Analysis

January 19, 2023

Hot Rolled Futures: Mills Sensing $800 in Near Term

Written by Michael D'Angelo

Editor’s note: SMU Contributor Michael D’Angelo is a researcher and trader at Marex. In his role, Mike performs fundamental and quantitative analysis, which directly leads to actionable trading/risk management strategies across the base, precious, and ferrous metals derivative spaces. Prior to joining Marex, Mike received a BA in economics with a minor in finance from Princeton University. Mike can be reached at mdangelo@marex.com for comments/questions.

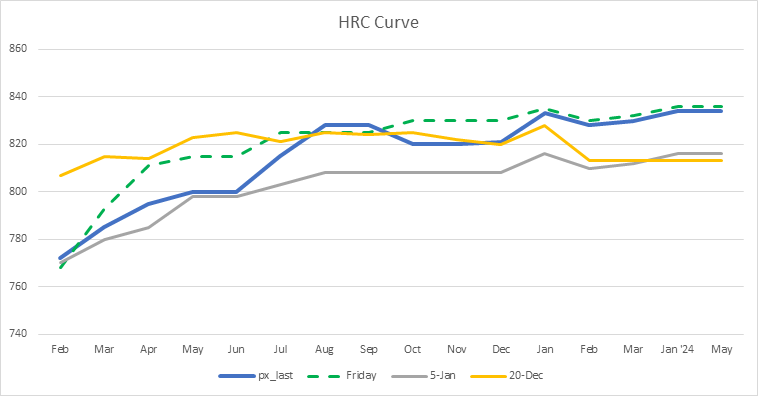

CRU’s weekly Midwest hot-rolled coil (HRC) index inched down to $702 this week after three consecutive weekly increases. However, prices will likely continue to rise as top steelmakers Cleveland-Cliffs and Nucor both announced $50/ton price increases this past week. Consensus seemed to be that prices will reach $800 within the next three months or so, but mills have been facing resistance lately, with buyers hoping Q2 prices will come back down.

The Consumer Price Index (CPI) was in line with expectations, but Empire Manufacturing, Industrial Production, Capacity Utilization, and Building Permits all missed expectations recently. Retail Sales also missed to the downside on Wednesday. The slew of misses initially caused a rally on the theory that weak numbers give the Federal Reserve more room to start cutting. However, the market quickly changed its mind and began selling off on concerns of a weak economy.

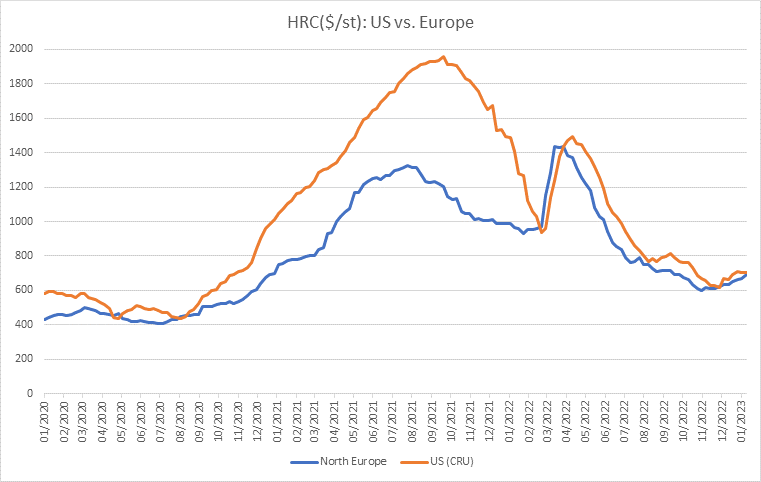

European prices have also been coming up as production slowed substantially in the downturn. However, buyers are questioning the sustainability of the rally as the demand picture has not improved that much. US prices are now just about on par with European prices after enjoying a premium for quite some time.

The curve remains upward sloping with February/May valued at about $30 contango, although it was trading closer to $50-60 contango last week. As we can see, the futures market is pricing in that $800 expectation that mills are banking on.

