Prices

January 17, 2023

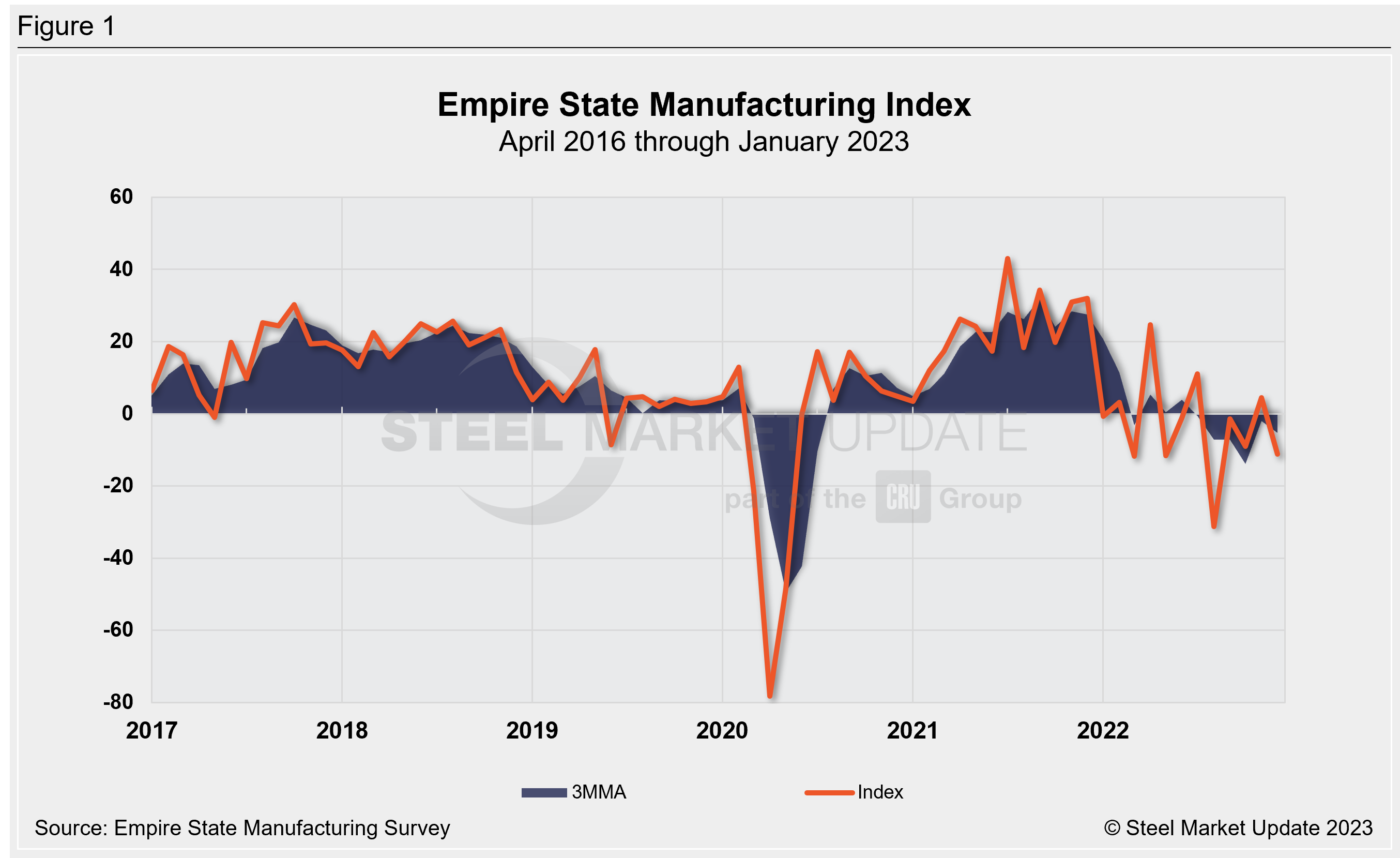

Empire State Manufacturing Index Plunges in January

Written by David Schollaert

Business activity in the state of New York fell in January, reaching its lowest level since the early days of the pandemic, according to data from the Empire State Manufacturing Survey.

The New York Fed’s Empire State headline general business conditions index — a gauge of manufacturing activity in the state — plunged from -11.2 in December to a reading of -32.9 this month. The reading came in as a surprise as the market expectation was of a modest recovery to -8.7. (Any reading below zero indicates deteriorating conditions.)

The index, at –32.9 in January, has not been in negative territory in seven out of the last 11 months, five out of the last six. It is the lowest reading since May 2020.

The latest result indicates that the November recovery resulted from respondents reporting that conditions had improved over the month, which was driven by mixed results. The report also doesn’t reflect nationwide activity, but it represents a stark reality check, highlighting a growing divergence between a relatively strong labor market and a stumbling economy.

The survey’s sub-index for future business conditions held steady at 8.0, suggesting that firms expect little improvement over the next six months, the report said.

Firms were again not very optimistic that business conditions would improve over the next six months. The index for future business conditions was up 1.7 points in January, indicating that firms expect conditions to remain in question over the next six months.

Though employment is expected to pick up, the forward-looking indices, though mixed, most were depressed. New orders and shipments are expected to rise somewhat, while employment is expected to increase only modestly.

An interactive history of the Empire State Manufacturing Index is available on our website. If you need assistance logging into or navigating the website, please contact us at info@SteelMarketUpdate.com.

By David Schollaert, David@SteelMarketUpdate.com