Prices

March 7, 2023

CRU: Turkish Scrap Import Prices Rise

Written by Rosy Finlayson

By CRU Research Analyst Rosy Finlayson, from CRU’s Steelmaking Raw Materials Monitor

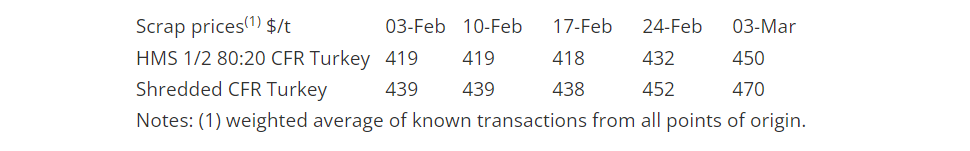

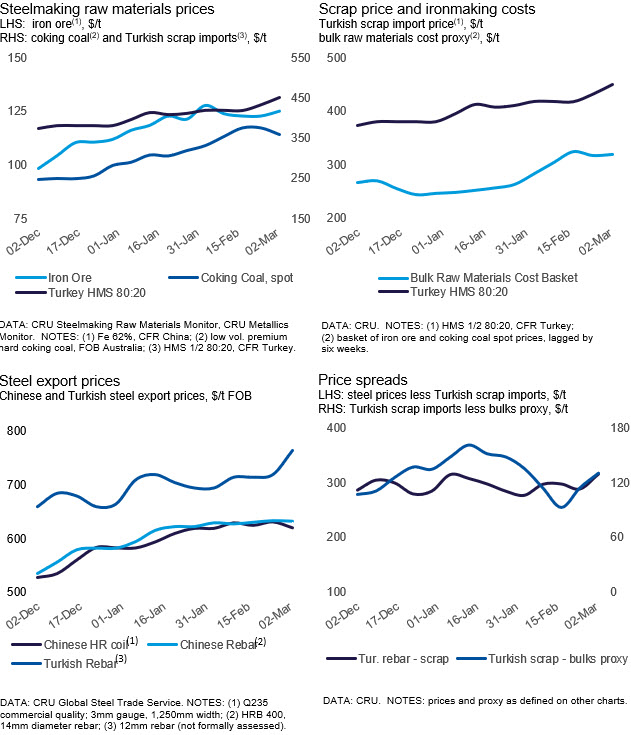

Last week, trading activity in the Turkish scrap import market was limited. Buyers held off on purchasing material as they awaited details on the announcement of a finished steel price cap agreement between the Turkish Trade Ministry and steelmakers. However, deals done late the prior week sent our assessment of HMS 1/2 80:20 prices up to $450 per metric ton CFR Turkey (up by $18/t week over week and by $32/t month over month).

The announcement of finished steel price control mechanisms came as Turkish rebar prices surged by $45/t w/w to $765/t following a rise in scrap prices. This proposed tool aims to prevent speculation due to bullish sentiment regarding demand linked to construction efforts in the earthquake-affected area. The Minister of Environment, Climate Change, and Urbanization stated at the beginning of March that excavation for temporary shelters in the area of Matatya has started.

Meanwhile, the Turkish government has postponed the imposition of custom duties on flat steel products to the beginning of April as demand has become stronger and the market tightens. Import duties will rise by approximately 6-7% to 13-20%.

Outlook: Turkish Scrap Prices to Stay Firm

We expect Turkish scrap prices to continue to be supported by the Turkish steel industry due to higher demand from the construction sector as temporary housing is erected and damaged infrastructure is rebuilt in the earthquake-affected area.

Although the price control mechanism is imposed on finished steel products, we think that scrap price rises will be rangebound because steelmakers are unlikely to accept squeezing margins due to higher raw material costs.

This article was originally published on March 6 by CRU, SMU’s parent company. If you would like more information on this topic, Rosy can be reached at rosy.finlayson@crugroup.com

Learn more about CRU’s services at www.crugroup.com