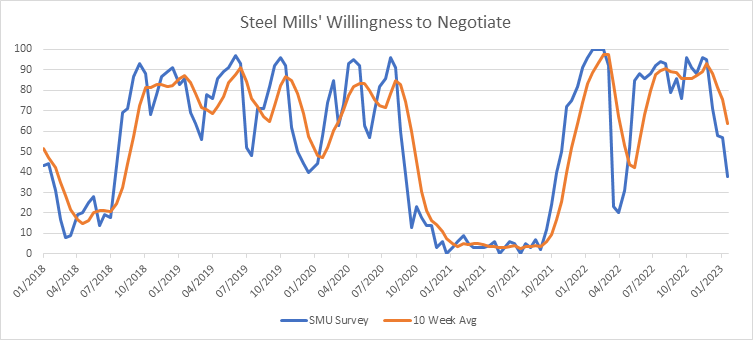

SMU’s Steel Mill Willingness to Negotiate survey has been plummeting. From July to November we were seeing readings consistently above 90. Fast forward a month and a half to today’s reading, which came in at just 38! The reading is consistent with recent news flow of mills regaining power and being stubborn to offer discounts much below $800.

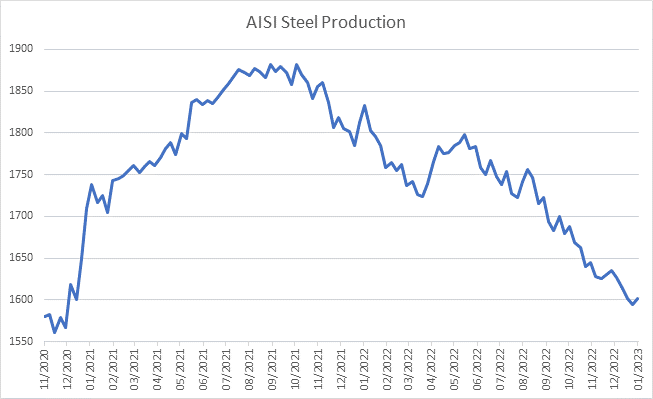

American Iron and Steel Institute (AISI) Steel Production inched up by 7,000 tons to 1.602 million tons. However, the metric is still at levels not seen since late 2020.

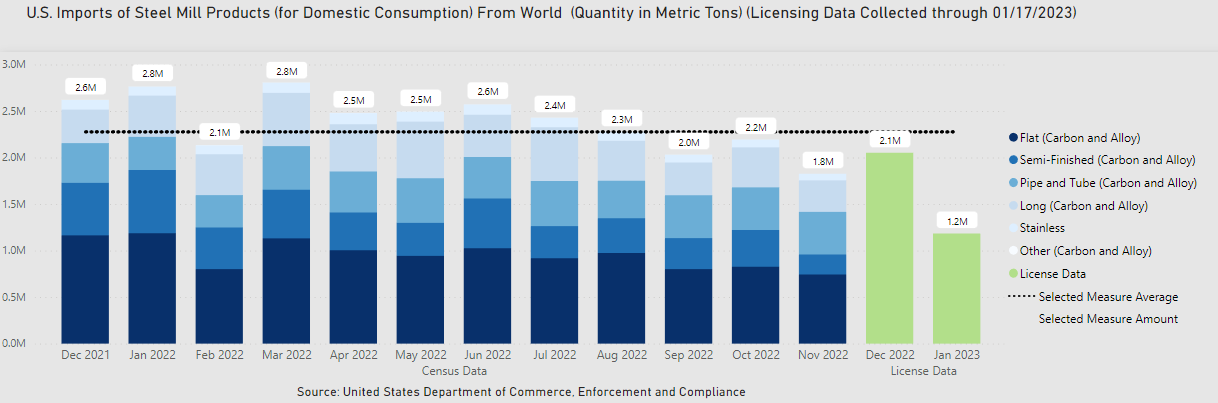

Imports for December were expected to be around 2.1 million metric tons based on licensing data, slightly below the historical average. Imports for the first few weeks of January were projected at 1.2 million metric tons, which implies a similar number to last month.

By Michael D’Angelo, Marex, mdangelo@marex.com