, don’t forget to mark Feb. 5-7 on your calendar. That’s when we’ll be holding our Tampa Steel Conference in conjunction with the Port of Tampa Bay. It’s a growing event, and a great reason to get out of the cold and catch up with hundreds of your closest friends in steel. You can register here.

And thanks, everyone, for your support of SMU.

By Michael Cowden, Michael@SteelMarketUpdate.com