Analysis

October 18, 2022

NAHB: Builder Confidence Reaches Lowest Mark in a Decade

Written by David Schollaert

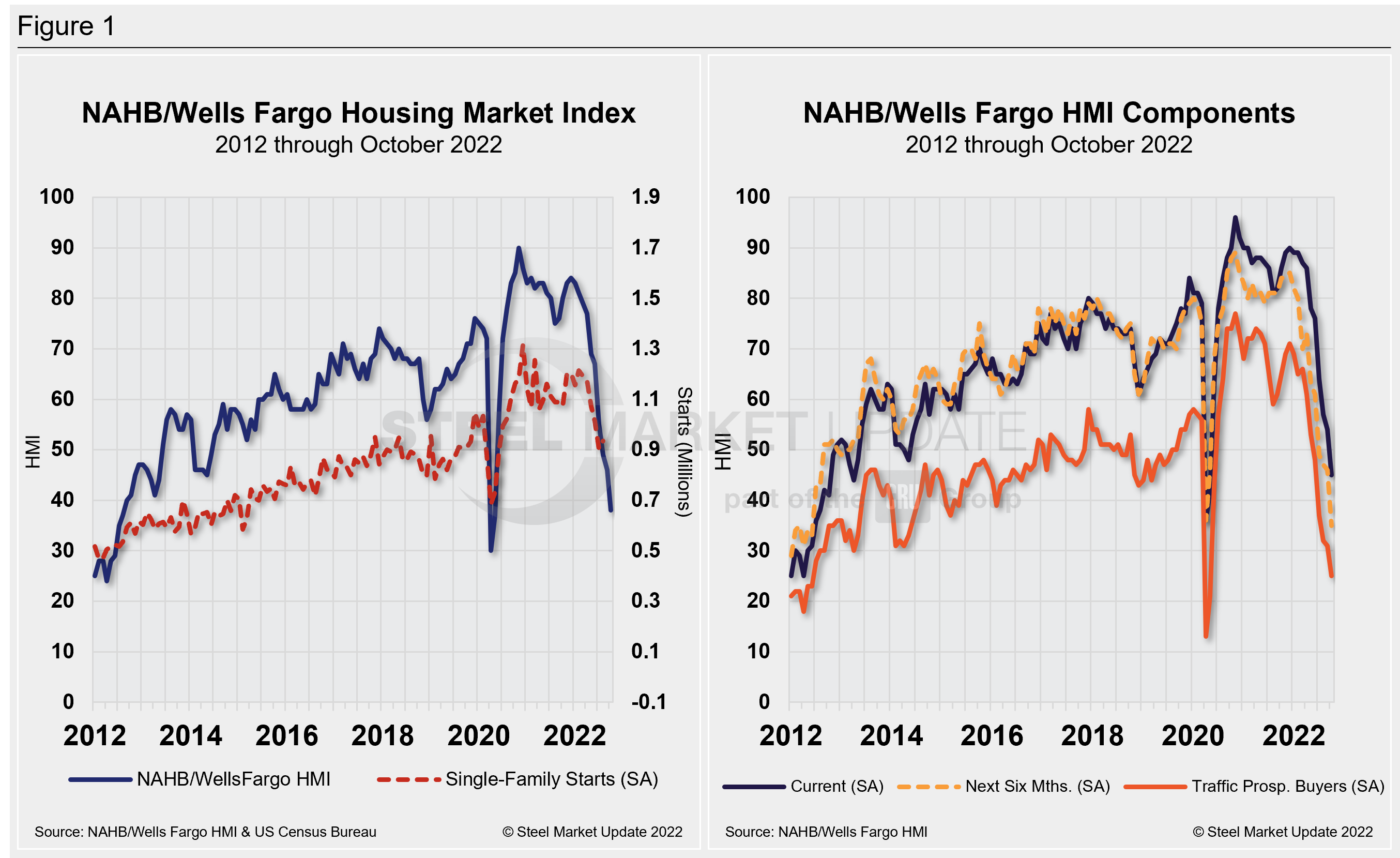

Builder confidence fell for the tenth straight month in October, while traffic of prospective buyers fell to its lowest level since 2012 (excluding the two-month period at the onset of the pandemic), the National Association of Home Builders (NAHB) said.

The report, in conjunction with the Wells Fargo Housing Market Index (HMI), said that rising interest rates, building material bottlenecks, and elevated home prices continue to weaken the housing market.

October’s HMI reading — the gauge of builder confidence for newly-built single-family homes — fell eight points to a measure of 38. The reading is now half the level it was just six months ago and has remained below the key break-even rate of 50 for the past three months.

“High mortgage rates approaching 7% have significantly weakened demand, particularly for first-time and first-generation prospective home buyers,” said Jerry Konter, NAHB’s chairman as well as a builder and developer in Savannah, Ga. “This situation is unhealthy and unsustainable. Policymakers must address this worsening housing affordability crisis.”

The NAHB/Wells Fargo HMI survey gauges builder perceptions of current single-family home sales and sales expectations for the next six months as “good,” “fair,” or “poor.” The survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average,” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.

All three major HMI indices posted major losses in October. The HMI index gauging current sales conditions fell to 57, a nine-point decline month-on-month (MoM). The gauge measuring sales expectations in the next six months slipped 11 points to a reading of 35. The component charting traffic of prospective buyers posted a six-point decline to 25.

“This will be the first year since 2011 to see a decline for single-family starts,” said NAHB chief economist Robert Dietz. “And given expectations for ongoing elevated interest rates due to actions by the Federal Reserve, 2023 is forecasted to see additional single-family building declines as the housing contraction continues. While some analysts have suggested that the housing market is now more ‘balanced,’ the truth is that the homeownership rate will decline in the quarters ahead as higher interest rates and ongoing elevated construction costs continue to price out a large number of prospective buyers.”

Looking at the three-month moving averages for regional HMI scores, the Northeast fell three points to 48 and the Midwest dropped three points to 41. The South fell seven points to 49 and the West posted a seven-point decline to 34.

By David Schollaert, David@SteelMarketUpdate.com